Good afternoon,

You can’t study history and not see vibrations shimmering in our current experience. In a recent treatment on Peter the Great, (Russian Tzar) it was made clear to me that, although not the only unruly and unprincipled dictator, (not by a long shot) Peter’s legacy of sheer random cruelty stands in sharp contrast his contemporary world, which was fumbling its way toward modernity. Said another way, we have it good in our current comfy western blanket of prosperous freedom. Most of us have never really known existential doom at the door, at least not since the end of the cold war. But, as Henry Kissinger notes below, we need to stay sharp.

Henry Kissinger could have been commenting on this week when he said:

“Whenever peace – conceived as the avoidance of war – has been the primary objective of a power or a group of powers, the international system has been at the mercy of the most ruthless member of the international community.”

so we look a little closer today at military spending and such along with its possible impacts on global finance. On this topic, below I have paraphrase from a recent internal piece called “Farewell to the Peace Dividend” by one of our senior analysts.

Following the dissolution of the Soviet Union and the Warsaw Pact in the late 1980s and early 1990s, governments rushed to slash defense spending, which for NATO members stood at over 4% of GDP in 1989 and diverted these resources into more productive and socially popular areas (social safety nets, health care, education). This so-called “peace dividend” is now being unwound as NATO members have agreed to raise their spending targets to 3.5% of GDP from 2% and commit an additional 1.5% in non-lethal defense-related spending (see exhibit below).

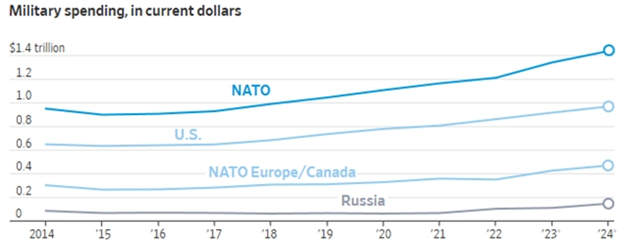

The post-pandemic world has seen a deterioration of the rules-based international system, underscored by the largest conflict in Europe since WWII, accelerating tensions in South Asia and the Middle East, and growing strategic competition between global superpowers. Yes, military spending has been scaled by NATO members since Russia’s annexation of Crimea in 2014 (see exhibit below), but the share of that has been borne by the U.S., a key point of contention so far in President Trump’s second term. This new NATO commitment means Europe and Canada will have to dramatically scale their military expenditures.

Higher defense spending is widely expected to be a net positive for long-term growth but may also come with some negative effects. Potential positive impacts stem from industrial development, innovation, and infrastructure given the research-intensive nature of the defense sector, while negative impacts may arise from overspending, capital leakage, and the risk of diverting resources from more productive sectors.

(Is there ever enough charts?)

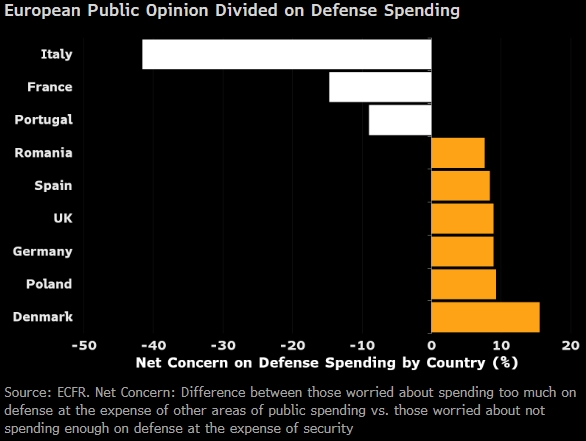

Does European defense spending have public support? (see chart below from Bloomberg): “NATO leaders aim to approve a core defense spending target of 3.5% of GDP, plus 1.5% for broader outlays on June 25. But even if that goal is finally agreed upon, will they all follow through? We think it is unlikely. Spain’s last-minute resistance has exposed the reality: while governments may endorse the 5% target to avoid angering Trump, some view it as unrealistic and counterproductive—and not all will be willing to deliver on it. EU member states’ support will hinge on perceptions of geopolitical risk and domestic political priorities, which vary widely across the bloc. In major NATO members like France and Italy, many voters are more concerned about overspending than underspending. In contrast, sentiment in parts of Eastern and Northern Europe leans the other way, revealing divergent public views on the urgency of military investment. This highlights the political work still required for EU leaders to build public support for these initiatives.”

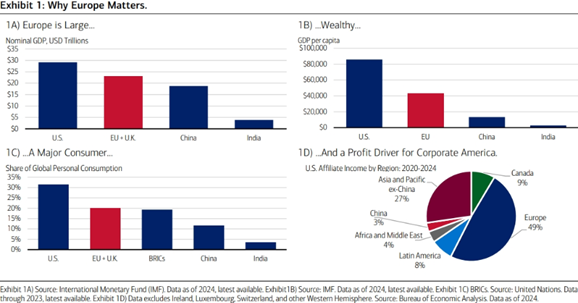

Why Europe matters to global finance (see charts below): “One, home to a population of more than 500 million, the European Union (EU+U.K.) remains one of the largest economies in the world. In fact, the EU lags only the U.S. when it comes to gross domestic output, measured in nominal U.S. dollars. EU GDP in aggregate (including the U.K.) totaled $23 trillion in 2024, versus $29.2 trillion in the U.S. and $18.7 trillion in China (Exhibit 1A).”

- Two, wealth matters, and, on this score, Europe stands out: 15 of the 25 wealthiest nations in the world are European. GDP per capita in the EU274 ($43,000 in 2024) is significantly higher than that in China ($13,300) or India ($2,700) (Exhibit 1B).

- Three, wealth equates to consumption, with the EU accounting for roughly 20% of global personal consumption expenditures in 2023. That’s a lower share than that of the U.S. but well above that of China (12%), India (4%) and the BRICs5 combined (19%) (Exhibit 1C).

- Finally, as depicted in Exhibit 1D, no region of the world accounts for more U.S. foreign affiliate income (a proxy for global earnings) than Europe, comprising nearly half of global affiliate income this decade.

Get a haircut and find a real job: (Note from Mark. Okay kids… when I was your age – in college - I cleaned up dog poop for like $3.50 an hour. Get off your butt and do something.)

Expert Comment: Tough job market for young Canadian (see chart below from Bloomberg): “Young Canadians are saddled with a labor market that has deteriorated faster than any other major advanced economy. Over the past two years, unemployment among 15 to 24 year-olds in Canada jumped 3.6 percentage points, the sharpest increase among the 25 largest economies in the OECD. And much of the pain unfolded before Trump’s trade tariffs began pummeling hiring and investment.”

From Mark: Whah! Oh… you mean we can’t just give everyone free stuff and expect everything to flourish?

Weekly insights - RBC Wealth Management's latest investment newsletter:

Gold’s regime change?

The longstanding inverse relationship between gold and real interest rates appears to have broken down, pointing to new forces—central bank buying, geopolitical uncertainty, and portfolio diversification—playing a larger role in driving demand for bullion.

Regional developments: Canadian inflation holds steady in May, but core measures remain above Bank of Canada’s target; Fissures emerge between Fed policymakers on rate cuts; Higher EU defense spending confirmed as U.S.-EU trade negotiations progress; Mixed messages from trade talks with Asian countries

More here: Global Insight Weekly.

Feel free to contact me with any questions and/or to discuss investment ideas.

And… enjoy your almost-Canada Day long weekend in this absolutely beautiful country of ours!

Mark