Good afternoon,

I’m not very familiar with this 1960’s economist, but I liked this twisty quote of his for its loaded nature. Both countries mentioned tell a story of enormous, and even well-proven economic success, followed by decades of systemic mismanagement.

Quote of the week: “There are four kinds of countries, developed, underdeveloped, Japan and Argentina.” (Simon Kuznets).

I would add, that ever since the 2008/09 financial crisis, there’s been a looming question in the back of my mind, and probably in the minds of more than a few others’. Are we going to end up like Japan, with its decades of low birth rates, low immigration, low growth and… perhaps most severely, low expectations?

So far, we’ve avoided the worst of it, but the question has by no means faded into irrelevance. And fortunately, we can learn not only from Japan and Argentina’s mistakes, but from their successes!

Here’s a few hand-picked charts and our weekly newsletter:

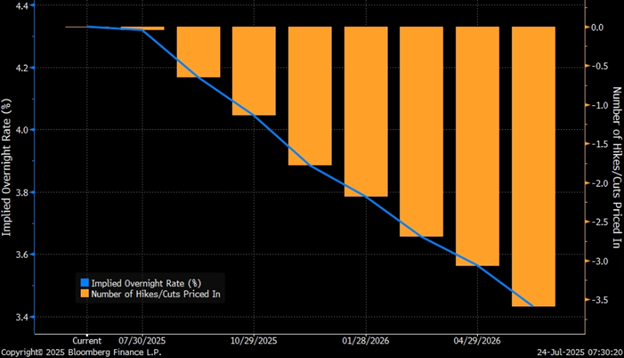

Sick up and Fed? Indicative Fed rate cut pricing through the end of Powell’s tenure as chair does not appear to have shifted more dovish in light of recent pressure on Powell. The chart below indicates no priced in expectation of Powell’s early departure. What is more, the firing of Powell would remove him as a sort of scapegoat for Trump, which is likely the actual tool the president is leveraging when he spouts off about Powell.

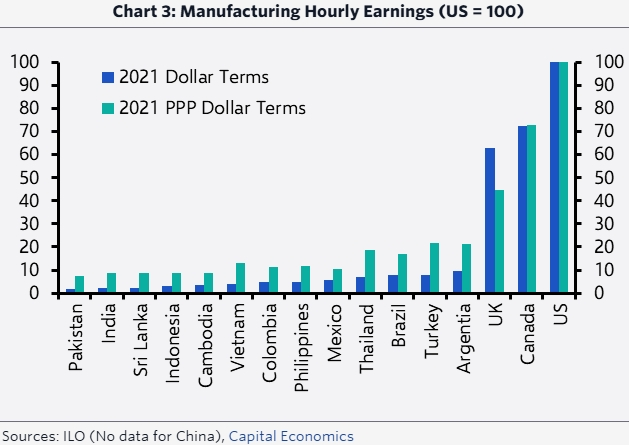

U.S. wages: An impediment to reshoring (see chart below): “While specific sectors like motor vehicles and pharmaceuticals have some reshoring potential, on the whole a tariff-led approach to attracting foreign manufacturers to the U.S. faces major constraints – namely, a tight labour market and significantly lower production costs overseas – that even the promise of preserving tariff-free access to the U.S. consumer market cannot overcome.”

“Given the massive disparity in relative manufacturing wage costs that exists between the US and most other countries, whether the tariffs being imposed will be substantial enough to meaningfully incentivize reshoring remains unclear. With manufacturing wages in countries like Vietnam, Indonesia and Cambodia sitting at around 5% of U.S. levels (see Chart 3), even a 10% to 20% universal tariff – our base case for where most countries’ rates will settle, except for China, where we expect a higher rate of roughly 40% – would do little to offset that competitive advantage. A return to “Liberation Day” levels would erode that advantage further but still probably fall well short of what is needed to trigger a large-scale shift in production from those low-cost manufacturing hubs back to the U.S., even when accounting for potentially higher U.S. productivity levels.

AI and robotics (see charts below): “… what threatens to shake up the real world is the growth of automation and robotics, since these can do physical, industrial work. Chatbots are stuck in the cloud. The proportion of robots to people is still only a few hundredths of a percentage point today, but the march of the automatons has already had a dramatic impact on industry (e.g. cars). Now they are growing smarter, more numerous, and more widely dispersed across sectors.”

The political ramifications will stem from the impact on the bulk of the people – the middle class. The impact will not necessarily be negative. Computers and the Internet have caused productivity waves since 1960 but unemployment has followed the business cycle – it never rose structurally. Not in the most advanced and roboticized societies. Indeed, Japan’s industrial robot orders rose from less than 10 billion JPY in 1987 to around 70 billion JPY today, but the unemployment rate peaked at 6.1% for different reasons (balance-sheet recession) and hovers around 2.7% today.

A market that costs a pretty penny

The S&P 500’s recent rally has been terrific, but it’s pushed the market’s valuation back up to lofty levels. We discuss key drivers of the valuation expansion and how investors should factor valuations into the portfolio decision-making process.

Regional developments: Canadian retail sales fell in May, in line with advance estimates; Weaker dollar helps push U.S. stocks higher; European Central Bank on hold and equity markets bolstered by trade deal optimism; Asian markets rally on U.S-Japan trade framework announcement

More here: Global Insight Weekly.

Feel free to contact me with any questions and/or to discuss investment ideas.

Enjoy your weekend!

Mark