Good afternoon,

Some world trade leaders -- who shall remain unnamed -- remind me of that kid who literally picked up his soccer ball and went home after his team started losing. He ran home to his mom rather than face the music like a… real boy. The funny thing in retrospect is that we (his pals with a legitimate beef) actually expected his mom to send him back outside for a little chat with us. I mean, my mom would’ve given me up like an expired bus ticket, but this kid’s mom stood at the window and defended the precious little baby from a decent learning opportunity. We learned him later is all.

There’s a legitimate place for tariffs, sure, in response to unfair trade practices. But too often they’re just an unfair trade practice themselves, making everyone a little poorer.

Financial Analysis: People threatening tariffs are whiners.

While North American equity markets flirt with new highs, the incoming U.S. administration introduces fresh uncertainty, some of it positive, and some not so much. President-elect Donald Trump, who was never spanked as a child, recently proposed sweeping tariffs: 25% on imports from Canada and Mexico and an additional 10% on Chinese goods.

You big crybaby. Get a soother.

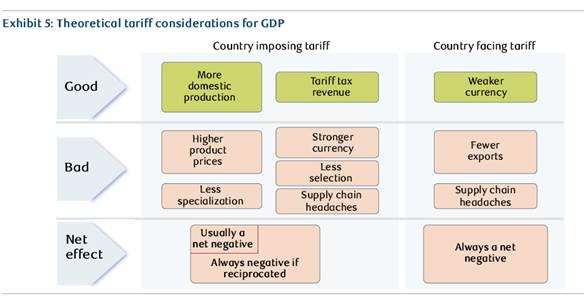

Impact: Countries generally use tariffs to protect domestic industries by raising the cost of imports and encouraging consumption of locally produced goods. Tariffs also provide a source of government revenue. However, in practice, the benefits to the country imposing the tariff are often offset by several forces. (See chart below). Domestic businesses that rely on foreign inputs to produce their own goods may face higher costs, and retaliatory tariffs can harm exporting industries.

Ultimately, consumers usually bear the brunt of the costs through higher prices.

But actually - Lessons from President Trump’s first term: Last round we saw similar threats result in negotiated compromises, which suggests this may be part of an early negotiation strategy.

- This time: Trump proposed these tariffs with the explicit aim of pressuring Canada and Mexico to enhance their border security.

- Last time: Trump threatened to escalate tariffs on Mexican imports unless the country took measures to curb illegal immigration. Mexico responded by deploying additional border troops, thereby avoiding the tariffs. A similar scenario may lie in front of us.

The term flying around this week is to take the new president seriously, but not literally. The new president is not unprecedented.

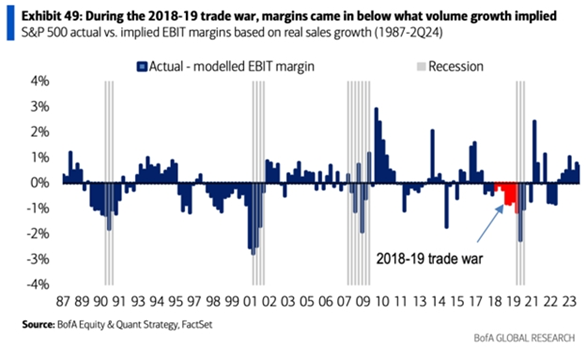

Margins are likely to get hit by tariffs (see chart below): “We estimate that there was about a 60 bps hit to EBIT margins from increased tariffs during the 2018-19 trade war. A 60 bps hit to current EBIT margin would translate to a 4% hit to EPS. 60% China/10% rest of world tariffs proposed could be done without congressional approval—we estimate a 3% hit to S&P 500 EPS but 60% may be a starting point for negotiations. Retaliatory tariffs would hurt U.S. multinationals, and the fact that intermediate goods are included is more problematic for Tech and Industrials than 2018's tariffs, in our view."

Yet markets so far have largely shrugged off the tariff threats. The Canadian stock market has marched higher, while the Canadian dollar has pared back some of its losses following the announcement. Still, the Loonie remains near multi-year lows, reflecting stronger U.S. economic growth and expectations that U.S. interest rates will eventually settle at higher levels than in Canada.

Canadian equities proved resilient during President Trump’s first term despite the imposition of steel and aluminum tariffs. Between 2018 and 2019, Canadian stocks outperformed other non-U.S. developed markets, as tariff-exposed industries represented only a fraction of the market. The Canadian equity market may be more insulated from the impact of tariffs than its own economy. Sectors such as financial services, software, and food retail are not directly exposed to tariffs as they do not rely on physical exports. Moreover, an increasing number of Canadian companies that make up its stock market have diversified their businesses internationally, reducing their sensitivity to economic developments at home. This stands in contrast to the thousands of small and medium sized private businesses that make up its economy and may be more directly exposed to domestic issues in Canada.

In sum, while we do not view tariffs as an empty threat, we believe any impact may be less punitive than some may expect. Nevertheless, this development has served as an early reminder that the new U.S. administration may introduce greater unpredictability, potentially adding to market volatility from time to time. This may create risks to consider going forward but can also create opportunities as short-term dislocations arise. We will be on guard for both as we move into 2025 and beyond.

Global Insights Weekly:

Last week’s report was canceled it was US Thanksgiving and people in Toronto -- who were also not spanked as children -- think they’re special.

But, Oh-Oh Canada:

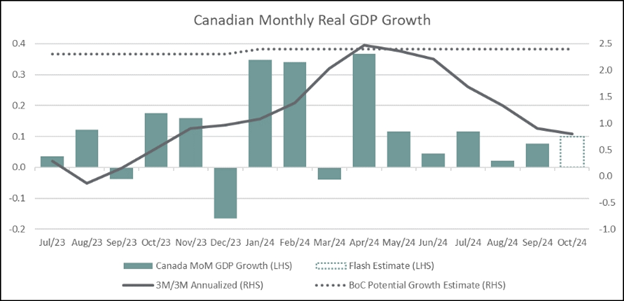

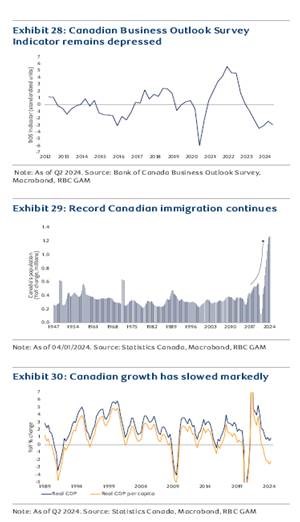

Q3 GDP in Canada fails to meet Bank of Canada’s expectations. Last week’s income and expenditure-based GDP report indicated that Canadian real GDP grew at an annualized pace of +1.0% in Q3 2024. GDP growth in Canada appears to be tracking well below the BoC’s potential growth estimates of 2.4%, indicating growing slack in the economy.

RBC Economics notes Canadian re: U.S. jobs reports.

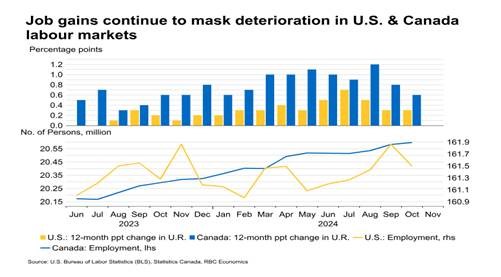

“Canadian employment edged up 10,000 with the unemployment rate rising to 6.7% in November from 6.5% in October. Canada has steadily posted job growth, but not fast enough to keep up with growth in the labour force as the population continues to rise rapidly…The unemployment rate is still running almost 1 percentage point above year-ago levels and hiring demand has continued to slow with job openings falling. Data from the latest Survey of Employment Payrolls and Hours showed September job openings were still down 18% year-over-year.”

“The U.S. labour market, on the other hand, has remained firm, supported by resilient economic growth. We look for U.S. payroll employment to bounce back 157,000 in November after a 12,000 increase in October. “

Quotable:

An RBC investment analyst at a recent conference I attended said:

“It’s becoming apparent that taxing and regulating the (heck) out of Canadians might be counterproductive.”

Thank-you for voicing it. If I was a puppy, my tail would have been wagging just then.

I’m so glad not all of the big blue bank has gone soft on me.

Punks we hire round here with all their bling need a little yank on the nose ring.

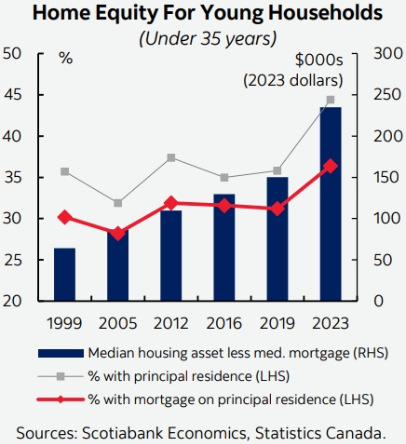

Canada young household ownership rate (see chart below from Scotiabank Economics): “Contrary to much hype, an increasing share of young households have a stake in housing markets. For those under 35, primary residence asset ownership jumped almost 9 ppts to 44.4% in 2023. A greater share of younger households also acquired secondary real estate assets, whereas the general population saw a pullback.”

Good news. Hey, do these young homeowners know what those extra bedrooms are for? Making us grandchildren, duh.

In truth, despite all the noise, we indeed have so very much to be grateful for. It’s a great country, and even a greater continent, and markets are like drones lately. Mostly nobody actually needs to get punched in the nose.

Enjoy your week!

Mark