Good afternoon,

Sorry about the formatting issue in my email preamble last week. After my 2nd & 3rd attempts at it, I realized that Bill Gates had personally intervened and foiled the message -- cranky about the US election. Can’t be sure, but I mean, woah. Rude!

Hockey Night in Russia: The story goes that a close oligarchic pal of Putin bought a hockey team years ago and then bought up several of the country’s best players, ensuring a few years in a row of domination in their Whatever League (I think it’s The League of Extraordinarily Pernicious Oligarchs).

Anyhoo… Eventually an upstart Russian team without any of that Daddy Oilbucks cash whatsoever had a great year and was poised to defeat the oligarch’s pet team in the championship series. At this point, the evil villain kept character, rigging the rules, and bribing the referees, thus ensuring that his team won the series.

So, basically it was like when Boston beat Vancouver that time and the head referee was the father of a Boston player. You with me here?

But the actual point is, that whether we like the US election results or not, and despite what was most definitely a caustic and divisive campaign, the process itself was still a win for democracy – imperfectly as always. Here’s why: Unlike that Russian hockey game, the outcome was in doubt until it wasn’t, and that uncertainty itself is a win because voices get to play a role to influence the outcome – the messy outcome. That’s one reason, at least temporarily, markets had a good week last week. A little bit more classy conduct on both sides would have been a still bigger win for democracy. But here we are.

Fed rate cuts for what?

The Fed faces a conundrum. It has cut policy rates by 75 basis points since September only to see longer-term Treasury yields and mortgage rates increase by the same degree. We look at what may be driving this divergence and the potential implications for lenders, borrowers, and the economy.

Regional developments: Housing activity in Canada beginning to move higher; U.S. equities marked a new high-water mark propelled by hopes for post-election deregulation; German snap elections in February could bring a more functional government; China’s latest stimulus package doesn’t meet investor expectations

Read the rest here: Global Insight Weekly

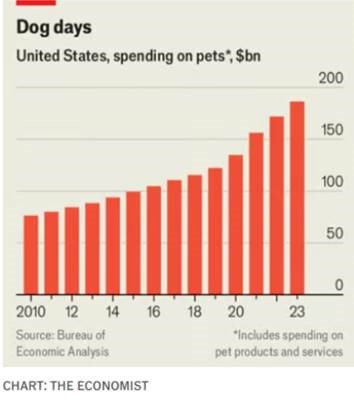

Meet the granddog: People are splurging like never before on their pets (see chart below from The Economist): “Americans spent $186bn on them last year, covering everything from food and vet visits to toys and grooming. That is more than they spent on childcare. Catering to pets has become big business. Mars, a company best known for its chocolate bars, made two-thirds of its revenue last year from pet-care.”

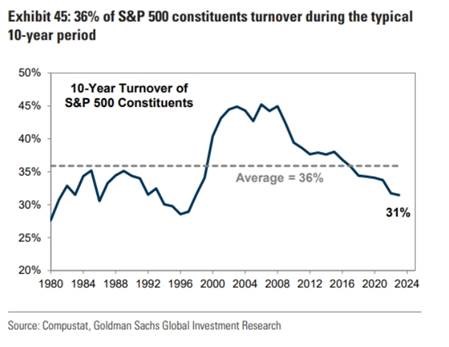

S&P 500 turnover (see chart on the right from Goldman Sachs): “Since 1980, 36% of S&P 500 constituents have turned over during the average 10-year period. As a result, the index is continually reconstituted and less successful companies are replaced by new firms that may have better growth prospects.”

The market chooses the winners.

There’s a Postal Strike: Said another way… Canada Post managed to Houdini-hammer a couple more nails into its own coffin from the inside today, as its strikers hit the streets without our mail over their shoulders this afternoon.

Hopefully it will be resolved quickly, but during the strike we will need to take some care to ensure that our documents, statements, and other communications with you stay current. We’ll be in touch if need be, but feel free to reach out if there’s something amiss in our system as a result of the strike.

Hey Mikie!! I just watched the Mike Tyson – Jake Paul fight, quite by accident over dinner. At 58, the old slugger held his own very well against a (non-pro) boxer less than half his age. Impressive. He lost, but not a bad effort.

And… enjoy your weekend!

Mark