Good afternoon,

It was a momentous week, made messier today as a global computer glitch from a security firm’s software update (of all places) temporarily took down several important online functions pretty well everywhere, RBC included. So far it’s been mostly a non-event for us here, with the main interruptions being the constant updates on the non-interruption. I’ll take that trade.

The 1381 Peasants’ Revolt is considered a key moment in the evolution of democratic England. The Black Death, a few years earlier, had created a labour shortage, which lifted the value of the surviving working and middle classes. The court of the boy king, Richard II, just 14 years old at the time, had required excessive and repeated tax levies against the budding middle classes to help fund military campaigns against the French, and eventually enough was enough.

What’s in a Name? Curiously, the first recorded violence was against a tax collector named… wait for it… William Payable.

Bill Payable was back to the tax troth for the third time in a short span when the peasants of Fobbing and Brentwood in Essex refused to pay any more. When the tax collectors ordered their arrest, the villagers drew their bows and chased them from the village. The Peasants' Revolt had begun.

The folks at Fobbing gave them a throbbing, and many died on both sides. The duplicitous King and his men eventually won the battles, but lost the argument and never collected the levy which had started the revolt.

With the unpaid Bill out of the way, next week, we will move on to a talk about the infamous Count Receivable, whose 4th great grandson reportedly lived just six degrees from Kevin Bacon. You heard it here first.

This Week’s Graphs:

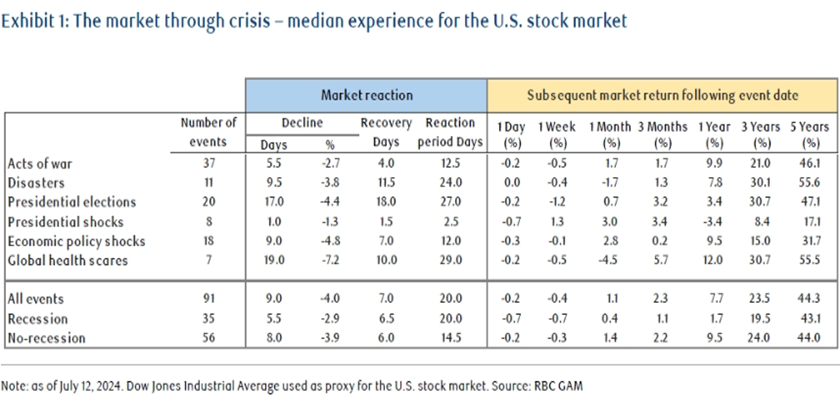

Trump Assassination Attempt: With some stunning geopolitical stories in the news this week, some very sobering, some a great relief, clients have asked us about the potential impacts these types of events have on markets. In short, results vary, but markets have tended to see past them rather quickly.

U.S. equity market reactions to unexpected shocks (chart below from RBC): “… 95 individual events separated into six specific threat categories, and then … thankfully small set related to threats on a president’s life, or existential challenges to their administration.

- The range of outcomes is wide, but some general conclusions can be drawn.

- First, on median, shock periods are usually contained. The U.S. equity market tends to react to shocks negatively, falling a median of 4% over the first nine days

- and then typically recovering the full amount of that loss another seven days following the shock.”

Click or tap on the graph below to see the birth shifting rates in various regions over time. Prognosticators watch these data closely, but this can be a very sensitive topic, often hushed. There are potential negative outcomes of not coming to grips it. For example, what if populations with long traditions of freedom and human rights become global minorities, or economically stunted over time, as may be implied here?

Weekly Insights:

Inside the S&P 500: Time to pass the baton?

While mega-cap tech stocks have dominated U.S. equity performance so far this year, recently the rest of the market has been trying to take the baton. We discuss the main factors needed to make a clean handoff.

Regional developments: Economic data reinforces the case for a Bank of Canada (BoC) rate cut in July; U.S. retail sales jump despite more signs of cooling in the labor market; European Central Bank deposit rate unchanged; The yen rebounded against the dollar

More here: Global Insight Weekly.

It’s a muggy one out there. Reminds me of the time I climbed into the freezer on a hot summer day, when my sister and her friend thought it would be funny to sit on the lid while I had an intimate and terrifying visit with a stinky bowl of freezer-burnt trout.

That’ll learn ya.

Enjoy your weekend!

Mark