Good afternoon,

We start out with a long read (about 20 minutes), comprising an in-depth analysis of the potential for BRICS nations to develop a political/economic block of sorts. It’s worth a look if you’re feeling inquisitive about the potential for US economic hegemony to diminish. The caution here is that this is one of a number of views we have on these issues and shouldn’t be taken as a doomsday prediction. Still, it’s worth a look if you’re so inclined.

The BRICS block beckons, and it’s dominated by dictators who can decisively do what democracies don’t. But swift decisions aside, tyrants tend to stifle innovation. (And now I’m about out of alliteration.)

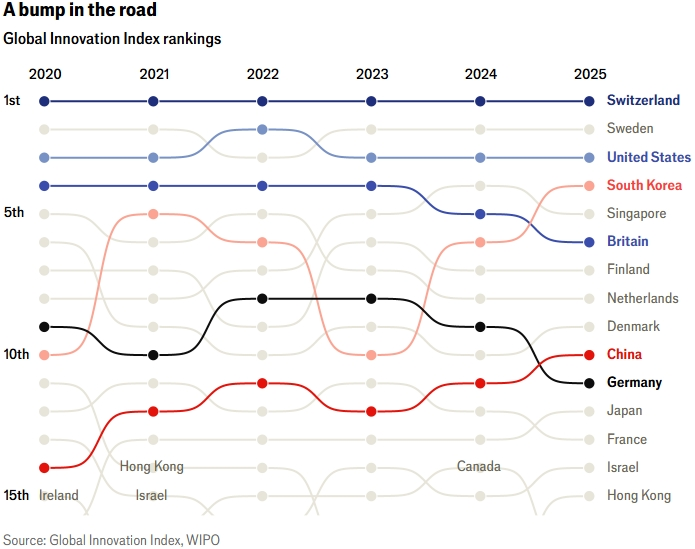

China is the only BRICS member on the innovation leaders list (chart below), and has shown great progress in, but its leaders are presently punishing innovators, so we’ll see how it plays out.

Mind you, neither is Canada so much as a pebble on the data. (I’d insert a sad face here, but I’m not allowed).

Just kidding.

See chart.

Here’s the BRICS story for those with the appetite.

How BRICS sees the world

The geopolitical order continues to shift amid fracturing trade ties and high tariff levels, raising questions about long-term economic and investment implications. Amid the changes, the BRICS association is attempting to chart a new course.

This report focuses on how BRICS is growing and evolving, and why countries within it—including the large Eurasian troika of China, Russia, and India—believe a new multipolar world order is inevitable.

PDF link: How BRICS sees the world

This is the latest edition of RBC Wealth Management’s ongoing “Worlds apart” series, which explores deglobalization risks, along with their ramifications for investors, economies, financial markets, and currencies.

Here’s RBC Wealth Management's latest investment newsletter.

The numbers behind U.S. tariffs

Collections from U.S. tariffs are surging, but trade diversion and exemptions have softened the macro impact. As legal uncertainty looms and costs gradually pass through, balancing resilient corporate fundamentals against policy risks remains crucial for portfolio positioning.

Regional developments: Bank of Canada governor emphasizes the importance of diversifying trade from the U.S.; S&P 500 valuations near multi-decade highs on AI momentum; Geopolitical tensions and military risks push European defence stocks higher; China responds positively to the Xi-Trump phone call and looks ahead to next month’s meeting

More here: Global Insight Weekly.

Feel free to contact me with any questions and/or to discuss investment ideas.

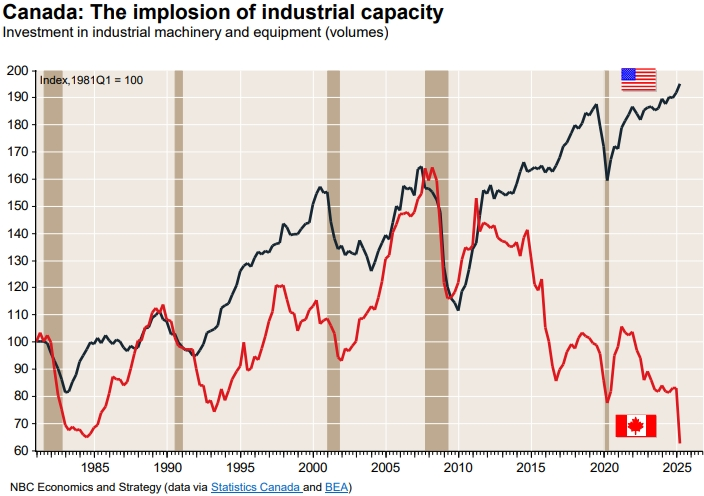

Another Canada Chart:

Slippy Slide to Industrial Irrelevance. Just in case you’re not depressed yet, here’s a look at slippage in industrial capacity. Not a pretty sight. If we overlay the federal governments in the last 20 years… then this would be political, and we wouldn’t want that.

But yeah, slippy slides have bottoms.

Chucking Bricks: And lastly, on the fun side of bricks, here’s a snip of an old Andy Griffiths show TV character I loved remember watching as a kid. He’s a school crossing guard who kept a sack of rocks and bricks to throw at cars who breached his safety zone.

Ernest T. Bass: https://youtu.be/MaqyhVmfkfI?si=7Pf5wAYwpp0NUvIk

Enjoy your weekend!

Mark