Good afternoon,

First, some slightly disturbing tax trivia: According to one researcher, around 600 years ago in the Kingdom of Kongo (around the 1400’s?) taxes were quite severe and arbitrary, including one tax which was triggered each time the king’s beret fell off. (Thornton, John, 1983, The Kingdom of Kongo, Madison: University of Wisconsin Press).

A Few Graphs:

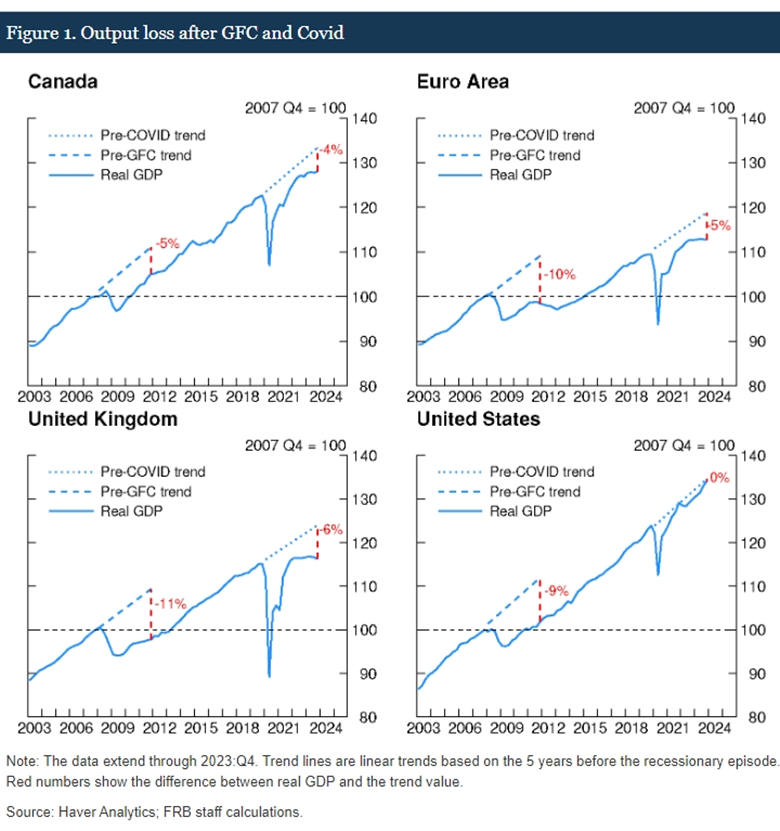

U.S. GDP recovered faster than other advanced economies (see chart below from the Federal Reserve): “While real GDP in the U.S. has already returned to its pre-pandemic trend, other advanced economies experienced a much weaker recovery, both relative to the U.S. and to their own pre-pandemic trend. In some countries, the gap between real GDP and its pre-pandemic trend has kept widening, suggesting continued scarring from the crisis as well as some new headwinds.”

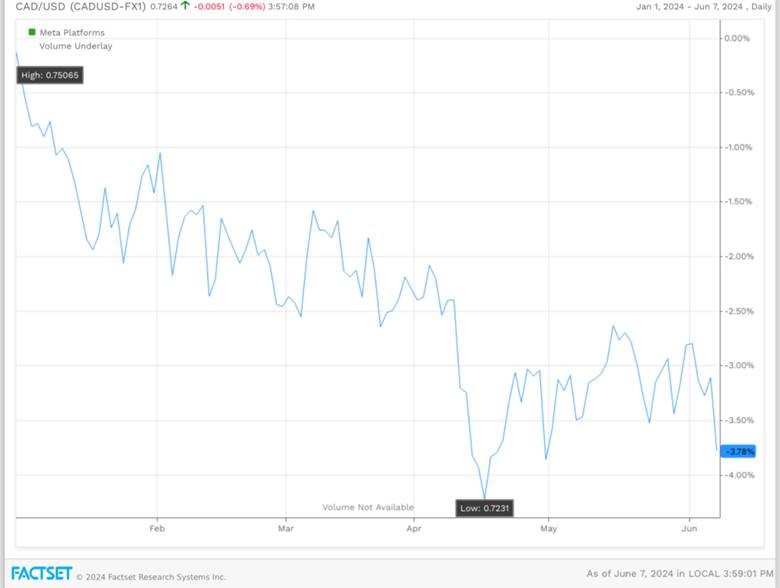

Policy Divergence: Referring in this case to central bank interest rate policies, this is a term especially relevant to the day’s news. US Jobs data came out this morning surprisingly strong, which weakens the case for lower US interest rates. The chart below shows the decline in relative value the Canadian Dollar against the greenback since the start of 2024. Noting that the European and Canadian central banks eased policy interest rates this week, the latest comparative C$ decline is at least partly reflected in the divergent interest rates paid. Other global currencies are also lower this year against the USD. None of this is alarming on its own, but it is a story to watch.

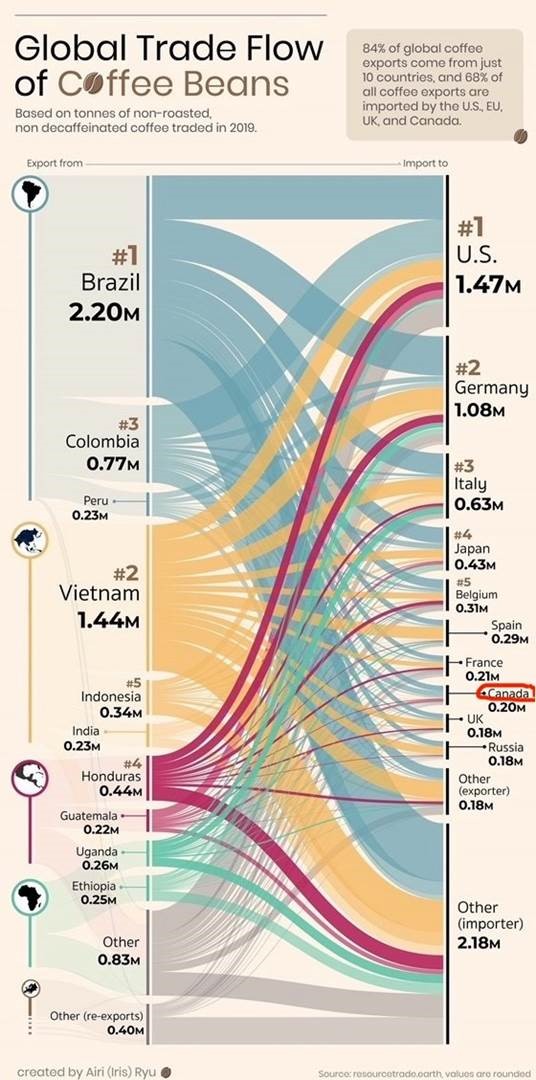

Canada Java Graphical: In case you were wondering, the global flow of coffee beans largely originates in South America, and – despite Tim’s and Starbucks being seemingly everywhere, Canada’s import share is pretty small.

Now this week’s Global Insight Articles:

BoC-Fed divergence: In it for the long haul?

The BoC lowered its policy rate, and we think it will continue to cut rates sooner and faster than the Fed. This may not be a passing fad given Canada’s relatively high debt load and weaker productivity. Divergence between the Fed and other central banks should be less acute, but fixed income investors outside the U.S. should consider U.S. exposure where rates will likely be higher for longer.

Regional developments: Canada’s economic growth slowed in Q1 amid tighter financial conditions; U.S. bonds rally as economic data slows, commodities fall; European Central Bank delivers the first interest rate cut, but with a hawkish bias; Indian equities fluctuate on general election results

Please take some time to review the Global Insight Weekly.

And finally, what’s a Liz Truss Moment? They say governments don’t find fiscal discipline -- it is imposed upon them by bond markets. A now already-infamous case was the brief 2022 UK Prime ministerial role of Lis Truss. As new PM, she promptly presented a fresh mini-budget for the country, and the next day bond markets basically did the math and said… “um… nope.” After that, she lasted about as long as jug of milk. Now, whether it’s the US or wherever, somewhere out there we may have a looming bond auction that could go nowhere. And her name will be floated onto the headline, or dangled in advance.

Stay tuned.

And beware leaders with ill-fitting hats.

Enjoy your weekend!

Mark