Good afternoon,

Although he was well before my time, I grew up believing FDR was inarguably the compassionate rescue hero of the 1930’s depression which both of my parents lived through. My dad was literally an unemployed young adult hobo during the 30’s, riding the rails from Halifax to Vancouver, not knowing where his next meal would come from. He and his pals always hoped to jump off the train near a farm, where they might beg a day’s work, a meal, and a spot in the barn. My mom was a prairie dustbowl girl, although they didn’t meet until after the war.

With this background I was mildly skeptical about the idea that FDR’s handling of the depression was a sort of heavy-handed, Manchausen Syndrome by Proxy of the economy – making things worse by getting in the way of the economy’s natural ability to reprice and heal itself.

Book Recommendation of the Week: FDR’s Folly, by Jim Powell

Powell makes several compelling arguments, and it may surprise a modern reader the extent to which that FDR interference seems egregious now. It’s a new thought for me, and honestly a frightening one – to see how fond the leading minds of FDR’s day were of those grand sweeping non-sequiturs of central planning. The main idea was, evidently: Business = nefarious. Government = pure. Powell details nearly every new policy as another massive mistake, followed and preceded by soothing words from a caring government. A different sort of industrial policy came to be after Pearl Harbor, and it is here that FDR was smart enough to get at least partly the heck out of the way, and where the entire country got moving like it hadn’t in a decade.

Thomas Sowell quotes of the week: Although not the aforementioned book, Thomas Sowell summed the same ideas up when he said:

- “It’s hard to imagine a more stupid or more dangerous way of making decisions than by putting those decisions in the hands of people who pay no price for being wrong.”

- “Einstein himself urged that his theories not be accepted until they could be verified empirically… The great problem, and the great social danger with purely internal criteria is that they can easily become sealed off from feedback from the external world of reality and remain circular in their methods of validation. What new idea will seem plausible depends on what one already believes. When the only external validation… is what other individuals believe… if they are simply people who are like-minded in general... (it) says nothing about the external validity of the idea.”

Here’s this week’s Global Insights submission:

| A return to normalcy? The ongoing yield curve inversion, a potential recession indicator, looks out of line with record equity markets and robust commodity pricing. We look at some reasons investors are accepting lower yields on longer-maturity bonds. Regional developments: Strong Canadian equity performance; Fed policymakers assess inflation and current interest rates; UK general elections scheduled for July, services inflation remains stubborn; China announced major policies to support the housing market More here: Global Insight Weekly.

|

And some Interesting Charts:

It seems likely we will still be gassing up for a while yet:

When it comes to satellites, there’s Elon and… everyone else. But mainly Elon:

Perspectives on US bank Failures measured by bubble size. I could put another chart here with Canadian bank failures, but it would be a polar bear in a snowstorm… nothing on it. At least not in my lifetime or yours. That’s not necessarily to be celebrated in every respect. As a credit risk management team, we were taught that if we don’t make some mistakes, we were probably being too tight with our lending decisions. So, in a way, bank failures in the US are a signal of a vibrant marketplace competing for customers. This isn’t to say we should celebrate the enormity of recent US failures, nor the culture of excessive debt, but… having not one single bank failure in my lifetime or yours in Canada might be too conservative.

Also they took our Stanley Cup, and won’t give it back. That’s annoying:

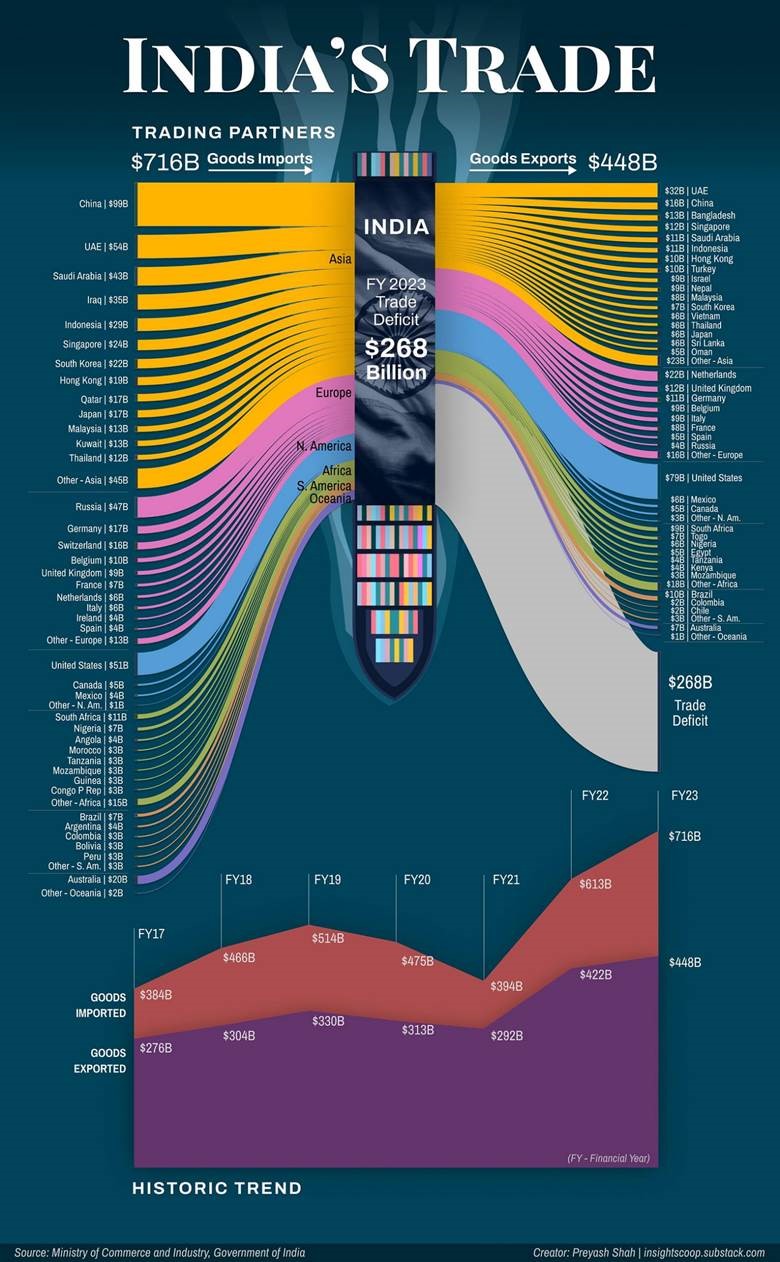

Mostly I thought this next one was gorgeous. Also, India’s trade data is very well-illustrated

Please note that just today I’ve got a new corporate cell phone which I’m told I need to use… I was wondering what my other pants pocket was for. I’ve highlighted the new cell number below.

Enjoy your weekend!

Mark

Mark Ryan | Investment Advisor | RBC Wealth Management | RBC Dominion Securities Inc.

T. 250-960-4927 | T. 1-800-668-3066 | Cell. 672-983-2040 | F. 250-960-4694

http://dir.rbcinvestments.com/mark.ryan