How to help your daughter find a decent husband: I had a local shop create a t-shirt for one of our daughters around the time she left home – it said: “Eschew Obfuscation.” And no, that’s not about an old lady sneezing. But if, like me, your edumacashion didn’t learn you them words, here you go:

From Oxford Online Dictionary:

Eschew: deliberately avoid using; abstain from.

Obfuscation: The action of making something obscure, unclear, or unintelligible.

So, the joke T-shirt said we should avoid being confusing, but it said so very confusingly. And if she had to explain all that to a boy... maybe she was too smart for him.

It may have worked. About a year ago (with or without the nerd-magnet t-shirt) she married a solid boy who was curious enough to try and figure her out -- I mean as much as that’s possible. (Hi Andrew. Luv ya man!)

Financialization: When folks complain against the idea of financialization, they’re probably bucking against (eschewing) the deliberate obfuscation of money – which is to say they don’t want the financial system rigged against all but the riggers. Fair enough. But if 5 guys pool their pocket change and share a cab ride home, they have made a simple, friendly financial agreement. And if these same 5 guys later start up a real estate project, and bind one another with a complex legal contract, they’re not suddenly misbehaving. The devil isn’t in the complexity, complexity is only a problem when painted over with lies.

And of all the nefarious financial fiascos, the financiest of them might be inflation. It’s sneaky, easily understood, often underestimated. We can’t gently tickle-massage our way out of it.

When governments get serious about budget constraint, (and hence, inflation) we’ll all know it, and it won’t be because we solved some confusing math puzzle. We’ll know because it’ll hurt. Like losing weight, by weening ourselves off Cheezits. (Noooooo!). It’ll be the counter-version of sitting at home watching Netflix during the pandemic while the economy apparently blossomed during that Covid spending.

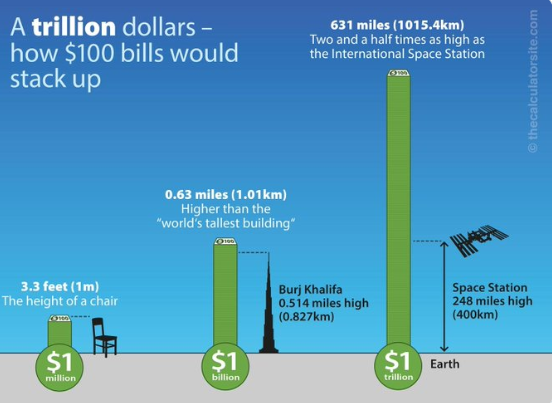

Scaling – This is handy for Budget Math:

- One million seconds ago was May 25, 2025 (11 ½ days ago)

- A billion seconds ago was in 1993 (32 years)

- A trillion seconds was 31,710 years ago.

This makes me hungry.

Where’s those Cheezits?

Visualize:

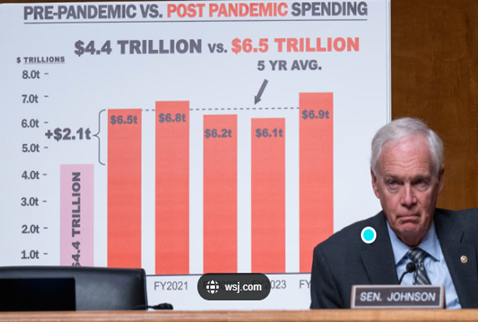

That’s a pretty good grandpa scowl Senator Ron Johnson has on (see below).

Person-years to pay just one years’ proposed deficit increase back:

- Median household income: $75,000

- $2.2 trillion/$75,000=29,333,333.

- More than 29 million median-earners would need to work a year and pay their entire income to pay just his year’s proposed US deficit increase.

“Hey there, what a cute baby you have! Do you think he would mind if I borrowed against his future pay cheque?”

Too lazy to type: For a thousand words, or something like that, see picture below.

Elon Gated:

- On Thursday, Telsa shares fell around 29% owing to a very public spat between President Trump and Elon Musk. That’s a one-day drop in shareholder value of $152.5 Billion USD.

- Trivia: The combined value of all North Central BC real estate title assessments sits today just shy of $100 billion CAD (see here).

- After adjusting for exchange, that’s about half of what Tesla dropped yesterday.

- So Tesla dropped yesterday enough to buy all the region’s real estate twice. But…

- But even after the one-day Tesla drop, the shares were up 68% on a 12 month basis. So that’s um… big.

- But then again, they’re also down 76% from their $488.54 high last December. Also big.

- So… yeah, it’s bumpy. Bigly.

That constant, annoying rub vexing Prince George’s working people. US Protectionist lobbies are a constant thorn against our amazing renewable resource and job creator. Here’s a longish, but great quote this week from a true global expert, Russ Taylor:

“The ‘made-in-the-US noise’ that the US does not need Canadian lumber – or from other countries – is completely bogus. US lumber imports represent… 30% of US consumption (Canada represents 24% of US consumption).”

“… One report suggests that 70 new US sawmills would be required to replace all imported lumber! This would require massive capital investments as well as huge increases in skilled and unskilled labour in logging and sawmilling that is currently lacking. (But) In March 2025, there were already 449,000 unfilled manufacturing jobs in the US. Logging and sawmilling jobs are not considered desirable by young workers, so trying to fill these forestry and mill positions will only get more difficult… imported lumber is still a key requirement for the US market, given the inability for US production to significantly ramp up production in the short term.” Russ Taylor

This week’s RBC Wealth Management's investment newsletter.

“Big and beautiful” or not?

The centerpiece of U.S. President Donald Trump’s economic agenda is winding its way through Congress. We provide thoughts on what’s inside the current legislation that’s of key interest to markets and investors, before noting why the ultimate outcome of the bill is likely to look different.

Regional developments: Bank of Canada holds rates steady for the second straight month; U.S. stock indexes rallied as investors looked past tariff threats; European Central Bank cuts rates and is in a “good place”; Japan-U.S. trade negotiations continue.

Full story here: Global Insight Weekly.

Feel free to contact me with any questions and/or to discuss investment ideas.

Charting things:

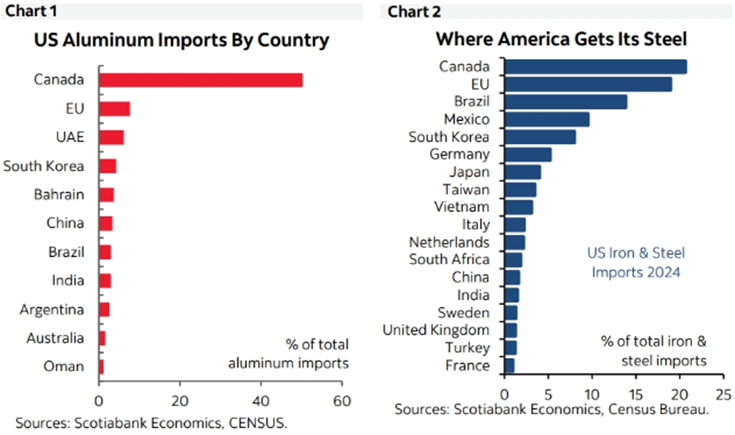

Aluminum & steel (see charts below from Scotiabank Economics): “Trump announced after last Friday’s close that he would double tariffs on steel and aluminum to 50% effective on Wednesday. He did so at a rally at U.S. Steel—a prime beneficiary of protectionism as the effects are borne by U.S. consumers and other U.S. businesses. Aluminum is especially mind-boggling because of the high pass-through risk of tariffs into prices given the dominance of imports particularly from Canada. Charts 1 and 2 show U.S. imports of both metals by country.”

Snarky Mark Comments here:

A smart strategy is for the US to import as much cheap raw material as possible, then add value domestically in the next phases of production, such as building cars, etc., creating jobs. It’s called “value added” for a reason.

So anyways… Sorry ‘bout that. Sorry for building out and creating an awesome bunch of resources for you to import build upon. You know. Cars and houses and stuff. No big deal. We’ll try to do worse.

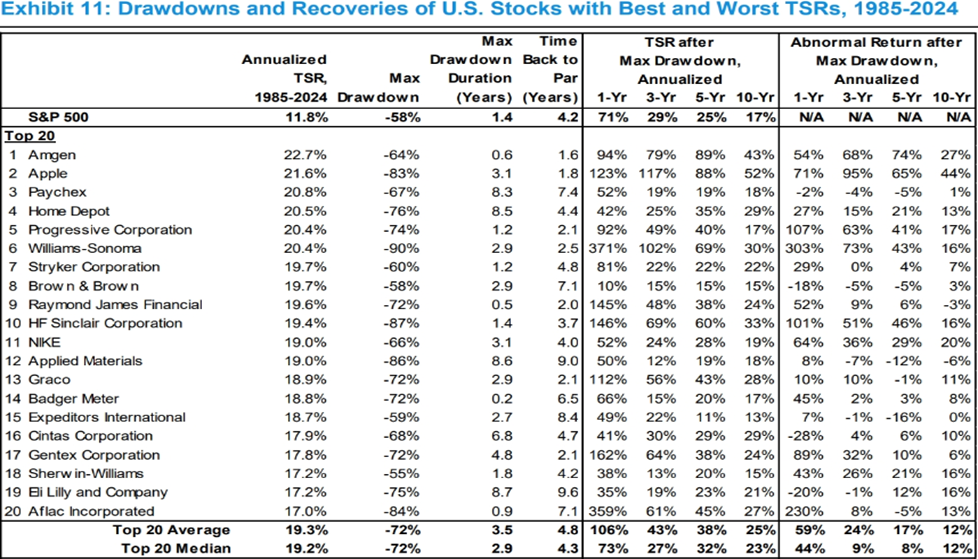

Highs and Lows: Even the highest-quality long-term positions suffer gut-wrenching drawdowns (see chart below from Morgan Stanley): “One of the hardest aspects of being a long-term investor is that even the best investments, or investment portfolios, suffer large drawdowns. A drawdown is the price decline from peak to trough. The drawdowns of individual stocks are much larger than those of diversified portfolios such as the S&P 500.”

The chart (below) shows the drawdown and recovery data for the 20 stocks with the best total shareholder returns (TSRs) from 1985 to 2024.

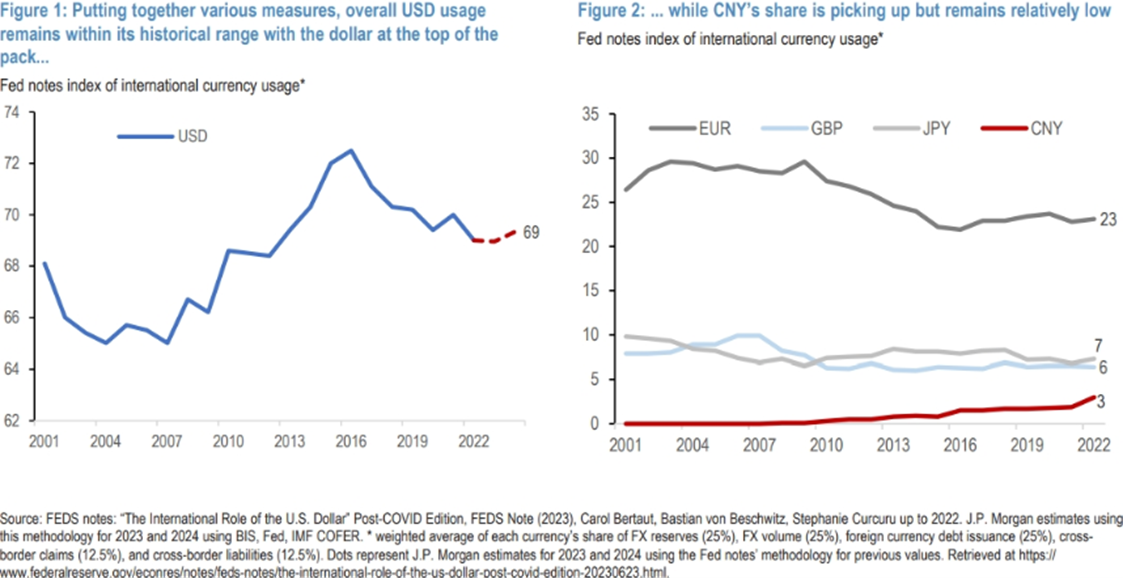

De-dollarization? Just the facts (see charts below): “Even as the U.S. share of global trade and output has declined, the dollar maintains its transactional dominance when measured by including FX volumes, trade invoicing, cross-border liabilities, and issuance of FX debt. A weighted index consisting of these measures suggests that dollar usage remains within its historical range even if it has declined somewhat from the 2016 peak (Figure 1), in contrast with other currencies (Figure 2).”

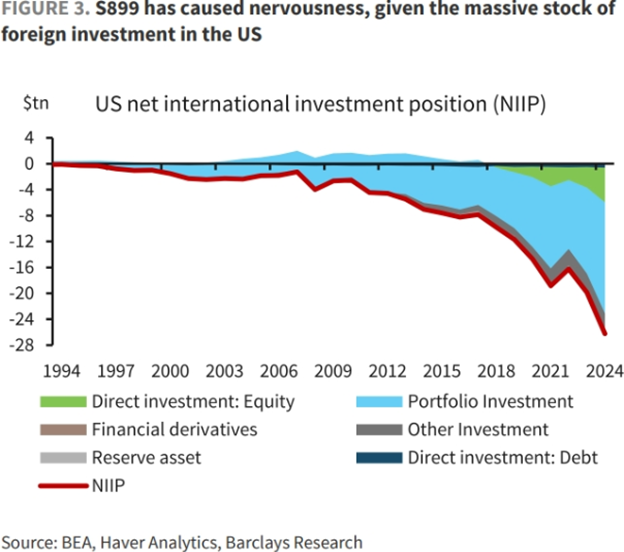

Section 899: (We may be discussing this for a while now. See chart below).

Burried deep in the so-called “Big Beautiful Bill” is a provision about which markets have become particularly concerned.

Section 899 on 'Enforcement of remedies against unfair foreign taxes', which appears on page 959 of the 1,038 page bill (which hardly anyone could possibly have read).

The wording would allow the US government to tax U.S. income of most U.S. nonresidents (including governments and central banks, regardless of tax treaties) from 'discriminatory foreign countries', such as those that impose digital services taxes.” (Canada does).

The rate would start at 5% and increase 5% per year, up to 20%. This would reduce the effective return on U.S. assets, including Treasuries, potentially reduce demand for them and lead to capital outflows, pushing up yields. Given U.S. net international investment position is sharply negative, there is indeed scope for capital outflows if indeed S899 passes through the Senate in its current form. It is unclear what its scope would be, however, and whether there would be some exemptions, like Treasuries for example. But it may well make U.S. assets less attractive to foreign investors, potentially weighing further on the dollar.

More on Section 899 just below, and likely more to follow in the days ahead.

More on Secition 899:

For now, I’ll just add that we have a couple of papers touching on this, which I can provide on request. It’s uncertain enough so far that we can only try to stay abreast of the potential impacts, and keep watch. The clause seems more targeted at overseas players, but when you sleep next to an elephant, and he reaches across the room for something, it can get awkward pretty fast.

Oh Canada!

Enjoy what should be a beautiful sunny weekend!

Mark