Good afternoon,

Markets enjoyed a good week, but you may wonder why we’ve had such a bumpy August? The back-story may bore you or fascinate you. Why has August been not so august?

The Yen Carry Trade – did it Miscarry?

The Yen Carry Trade Simplified:

- Borrow yen in Japan at very low rates;

- Invest in the US at relatively higher rates;

- Assuming the exchange rate is relatively predictable, the difference can be a fairly safe profit.

Carry Trade Risks: Many factors impact exchange rates. Crucially, if the Japanese borrowing rates increase, (as they did earlier in August) you are penalized (at least) twice because that higher loan rate also pushes up the yen, which is the currency you need to pay your loan back with.

Characters in this drama:

Mrs. Watanabe

Smart: The name is a term going back as far as the early 90’s.

Smart: The name is a term going back as far as the early 90’s.

It refers to the mythically- savvy Japanese housewives who

purportedly started the Yen carry trade.

Aunt Agatha

Cautious: Aunt Agatha, is a British term referring to the very conservative investors. (Agatha refused to sit for a picture.) Mrs. Watanabi is said to have been a clever Japanese reply to Aunt Agatha.

Mr. Paganini

For a superior use of gibberish: Click here for Ella Fitzgerald’s wonderful rendition of Mr. Paganini. (This is for the readers who are already bored)

For a superior use of gibberish: Click here for Ella Fitzgerald’s wonderful rendition of Mr. Paganini. (This is for the readers who are already bored)

In truth, “Mrs. Watanabe” is probably more like a jazz club of hedge funds, dealing in very large sums. The yen carry trade gets more complex as some of these investors lean into riskier US currency assets at the same time, rather than Aunt Agatha’s US T-bills. When rates change unexpectedly, the calculus changes, and traders scramble. Like last week.

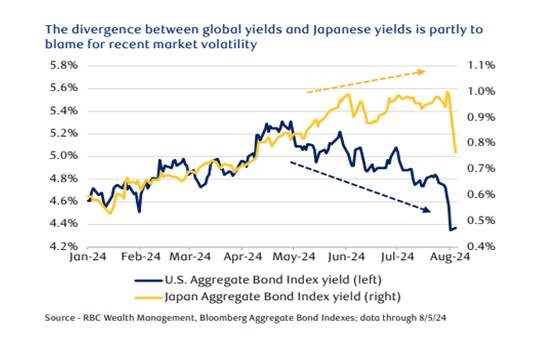

Interest rate differentials. Key drivers of currency exchange rates are simply the gap between interest rates—countries with higher/rising rates tend to see their currencies appreciate, those with lower rates the opposite. But hedge funds, traders, and others can also borrow in the low-rate country and invest where expected rates of return are higher—hence the so-called “carry trade” that has captured headlines.

Like many things, this usually works. Right up until the point that it doesn’t

That, very simply, is the dynamic behind the most recent bout of global market turmoil, in our view. As the chart below shows, the first half of the year was characterized by global bond yields rising in unison as investors came to realize that central bank rate cuts would likely be both delayed and fewer in number. But after a favorable run of inflation data in many developed economies which reignited rate cut hopes, at a time when the Bank of Japan was guiding toward rate hikes, the gap began to grow. As a result, after a long stretch of weakness the yen began to strengthen in July, whereupon the Bank of Japan delivered a surprise rate hike on July 31.

Markets didn’t appreciate the surprise. The unexpectedly soft U.S. labor market report which followed sparked a “flight to safety” that drove global sovereign yields down by historically large degrees.

Though it remains too early to tell whether this is a simple unwinding of trading positions that will cause some market consternation but ultimately fade away or if it’s simply a big warning about even bigger risks to the global economy, we think it will almost certainly amplify the focus on what central banks do next.

It ain’t over until Aunt Agatha Sings: (or something like that).

Over the near term, global yields (interest rates) have likely fallen too far, too fast, in our analyst’s view. We think they could they’ll bump along, probably not much higher as global risks—both market and economic—weigh on the market. Longer term, we still expect global yields to trend lower.

Featured articles:

August 2024 Equity Strategy: Global Insight Equity Perspective - August 2024 (rbcinsight.com)

August 2024 US Recession Scorecard: Global Insight U.S. Recession Scorecard - August 2024 (rbcinsight.com)

RBC Wealth Management's latest investment newsletter.

North American labour markets: Past the point of no return?

The heat has come out of labour markets in the U.S. and Canada and they’re now at risk of cooling too much for the Fed and BoC’s liking. Recession risks have risen slightly, but that doesn’t necessarily mean we’re past the point of no return. That said, investors should evaluate defensive options, particularly in an environment where higher-quality fixed income continues to offer attractive returns.

Regional developments: Canadian labour market continues to soften gradually; Retail sales accelerate as consumers take advantage of easing inflation; UK inflation data supports the prospect for further rate cuts; Japan to have third prime minister since 2020

More here: Global Insight Weekly.

That’s all for now.

But the blueberries out there are plentiful and scrumptious – I have proof!

Enjoy your weekend.

Mark