Good afternoon!

We’ll start today with a quick quote: Socialism-with-power’s Unexamined Legacy:

“No cause, ever, in the history of all mankind, has produced more cold-blooded tyrants, more slaughtered innocents, and more orphans than socialism with power. It surpassed, exponentially, all other systems of production in turning out the dead. The bodies are all around us. And here is the problem: No one talks about them. No one honors them. No one does penance for them…. No one is hunted down to account for them.”

“… The denial of Hitler’s dead, or minimization of the holocaust is literally a crime in most of Europe. The denial or minimization of communist crimes is an intellectual and political art form, and a good route to a chaired professorship.” Alan Charles Kors

So, take that all ye self-appointed lunch ladies of economic avarice!

Get me to the church on time: We’re off for a few days to our daughter’s wedding on Vancouver Island. “Wasn’t that last summer” you say? Well yes. We have six daughters, and this is the third to marry. “Wow! Isn’t that exhausting?” you ask. Well, yes. And fun. And it’s especially pleasant looking backward.

Meanwhile, as long as he treats her right, there’s no need for me to even think about carving up his liver with a rusty spoon. And if our third son-in-law is as wonderful as the first two, we couldn’t be happier.

That rusty spoon can just sit there in my back pocket.

Ominously.

Sweaty.

Menacing.

And on a less ominous note, here’s some charts as food for thought:

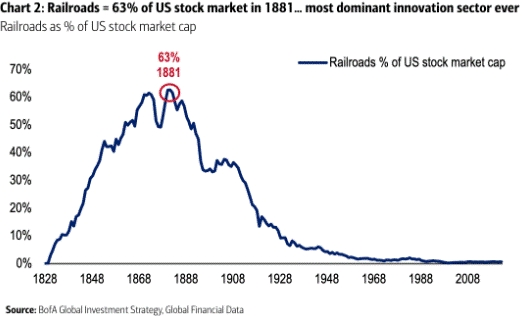

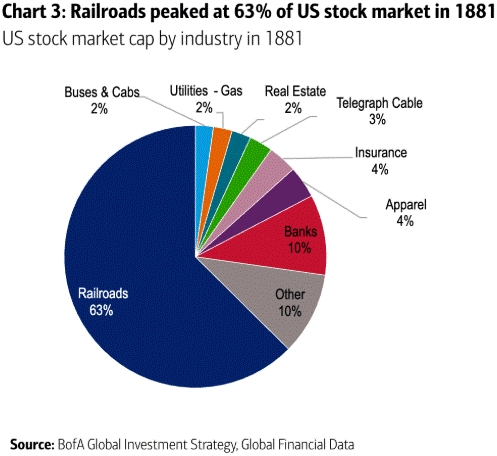

Railroads were the most dominant innovation sector in the USA ever (see charts below):

Rolling on with change: Alphabet’s Google, Microsoft, Amazon Meta Platforms are set to spend nearly $400 billion this year on capital expenditures, largely to build their AI infrastructure (like laying train tracks). That is more than the European Union spent on defense last year.

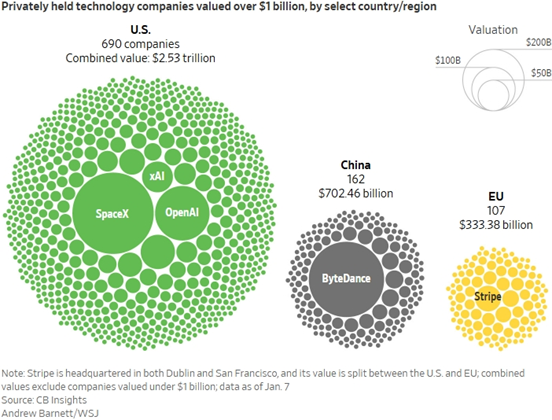

Venture capital is a wealth-making machine that is rooted deeply in US culture (see chart below from the Wall Street Journal): On the other hand, a risk-averse business culture and complex regulations have stifled innovation in Europe. (By the way, the US venture capital market is partly funded by global investors. In part, this is where the trade surplus money goes – so… it benefits the US again. Cheap t-shirts, Tech billionaires and lots of off-putting politics - -somehow it all works!)

Some stats:

- Over the past 50 years, the U.S. has created, from scratch, 241 companies with a market capitalization of more than $10 billion, while Europe has created just 14. The typical company in the top 10 publicly traded U.S. firms was founded in 1985, while in Europe, it was in 1911. In Europe, venture capital tech investment is a fifth of U.S. levels.

- Only four of the world’s top 50 tech companies are European, despite Europe having a larger population and similar education levels to the U.S. and accounting for 21% of global economic output. None of the top 10 companies investing in quantum computing are in Europe.

- By the late 1990s, when the digital revolution got under way, the average EU worker produced 95% of what their American counterparts made per hour. Now, the Europeans produce less than 80%. The EU economy is now one-third smaller than the U.S.’s and is stuck in low gear, growing at a third of the U.S. pace over the past two years.

- (Canadian comparative data is even worse.)

Here’s our latest monthly newsletter, with an in-depth look at tariffs.

Global Insight Monthly

August 2025

Here’s the latest investment strategy report from RBC Wealth Management—Global Insight, which provides our current thoughts on asset classes, the economy, and so on. There are various links below, depending on what interests you most.

Full report: Global Insight

Highlights:

Transmission framework: How tariffs will flow through the U.S. economy

As U.S. tariff policy continues to evolve, investors are facing more questions than answers. RBC Economics provides a roadmap on when and where tariffs will start to impact the U.S. economy.

Global equity: The shift is on

Despite the arrival of tariffs, most major indexes have posted new highs spurred by investor confidence in a resumption of growth next year. Supportive market breadth suggests more new highs lie ahead. Full valuations argue for a watchful commitment to equities.

Global fixed income: Changing views precede a changing of the seasons

As many global central banks near the end of rate cut cycles, markets start to consider if, not when, the U.S. Federal Reserve restarts its own.

If you have any questions or need further guidance, please do not hesitate to contact me.

Enjoy your weekend!

Mark