The Spendemic:

Based on the menus of the various streaming services, it seems that baking shows are all the rage. Today we imagine new one:

It’s called “The Little Shop of Uncut Budgets.” It’s about a freaky little bakery in (name your capital city) where the owners make meat pies from a secret recipe, now revealed exclusively for you:

- One bucket stuffed to overflowing with the dreams of our young

- Bags and bags of dough (no specific upper limit).

I just look at my beautiful little grandson and I keep wondering why we (or the governments we seem compelled to elect) keep borrowing from him and his cute little stroller-riding pals (there’s only like 4 babies on earth right now I think).

He’s just a squishy little adorable baby, but who is carrying whom here? Maybe all this debt-fueled spending is why he sometimes cries in the night?

US Shutdown:

It all feels a bit high-noon-at-the-Ok-Corral out there right now. Here’s a piece from RBC Economics on the action and it’s possible outcomes.

Link here: Shutterdown

We do big: Here’s another outsized read for you:

October Global Insights: In this month’s issue:

AI’s big leaps in 2025

Artificial intelligence is seldom out of the headlines in 2025, with defining developments coming one after another. We look at where AI is today and how its promise is matched against technological, economic, and geopolitical challenges

Global equity: Threading the needle

We expect the current equity market uptrend has further to run—occasional pullbacks notwithstanding. However, elevated valuations and GDP growth expectations currently stuck in low gear leave us advising a commitment to equities consistent with long-term financial goals, but not an overcommitment.

Global fixed income: One cut down

The U.S. Federal Reserve made a widely anticipated rate cut in September. While we think future reductions are likely, market projections for monetary policy seem aggressive.

Regional commentary

Our regional analysts present their views of markets, including commodities and currencies, as well as how to position portfolios.

Read or skim the whole thing here: Global Insight - October 2025

And some charts:

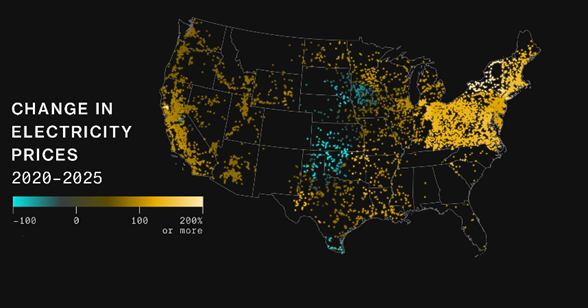

Consumers will increasingly feel the rising cost of electricity from the AI infrastructure buildout (see chart below from Bloomberg): “AI data centers are sending power bills soaring, with wholesale electricity costing as much as 267% more than it did five years ago in areas near the sites. That’s now being passed on to consumers.”

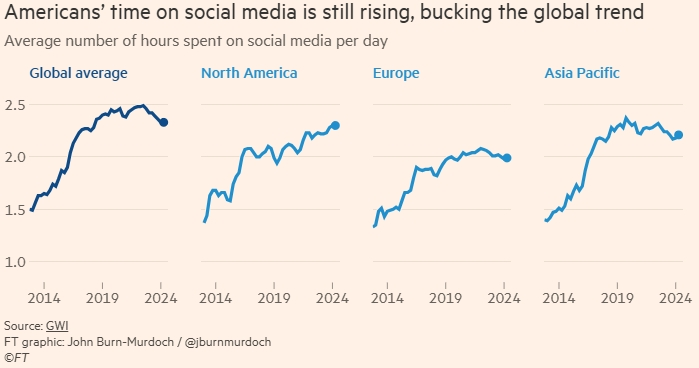

Peak social media? Not in North America. (see chart below from Financial Times): “Users are turning away from social media platforms as they degrade into outrage and AI-generated slop. Time spent on social media peaked in 2022 and has since declined steadily, according to an analysis of the online habits of 250,000 adults in more than 50 countries.

There is one notable exception to this promising international trend: North America, where consumption of social media’s diet of extreme rhetoric, engagement bait and slop continues to climb. By 2024, it had reached levels 15 per cent higher than Europe.”

Enjoy your weekend!

Mark