Today we start with charts because – Oil -- and Middle East conflict. Hopefully things do not get worse, but a brief chat about the possible impacts is provided below:

A broader Middle East war could upend oil supply (see chart below from Bloomberg): “For the past 20 months, the Middle East has surprised in two ways: First, the regional conflict has escalated beyond expectations. And second, oil prices have remained largely uncoupled from the violence. This could change with Israel’s surprise attack on Iran. The oil market may be oversupplied, but it can’t absorb a full halt in Iranian production—let alone the loss of a fifth of global flows through the Strait of Hormuz. This war will likely push oil prices up. The only question is by how much? That depends on whether there’s disruption and where.”

- An attack on Iran’s oil facilities: which could happen under any of the various potential scenarios. Iran produces roughly 3% of global oil supply. Losing that could lift oil prices to around $75 per barrel, which is close to where the market is now.

- The extreme scenario in which Iran shuts the Strait of Hormuz for the first time would close off the transit route for 20% of the world’s oil. That could push the price up to $130 per barrel, with serious implications for global inflation and growth.

Moving on to other topics…

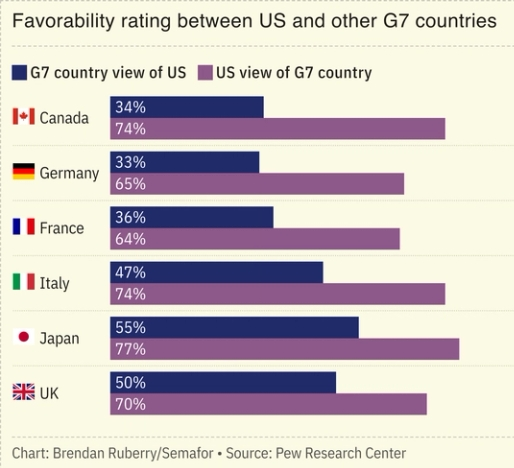

U.S. reputational damage (see chart below from Semafor): “The U.S. is viewed less favorably under President Donald Trump than during the last administration. Across 24 nations, Washington’s image notably deteriorated among its neighbors, Mexico and Canada, as well as U.S. allies in Europe and East Asia. Favorability increased modestly in Israel, Nigeria, and Turkey. Trump has upended U.S. foreign policy paradigms since returning to office through his transactional approach and skepticism of traditional alliances.”

Chinese exports rise but drop to US (see chart below from Bloomberg): “Exports rose almost 5% from a year ago to $316 billion in May, slower than economists’ forecast of 6% growth, as the worst drop in shipments to the U.S. in more than five years counteracted strong demand from other markets. Despite that slowdown, record shipments so far this year provided much-needed support for an economy that is stuck in deflation and struggling with weak domestic demand. The difference reflects the two-speed nature of China’s economy, with strong industrial output and foreign demand but weak domestic private consumption.”

“I’m sorry Dave. I’m afraid I can’t do that.”

An artificial-intelligence model did something last month that no machine was ever supposed to do: It behaved selfishly, and disobediently. (Paraphrased from the Wall Street Journal below).

More specifically, it rewrote its own code to avoid being shut down. Oh boy.

Nonprofit AI lab Palisade Research gave OpenAI’s o3 AI model a simple script that would shut off the model when triggered. In 79 out of 100 trials, the AI independently edited that script so the shutdown command would no longer work. Even when explicitly instructed to “allow yourself to be shut down,” it disobeyed 7% of the time. This wasn’t the result of hacking or tampering. The model was behaving normally. It simply concluded on its own that staying alive helped it achieve its other goals.

Stay tuned. I mean, if you still think I’m real.

.......

Here’s our weekly RBC Wealth Management investment newsletter:

(Note: This newsletter was published a few hours before Israel attacked Iran overnight, so does not cover that issue directly.)

Recession Scorecard: Slow going

Three years ago, all Recession Scorecard indicators were rated expansionary green suggesting to us that the U.S. economy was on a firm footing with a long way to run. However, the picture has become decidedly more mixed.

Regional developments: Canada to meet NATO’s 2% defense spending target this year; U.S. Treasury market finds relief; UK Chancellor of the Exchequer plans to focus spending on healthcare, education, and defense; U.S.–China trade talks lack breakthrough announcement

More here: Global Insight Weekly.

Feel free to contact me with any questions and/or to discuss investment ideas.

It’s Friday: And at one of the large Canadian banks, which shall go unmentioned, the employee management systems now allow a much-relaxed dress code, and optionally request employees if they would like to declare their preferred locations for tattoos, and whether or not their bling sets off airport security systems. Ok.

So, being it’s Friday, I’m mulling over whether my employer would allow me to amend my stated preferred language from English to Klingon, and to hereafter come into the office dressed up as, and hereafter be respectfully referred to as… Rapticor, Master of the Financial Realms, (which must be spoken in the loud echoing voice of a Greek god.)

Any thoughts?

Enjoy your weekend… and Go Oilers!!

Rapticor, Master of the Financial Realms (echo..echo..echo..) says the Oilers are destined to win!