Question: What body of water separates Victoria, BC from Washington State?

Answer: The Strait of Juan de Fuca

Question: When did gold actually cause inflation?

Answer: Read on.

Juan is a Spanish name, like so many other placenames that linger on the BC coast. Think of Galiano Island, Flores Island, Port Alberni, Tofino, Spanish Banks, Malaspina Inlet, Quadra Island, etc. etc. The list is long, but … then I must ask:

- Where is all that expected Spanish heritage that one might have after these initial southern European visitors?

- And why is it so hard to get good burrito in Vancouver, despite this early Spanish influence?

The Spanish Price Revolution: The answer is the story about gold and silver and the sort of lessons about inflation you mightn’t expect.

Finding money on (and in) the ground: When early Spanish explorers brought back shiploads of gold and silver from South & Central America – (I mean, what could be more awesome than boatloads of money?) – the result was – more boatloads of money, literally. Also, still more after that. And spending, lavish spending. And debt. Lots of it. And more boatloads of money, and wars and… wait for it… all that money – all that beautiful ill-gotten gold-and silver. The gold standard of moomoo, and it all eventually led to… ?

Anyone? Anyone? Bueller? Bueller?

Stuff got more expensive.

And, all the while, instead of directing all the King’s men toward such boring things as food, clothing, weapons, and other goods, basically, the Spanish royalty said: “Bling more.”

More shiny rocks a meal doesn’t make. And (although relatively moderate compared to what we are used to) the ensuing inflation, and dereliction of the usual sorts of housekeeping resulted in a spectacular fall for the once mighty colonial nation, right around the time Juan De Fuca (who was actually Greek) sailed toward Victoria looking for a burrito food truck and didn’t find one.

That’s a crude summary, but it’ll do here (I hope).

If you want to nerd out on this some more, see here: https://eng.globalaffairs.ru/articles/lessons-of-the-spanish-empire/

Mid-year Insights:

So What Now? A dramatic shift in the appetite for securities issued outside of North America has emerged in 2025. We examine the causes, what they mean for international stocks looking ahead, and how investors may want to position portfolios.

Full article here: “A World of Opportunities?”

US Debt: Is this the freaky clown in the dark basement closet, or something to brush aside? Is this an emergency, or a long-term headache? We examine the problem, what is isn’t and what it is, and suggest an approach.

Full article here: U.S. debt: Changing facts, updating views

RBC Wealth Management's latest investment newsletter.

Wait and wait and wait and wait and see

While inflation has stayed calm in 2025, concerns about potential tariff-related price hikes have kept the Fed sidelined. We look at its recent commentary, the impact of market forces and political pressure on yields, and the probability of rate cuts before year’s end.

Regional developments: Bank of Canada has the flexibility to cut rates, but we question its need to do so; Oil prices spike as tensions rise in the Middle East; Bank of England maintains Bank Rate at 4.25%; Political woes in Thailand

More here: Global Insight Weekly.

Feel free to contact me with any questions and/or to discuss investment ideas.

Charts:

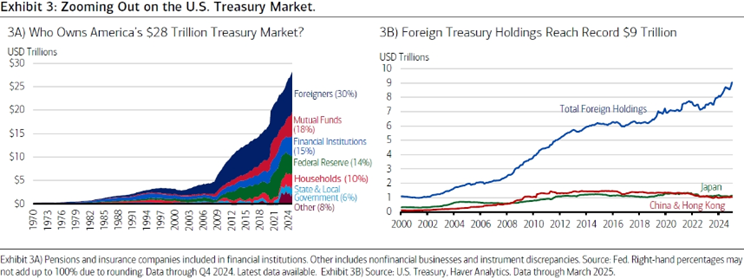

U.S. Treasury selling concerns (see charts below): “Concerns of meaningful foreign selling may be overblown. Zooming out in Exhibit 3A, while foreigners remain the largest holder of the U.S. Treasury market, their share of the total has technically been in a steady decline for years. It peaked in 2008, in fact, at 57% of $5.8 trillion. Since then, while foreign holdings have more than doubled, debt held by the public has nearly quintupled—i.e., demand for Treasurys has broadened out over the past decade. Among today’s diverse pool of buyers: mutual funds (18%), financial institutions (15%), the Fed (14%), and households (10%). Meanwhile, for all the recent attention on anti-U.S. sentiment in markets, zoom out a second time with Exhibit 3B: Foreign holdings of U.S. Treasurys hit an all-time high of $9 trillion in March 2025, the last available month of data. That’s $233 billion higher than February and nearly a trillion higher than just a year ago.”

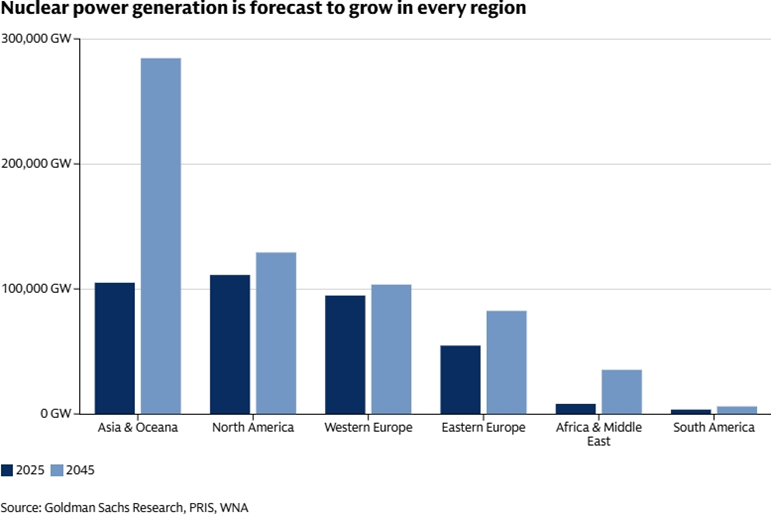

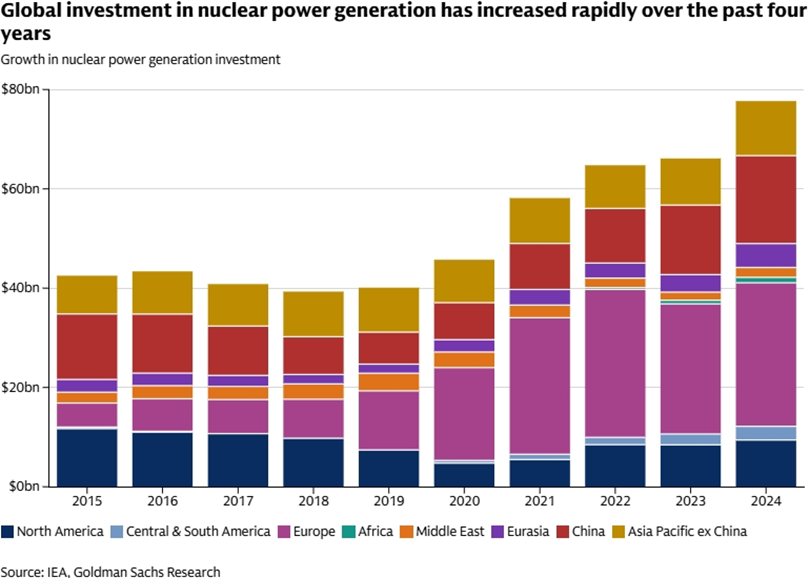

Going nuclear (see chart below from Goldman Sachs): “The world’s nuclear reactor fleet has been aging rapidly due to underinvestment and a lack of interest in the technology. After decades of underinvestment, the median nuclear reactor is around 32 years old. Now, however, conditions appear to be primed for the construction of nuclear power plants to accelerate. At the most recent COP29 climate summit in November 2024, 31 countries pledged to triple the world's global nuclear generation by 2050, alongside 140 nuclear industry companies and 14 large financial institutions.”

“Global investment in nuclear power generation grew at a compound annual growth rate of 14% between 2020 and 2024, following almost five years of no growth in spending. This has come on the heels of improving policy support globally, underscored by the growing demand for power and less emission-intensive alternatives in a world that is retiring coal plants at a rate much faster than it is building new ones. There are currently 61 nuclear reactors under construction across 15 different countries, with roughly half of them located in China. 59 of those are scheduled to come online in or before 2032. In addition, there are roughly 85 reactors planned across the globe, with another 359 proposed.”

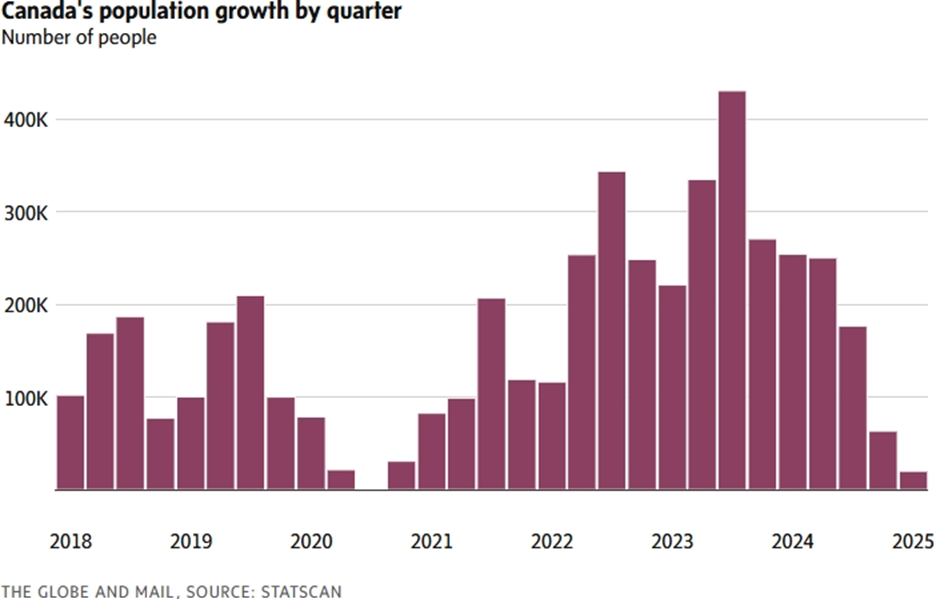

Canada’s population growth slows to a crawl (see chart below from The Globe and Mail): “Between Jan. 1 and April 1, 2025, the overall population grew by just 20,107 people to roughly 41.55 million. At 0.05 per cent, this was the weakest quarter for growth since the height of the COVID-19 pandemic. From 2021 to 2024, the population jumped by an average of 217,000 people a quarter, a historic period for growth that raised widespread concerns about access to housing and health care – and eventually forced the federal government to implement new restrictions on migration, particularly for temporary residents.”

Enjoy your weekend!

Mark