Good afternoon,

We had some dear friends over for dinner the other night, Americans. Salt of the earth types. A wonderful visit. Our friendship runs deep enough that the obvious didn’t even surface through several hours of catching up – until it did. As they were just about to leave, I invited my pet elephant into the kitchen and blurted out. “So tell me… which sunshine coast would you roast the most?” (silence)… “I mean… who you voting for?”

Since it’s on most minds these days, on nearly every newscast, and on every media scroll, here’s a couple of quotes on the two would-be US Presidents. Both are a fittingly sarcastic, from Wall Street journal’s Lance Morrow.

Morrow -- on the Orange Man:

As the leaves turn, there’s that atmosphere of Saturday morning cartoons—or professional wrestling—that Mr. Trump brings with him everywhere. The real world is darkened by wars in the Middle East and Ukraine and by assassination attempts in Pennsylvania and Florida. Rarely has history seemed so silly and so ominous at the same time.

And this isn’t to imply an easy choice. Here’s another bit from Morrow describing the conundrum facing undecided potential Harris voters.

Morrow -- on the Not-orange Woman:

“Ms. Harris was a failed presidential candidate in 2020, dropping out before a single primary vote was cast; for more than three years, she was a mediocre vice president. She owns the Biden record, although she would rather not…(she) stands above all for the Democrats’ master premise of ever-increasing government spending and interference in people’s lives.”

So… Who? Our friends’ answer was the same one they gave us in 2016. Buy shares in SprayTan Inc.. These are not crazy people -- it’s their country, and of course it’s they’re choice. And for their tastes, they feel it’s the lessor bad choice, I suppose.

Impacts on Markets: The US constitutional core, swampy though Washington may well be, still seems to ably congeal two unnerving semi-opposites into something functional. This is notwithstanding the seemingly endless Jerry Springer rerun their election system spits out.

When all is said and done, one turkey or another will see in the 2024 US Thanksgiving. Christmas will come and go, and sometime early next January, Pomp & Circumstances will chime in, choirs and flags will ripple the air -- and it’ll all feel as though we’ve seen something dignified arise from the cacophony. Then, like clockwork, the talking heads will talk, and on that note the 2028 election cycle will begin.

Maybe it’s just really that ugly seeing how the sausages get thrown together.

Here’s our weekly Global Insights:

Here’s this week’s submission (actually from this past Thursday night, but still current):

Bigger BRICS: Building a multipolar world?

The latest installment in our ongoing “Worlds Apart” series looks at the just-concluded BRICS summit and how the group aims to rebalance the global order. We believe the shift to a multipolar, more fragmented world argues for viewing portfolio allocations through a different lens.

Regional developments: Bank of Canada delivers 50 basis points rate cut; Better-than-expected economic data in the U.S. drives higher yields; Markets eyeing a 50 basis points European Central Bank rate cut in December; China to likely see another soft earnings season

Full piece here: Global Insight Weekly.

Charts: Welcome to Chartopia’s chamber of ka-ching!

Baseball has been very very good to me.

The Los Angeles Dodgers vs. the New York Yankees in a coastal city clash of cash (see exhibit below from Wells Fargo): “The 120th edition of the World Series is underway. The matchup features the Los Angeles Dodgers and the New York Yankees, two storied franchises who have spared no expense in the pursuit of bringing home the Commissioner's Trophy. The Dodgers' combined 2024 payroll totaled nearly $250 million, the third highest in the MLB. In 2024, the Yankees combined payroll amounted to over $303 million, the second highest in the MLB behind the Mets.

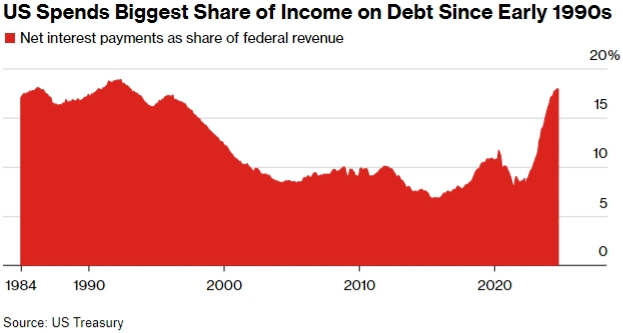

U.S. government net interest payment (see chart below from Bloomberg): “The Federal Reserve’s shift to lowering rates is offering some relief to the Treasury. The weighted average interest on outstanding U.S. debt was 3.32% at the end of September, marking the first monthly decline in nearly three years. Even so, debt servicing was among the fastest growing parts of the budget last year. Spending on interest also risks weighing on economic growth by crowding out private investment. The nonpartisan CBO estimates that every additional dollar of deficit-financed spending reduces private investment by 33 cents.

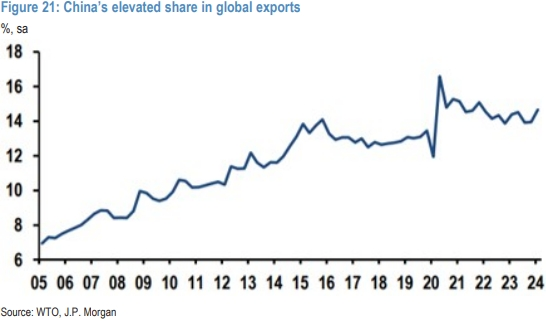

China’s remains the dominant player in global supply chain (see chart below from J.P. Morgan): “China has increased its trade market share since the pandemic. Its share in global exports has risen around 3 percentage points post-pandemic and remains elevated at 14.7% in early 2024, well above pre-pandemic levels even with the imposition of tariffs and export restrictions by the U.S. and western allies.”

Rush to get capital out of China (see chart below from the Wall Street Journal): “Moving fortunes out of China is hard: The country imposes strict capital controls that cap individual purchases of foreign exchange at $50,000 a year. Violators can receive big fines, or even prison sentences, if they break the law. Nevertheless, the stampede for the exit in the past few years appears to dwarf the outflows that occurred in 2015 and 2016, when an earlier property downturn propelled what at the time was the biggest episode of capital flight from China, in dollar terms, according to economists and a Wall Street Journal data analysis. The Journal’s tally suggests as much as $254 billion might have left China illicitly in the four quarters through the end of June.”

(I wonder how much this is tied to the buoyancy of Vancouver real estate?)

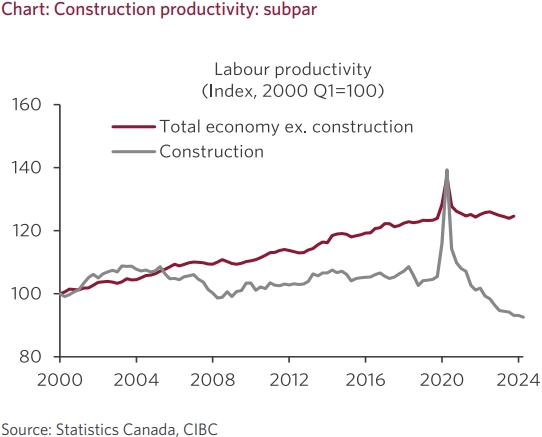

Productivity in Canada’s construction industry is dreadful (see chart below from CIBC Economics): “Take a pilot from 50 years ago and put him/her in a cockpit of a modern jet, and that pilot will be totally lost. Take a construction worker from the same period and land him/her in any currently active construction site, and that person will fit in immediately. Technology is changing at the speed of light but in the construction industry there is little new under the sun. No wonder then that productivity growth in the sector is miles below what we see in the rest of the economy (which is nothing to write home about to start with).”

And… Enjoy your week, even if it is a Monday!

Mark