Red Button:

It was at the end of a 2-week summer vacation – the cheapo Ryan Family version, where our 7 kids slept on the floor at our friends’ place. We had said our goodbyes the night before and I was tip-toing around just prior to our 5:00 am departure back to PG when I noticed a small red button on the wall, about a foot above the bedroom light switch. There was no indication what it was for.

I thought to myself, “I should probably push that red button on the wall because, if I do, something neato will happen.”

I pushed it.

Sirens blaring!! – not just wake-up-the-house-sirens, WAKE-UP-HALF-THE-CITY sirens! Deaf-people-feel-the-vibrations sirens!

Why?

I mean – why was it there if they didn’t expect me to push it?

Legal and Financial Disclaimer: Since we are not allowed to comment on anything too political, please note that this red button-pushing story has nothing to do with Trump and tariffs.

Also, this one time, I stuck my finger in an electrical socket… which is also not about He Who Must Not be Named.

Here’s this week’s Investment Newsletter Global Insights Weekly:

In this week's issue...

- In brief: Vortex of Volatility - A period of rapid-fire developments has understandably put investors on edge. We make sense of five catalysts tugging on stock markets and elucidate why we’re not ready to throw in the towel on the two-year-plus bull market just yet.

- Regional developments: Tariff turmoil drives Canadian market volatility; Federal job cuts fuel concerns across the U.S. labor market; Seismic change appears ahead in Germany; China maintains 2025 GDP growth target of approximately 5%.

Full story here. (Let me know if the link doesn’t work)

From our Canadian Economists:

Trade Turmoil and Canada’s Housing Market Turmoil. Story here

From our US Economists:

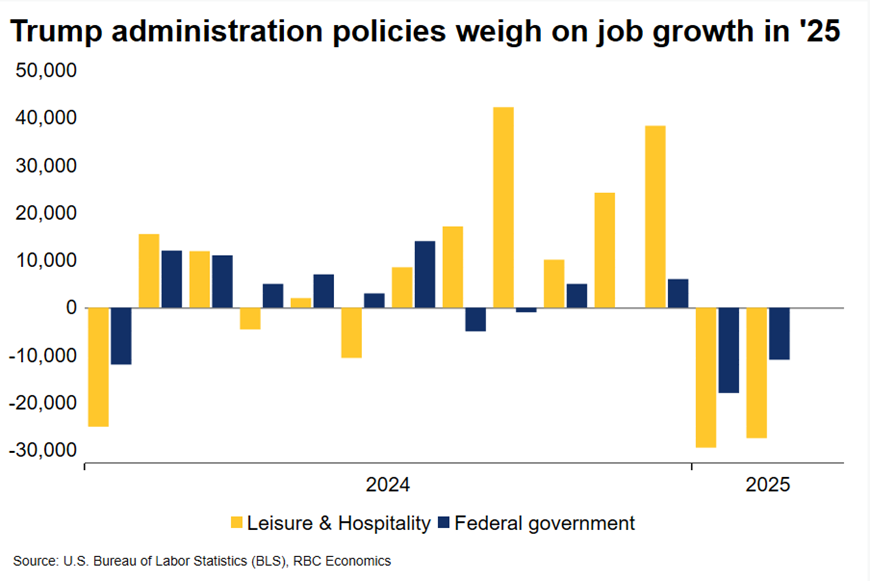

U.S. government policies weigh on job growth in ‘25

Bottom line:

This report is reflective of government policies weighing on growth in 2025. Health care remained the primary driver as its growth held steady (we expect to see health care continue to grow with the aging of the U.S. population). But we saw job losses in the Federal government and leisure and hospitality. While the Federal layoffs should not be a surprise given the recent layoff announcements by DOGE, what is interesting is the drag seen in Food services – a sector that is likely facing a shortage of workers due to the slowdown in immigration. Looking ahead, we expect the uncertainty around tariffs will weigh on payroll growth in trade-related sectors and look for the DOGE layoffs to continue to subtract from headline growth. This trajectory poses upside risk to our unemployment forecast, which we currently have rising to 4.2% by year-end.

The Details:

- Payrolls added 151k jobs in February, below the expected 160k. The unemployment rate ticked up to 4.1%, in line with our expectations.

- The payroll gains were driven by a continued rise in healthcare & social assistance (63k) as well as gains in finance (21k), and construction (19k).

- The Federal government shed around -10k jobs this month (we do expect to see that continue in the months ahead). Leisure and hospitality shed jobs for a second consecutive month, driven primarily by a drop in Food services, suggesting the slowing in immigration is weighing on hiring.

- The household survey showed a rise of 40k in permanent job losers and 58k in workers who completed temporary jobs – both reflective of cuts to the Federal workforce as well as the contractor workforce.

- On a monthly basis, AHE slowed to 0.3% m/m (following a downward revision to January to 0.4%). Still, the y/y pace remains elevated at 4.0%.

Enjoy your weekend! Spring rolls up this year, it seems, like an Amazon driver in the afternoon.

Mark