This week hit hard, though markets lumbered well enough, largely inched forward by rate cut expectations and still more favorable big tech news.

Too Close and So Very Sad: We have some close personal ties with Utah Valley University, (where the Charlie Kirk assassination occurred) which I won’t detail here. But I hope this helps.

When President Reagan was shot on March 30, 1981, at first, he didn’t know he’d taken a bullet. Rushed to hospital, he walked in for examination under his own power and then learned he had a bullet in his lung, which was filling up with blood.

A week later, Reagan wrote in his personal journal:

“… my fear was growing because no matter how hard I tried to breathe it seemed I was getting less & less air. I focused on that tiled ceiling and prayed.”

“But I realized I couldn’t ask for God’s help while at the same time I felt hatred for the mixed-up young man who had shot me. Isn’t that the meaning of the lost sheep? We are all God’s children & therefore equally beloved by him. I began to pray for his soul and that he would find his way back to the fold.” (Reagan Journal here.)

In truth, the apparent cold, calculating realities of finance are warmer and fleshier than we can easily quantify. Our southern neighbour’s greatness is buried somewhere deep in its ability to wade through messy times which itself is born of its open society values, complete with eyes-wide-open imperfection. Reagan’s grace doesn’t imply brushing this latest assassination tragedy aside. Not at all. But it says something.

Reagan was not one to shrink from controversy, and nobody ever accused him of passivity. Far from it. But maybe his remarkable grace under the (literal) fire of his enemies was woven with the DNA that helped him win such a monumental battle as the Cold War, which in turn lifted literally billions out of poverty and state imprisonment.

And maybe that’s part of what he meant when he (originally) said he wanted to make America great again.

Here’s a few interesting charts:

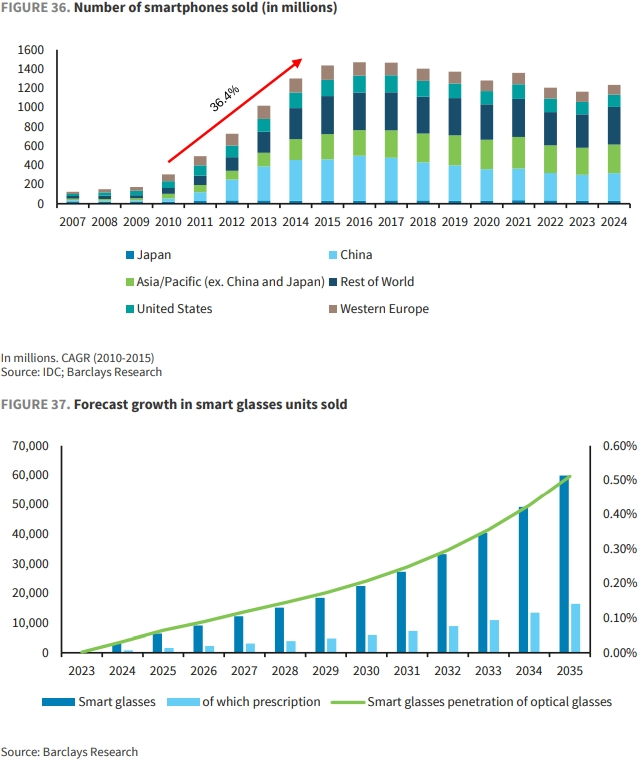

That Creepy Guy with Smart-glasses (see chart below): “We see scope for this nascent industry to be highly disruptive and, whilst the exact trajectory may differ, we observe parallels to the innovation and progress seen in the golden decade for mobile phones in the early 2010s, where smartphone volumes expanded from 305 million in 2010, to over 1.4 billion by 2015 (see Figure 36). We believe that roughly a quarter of smart glasses being sold today are with prescription. Overall penetration of the prescription glasses market is low (~0.03% in 2024 per our estimates), and we expect this to expand to ~0.5% over the next decade as smart glasses volumes reach ~60 million from ~3 million today.”

The zombies are coming.

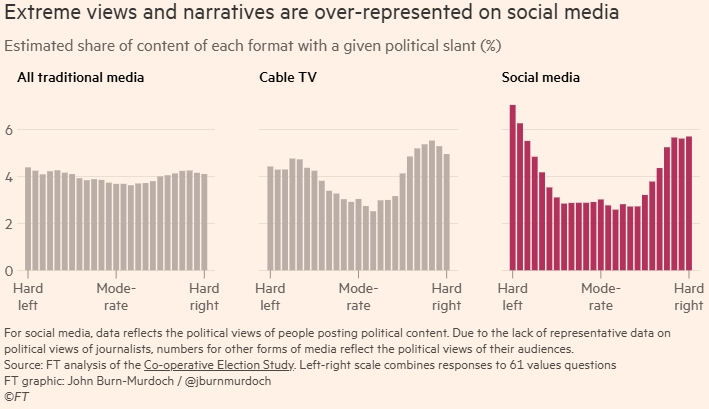

Populism (see chart below from the Financial Times): “There are many interlocking reasons for the march of populists in recent years, but one that is often misunderstood is the role of social media in dismantling guardrails… Social platforms’ inbuilt tendency to reward indignant and hostile content creates incentives that systematically reward the production of simplistic messages and extreme positions, while rendering moderate views less visible.”

Here’s an RBC Economic Update: https://www.rbcgam.com/en/ca/article/macromemo-september-9-22-2025/detail?utm_medium=email

And here’s are most recent financial newsletter for investors:

Six rate cuts in search of a reason

With the Fed poised to lower overnight interest rates next week, we think investors may be disappointed with what lowering rates is likely to accomplish. This monetary tool is simply too blunt to deal with many of the issues facing the U.S. economy, and we look at the potential asset-class implications if the Fed moves too aggressively.

Regional developments: The Canadian labour market weakened again in August; Soft economic data drives rush to U.S. Treasuries; The ECB sees a balanced outlook on growth and holds rates steady; Resignation of Japanese prime minister drives stock market to new high

More here: Global Insight Weekly.

Feel free to contact me with any questions and/or to discuss investment ideas.

Enjoy your weekend

Mark