Good afternoon,

It was a strong Friday in markets, but capped a weak week, which reflected a few disappointing performance reports from major reporting entities. And perhaps the stocks let a little air out of the tires after a well-inflated year and no small amount of hot air circulating in US election newsfeeds.

Overheard: These conversations reportedly took place at recent treasury bond auction dart tournaments, first in the US and later followed by something similar in the UK as governments try to keep up with their very spendy leaders:

Treasury: “Psst. Yo bond market. What up?”

Bond Market: “Whut.”

Treasury: “Come- ‘ere! Buy my T-bills!“

Bond Market: “So who are you, Xi Jin-ping-pong? No thanks.”

Treasury: “Whudumean Who am I?! Common, you always buy them! Donchu you want sumore?”

Bond Market: “Nope.”

Treasury: “But… we… ah… Your Uncle Sam needs you!”

Bond Market: “Smunkle Shmam is yesterday’s two-day-old donut.”

Treasury: “What?”

Bond Market: “Okay, listen Uncle Chump Change, I’ve got other uncles.”

Treasury: “Right. Umm. Well, how about we pay you more?”

Bond Market: “Now you’re talking. But are you gonna behave?”

Treasury: “Behave?”

Bond Market: “You’re an idiot. Ask Liz Truss. She’ll explain.”

Treasury: “So… you gonna buy?”

Bond Market: “Bye.”

Elections and spending: As we’ve noted before, governments don’t get fiscal discipline, bond markets force it on them. At that point that country’s treasury/central bank no longer has the clout to impose a price (interest rate) on the rate marketplace and the ball is volleyed back to where it belongs, in the legislatures where spending decisions are made.

So… stay tuned. And don’t hold your breath just yet. It’s almost Christmas and Santa and all the elves are running for office.

Next, this week’s Global Insights stories we’re following:

The end of China’s challenging chapter?

China’s economy, faced with structural and cyclical challenges, is now growing more slowly than in its glory days. The authorities seem determined to draw a line under the crippling housing crisis and have announced a coordinated stimulus. We explore the monetary and fiscal measures undertaken and contemplated and conclude that, despite slower growth, the country should be in good stead to remain the main contributor to global growth.

Regional developments: Sluggish growth supports dovish Bank of Canada posture; Resilient U.S. economic data defies rate cut expectations; New Labour government Budget makes Gilt market jittery; Snap election called by Japanese prime minister backfires

More here: Global Insight Weekly.

According to this, more diversified portfolios could benefit from the end of election uncertainty (see exhibit below): “Historically, U.S. Presidential elections tended to kick off a period of outperformance for S&P 500 Equal Weight vs. S&P 500. Since 1980, S&P 500 Equal Weight delivered median excess returns of 4.3% against S&P 500 approximately 1 year after Election Day. These findings are consistent with prior analysis we have done regarding factor returns around US Presidential elections, which tend to favor systematically-defined “Value”.

However, will this time be different? Recent S&P 500 Equal Weight / S&P 500 relative returns have deviated from trends we observe throughout past election years. The unusual market concentration driven by Big Tech led to S&P 500 Equal Weight underperforming S&P 500 by ~6% over the past year, when S&P 500 Equal Weight / S&P 500 relative returns are typically flat to slightly positive over the year leading into Election Day. But we now enter favorable Nov-Dec seasonality for S&P 500 Equal Weight / S&P 500 relative returns, which could coincide with the long-awaited convergence in earnings growth between Big Tech and the broader equity market. Combined with clearing the election overhang, we think that a broadening of market returns beyond the mega-caps could be entering a more sustainable phase.”

Oh Canada – Mortgage Rates

Where Canadian mortgage rates settle? (see chart below from RBC CM): “The chart below shows different tenors of mortgages rates compared to the BoC policy rate and the 5-year swap rate. Mortgage rates have come down from the peak but are still at comparable levels as two years ago. Importantly, the spread between 5-year mortgage rates and 5-year swap rates (~150 bps in CORRA terms) is closer to the bottom of the historical range (limited room for further compression). Mortgages rates should continue trending lower alongside BoC rate cuts, and while housing affordability will improve it is still challenging. Lower rates will help housing, but it might take 5-year fixed reaching 3% or below to really supercharge the real estate market. The interplay between other forces―amortization extension for first time buyers (positive) and lower immigration targets (negative)―might roughly balance out. We think the BoC could cut rates to 2% and the market is pricing the terminal rate at ~2.75%. Based on this and historical patterns in the spread between the 5-year fixed and 5-year swap rate, we hazard a guesstimate on where 5-year mortgage rates could be based on different policy rate assumptions.

Policy rate (1.5% - 2.0%) = 5y mortgage rate (3.0% - 3.5%)

Policy rate (2.0% - 2.5%) = 5y mortgage rate (3.5% - 4.0%)

Policy rate (2.5% - 3.0%) = 5y mortgage rate (4.0% - 4.25%)

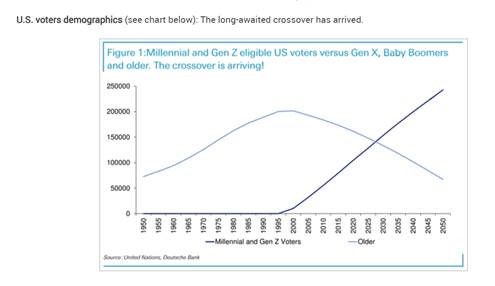

The kids are alright – they’d better be! Oh ohhhhhh. U.S. voters demographics (see chart below): The long-awaited crossover has arrived. Soon the pups will be running the dog show as Gen Z and Millennials will exceed boomers in boom town! Foreshadow… I see President Taylor Swift in 2032. Gross.

Enjoy your weekend!

Mark