Waffle House Democracy.

Mostly Irrelevant quote of the week: “Something joyously democratic surrounds the wayward cross section of humanity that gathers at a waffle house in the dead of night.” Lance McMillan

Reminded me of a time when I had belt notches to spare, when nobody was waiting for me at home, and thus spending a couple more hours with other young friends, stuffing our faces with empty calories between midnight and 2:00 am seemed like a good idea. It was.

Quote regarding the latest tariffs, and why all heck hasn’t broken loose again yet: “… when the actual tariff levels come in lower than the worst fears, the psychological effect can be positive; that odd feeling of contentment you get when you discover that the $100 bill you thought you had dropped on the sidewalk was only a $20.” Gerard Baker. In his Wall Street Journal editorial this week, Baker cites three plausible interpretations for the muted tariff impacts so far. It’s worth reading.

And I’ll propose a possible 4th:

It’s only mostly bad. It’s the counterfactual I’m mulling over, which economists refer to as “opportunity costs.” In other words, how much better would it be without tariffs voluntarily raising taxes on the stuff you need? With modest tax deductions and deregulatory initiatives and other measures generally, it could have been even better if not for the dampening impacts of tariffs.

Also, what separates this era from Smoot Hawley (the 1930’s tariffs) is that Trump has been obnoxious enough to recognize the obvious weight advantage the US has in a series of one-on-one negotiations. Smoot Hawley was fraught with full-on retaliation, whereas Trump 2 isn’t (yet). But that doesn’t for a minute mean we can raise import prices 15% and call it a win for consumers, who are always the driving force in GDP calculations.

Why shrink your market? At its core trade widens the opportunity set for humans to impress each other with their amazing ingenuity. Why else do we get a surge of excitement to go to an auction, or walk Queen Street in Toronto, or Robson Street in Vancouver. (It’s the yogurt cones, stupid!) Studying extremes, we see that free trade zones like Singapore and Hong Kong flourish. And alternatively, we see severely restricted trading regions like North Korea fall among the most impoverished and miserable in history. The rest is just details.

Waffling Freedom: It’s tough to find a 24-hour waffle house in a small town, you need a bigger market for that.

More choices. Like democracy, free markets are imperfect, but here bigger is better.

Here’s the latest from an RBC Economist: The What-ifs-of-Tariffs

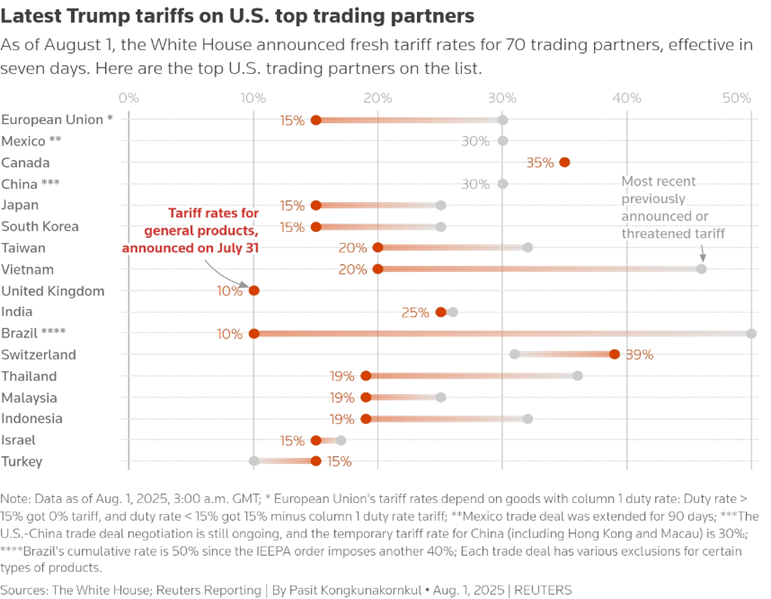

The latest tariff rates (see chart below from Reuters): “Trump again ramped up tariffs on trading partners worldwide, including Canada, Brazil, India and Taiwan, ahead of a Friday trade deal deadline, pressing ahead with plans to reorder the global economy.”

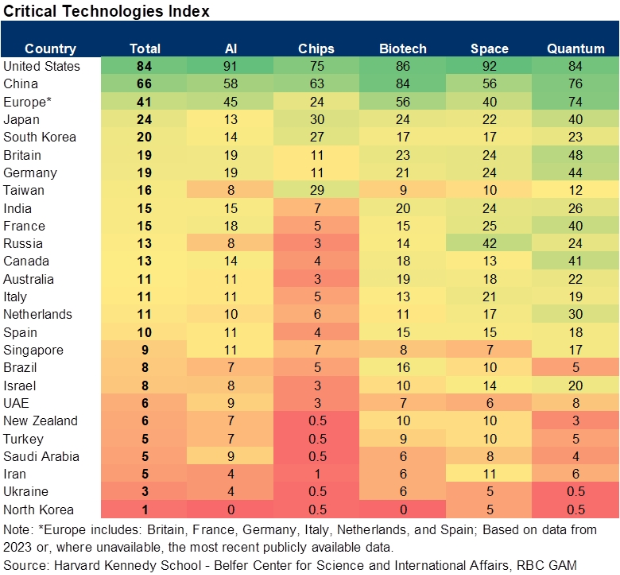

Critical technology leadership (see chart below from RBC GAM): “The world is changing in many ways, several of which are to the disadvantage of the U.S. The American economy appears set to be somewhat less exceptional than in the past as China rises, tariffs threaten to undermine U.S. growth, the domestic political schism grows, the rest of the world loses confidence in the country, and fiscal obligations and concerns mount”

- But we must not write the U.S. off altogether. It remains a dynamic place, and more capable than most of enjoying rapid productivity growth in the decades ahead. The U.S. retains many of the world’s most innovative companies, and recent tax changes arguably render it even more attractive than before. Consistent with this view, new research from Harvard’s Kennedy School makes the argument that the U.S. remains well positioned to lead from a technological standpoint into the future. Rising productivity is the key determinant of financial well-being, and there is every reason to believe the U.S. will remain a force on this front.

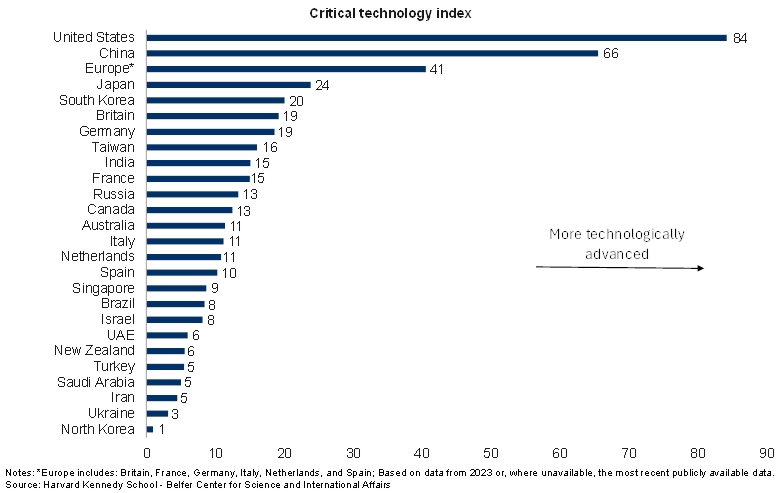

- The Critical Technologies Index examines five fundamental technologies that may drive prosperity gains in the decades ahead: artificial intelligence, computer chips, biotechnology, space technologies, and quantum computing (see next table). Incredibly, the U.S. holds the lead in all five technologies. This lead is particularly large in AI and space, is substantial in computer chips and quantum computing, and is conversely only marginal in biotechnology.

Yes, China is in second, but not exactly nipping at American heels. Europe, Japan and others are much further back (see next chart).

Here’s RBC Wealth Management's latest investment newsletter.

Objects at rest tend to stay at rest

The Federal Reserve not only held rates once again in July, but a surprisingly hawkish tone has likely pushed back the timing of any rate cut until at least December. We look at some of the key drivers and why markets may need to prepare for a return of the “higher for longer” scenario.

Regional developments: Bank of Canada keeps policy rate steady, and May GDP declines; U.S. stock indexes rallied driven by a trifecta of tailwinds; The U.S. and European Union finally strike a trade deal; Diverging interpretations emerge on both sides of the U.S.-Japan trade deal

More here: Global Insight Weekly.

Please feel free to contact me with any questions.

And… enjoy the long weekend!

Mark