Good afternoon,

It seemed like good timing – attending a national investment conference during a week which straddled the conclusion of a bitter US election campaign. We heard a few financial analysts from the US, drilled them with questions on Monday and Tuesday, took notes on their thoughtful predictions. The biggest worry, most agreed, would be the near certainty of an uncertain outcome – likely followed by weeks of conflicts, lawsuits, street protests or worse. We would get through it, but it would be messy.

It's those close ones that hurt. I know this because I’m a Canucks fan. I can barely think about that Boston series, losing in game 7. And it hurt a lot more than the game 7 loss against a stronger New York team in 1994. The street protests were so violent after the Boston loss our daughter, who was in Italy at the time, saw something on the Italian news and asked us if everything was okay at home. But when we lost to New York, we all celebrated. It was 7 beautiful games of full-on impostership.

So, like him or not, the re-election of Trump was decisive. And that’s probably good, at least for now. We’ll see how it unfolds – how much of a tariff war he steps into, how much he and his red congress spreads the red – and just when the spending ends. And how much the competing factions (that’s a good thing) meter his stride -- temper his temper.

Go Canucks go.

It’s Season 2 – He re-ran - An RBC Chief Economist on the recent election. Here: A new chapter begins

Here’s this week’s Global Insights:

RBC Wealth Management's latest investment newsletter.

Back to the future

In a historic political comeback, Donald Trump won the presidency for a second time, and we look at the key policies like taxes and tariffs that will shape the investment climate. But given the heated discourse across the political spectrum, it’s critical to not let emotions get in the way of sound investment decisions. While Washington can influence the business cycle for good or for bad, it doesn’t control it.

Regional developments: Canadian manufacturing and services sector activity improves; The Fed delivered an unsurprising rate cut, but markets stayed focused on what might come next; Trump presidency likely to bring changes to Europe; Asia investors assess potential impact of higher tariffs

More here: Global Insight Weekly.

Here’s a few Graphs:

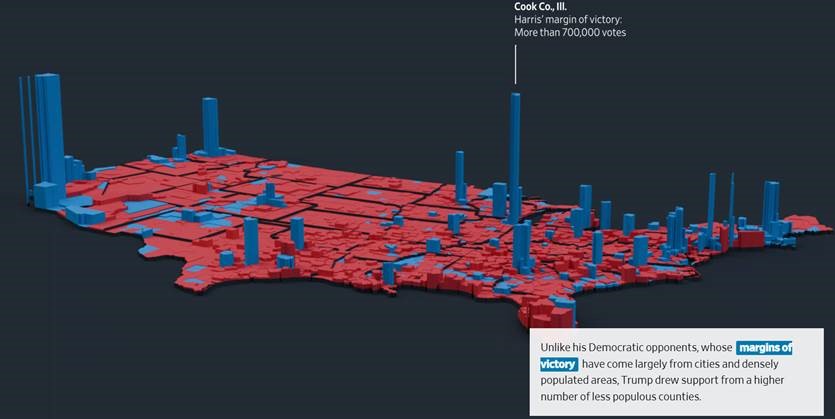

Lumpy jam: Like baseball stats, which are endlessly analytic, Americans love statistical views of the electoral leanings. In this brilliant interface, the Wall Street Journal shows how the Democratic party vote was concentrated in cities, while the Republican support was spread more thinly and widely across the nation. It’s not so much a new insight as a great visual.

Well-Red, Geographically and Demographically: Republicans gained in nearly every category. The graphic below, from the NY Times, shows wide GOP increases among the states shown, but other data also shows nearly every identifiable group leaning more toward the GOP nominee as compared to 2020. One key demographic was an exception to this trend – mature college-educated white women.

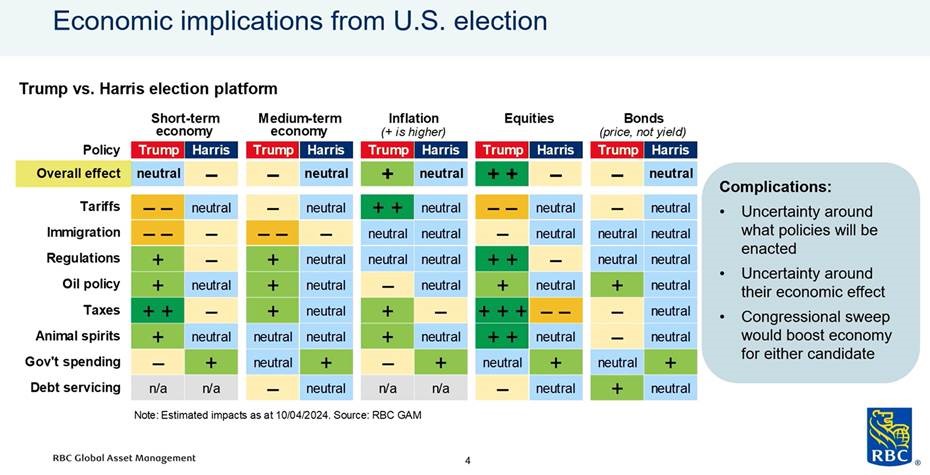

Let your eyes glaze over (did I even need to say that?) and you can see a bit more green under the proposed Republican platforms than on the ones from the Dems in the RBC graph below. But congress is its own animal, regardless of affiliation (oh how I wish it was this messy in Canada – seriously. Quick reminder here – political arguments are good inasmuch as they represent broad coalitions).

Still, the news sent a fairly bananas market bananas-er this week, with US indices are up over 5% on the week as I chisel this email.

So here we are. Three days after the election and not in the midst of utter chaos. Fingers and toes knocking wood while crossed.

Enjoy your weekend!

Mark