Good afternoon,

Important Tax Alert for CCPC’s: For some readers, I’ll soon be sending along an important, and somewhat lengthy piece on the proposed new federal capital gains tax. This is especially (but not only) important for owners of Canadian Controlled Private Corporations (CCPC). I hesitate to say it, but it seems you are being treated a bit like Kulaks, targeted for yet an additional tax. The paper (PDF) is a long read, and we (and your accountant) should touch base in the next few short days/weeks. The crucial deadline, before which we should speak well in advance, is June 25th.

This week’s Global Insights:

RBC Wealth Management's latest investment newsletter.

Gold: More than meets the eye

In a conversation with RBC Capital Markets, LLC Commodity Strategist Christopher Louney, we look at aspects driving the gold rally and explain how world events and policy shifts could impact its prospects. Louney also gives his take on why gold investors should pay close attention to inflation, but not for the reason they may be thinking.

Regional developments: Strong Canadian jobs report masks signs of easing labor market; U.S. equities hit new highs as soft-landing narrative dominates; Banks and commodities support the UK’s FTSE 100; Potential new support for Chinese real estate sector

More here: Global Insight Weekly.

I bet you didn’t know…

The Chinese tycoon who bankrolled Forbes: US businesses have been fascinated by the Chinese market going back 100’s of years. In the 1830’s, a very young John Murray Forbes (yes, that Forbes) was mentored, treated like a son, and even bankrolled by uber wealthy Chinese merchant Wu Bingjian (AKA Howqua). One historian referred to Howqua as “the Bill Gates of his day.” America was just a fledgling emerging market at the time, and it was a savvy investment for Wu Bingjian, and would ensure the enshrining of Forbes into American folklore and, as it were, royalty.

Today’s US/China:

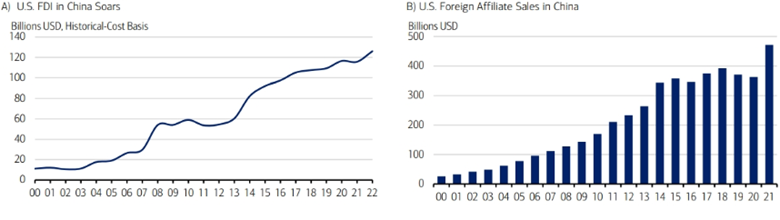

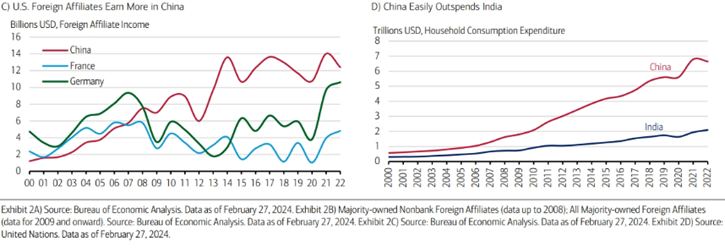

| The US “De-risking” from China is… complicated. (see charts below): U.S. exports to China don’t even begin to capture how much business China generates for Corporate America each year. Success in China requires that firms be based in China. Hence the near 12-fold increase in U.S. FDI (on a historical cost basis) between 2000 and 2022 (Exhibit A) and the corresponding 18-fold increase in affiliate sales over roughly the same time frame (Exhibit B). |

|

|

| Income earned by U.S. foreign affiliates in China has soared since 2000 and now easily outstrips what U.S. affiliates earn in wealthier markets like Germany and France each year (Exhibit 2C). India is a legitimate supply alternative to China when it comes to labor and the reconfiguration of global supply chains. It’s far from ready, however, to offset China as a source of demand given the fact that India’s per capita income is not even one-third of China’s.

India’s personal consumption expenditures in 2022 ($2.1 trillion) was well under China’s figure for the same year ($6.7 trillion), as illustrated in Exhibit 2D. The cold reality is that China remains a key source of earnings potential for many U.S. firms and likely to remain so in the future.” |

|

|

A Buckley Quote: “We are reluctant to make our voices heard, hesitant about claiming our right; we are afraid that our cause is unjust, or that if it is not unjust, that it is ambiguous… That tendency to passive compliance, to a heedless endurance, is something to keep one's eyes on -- in sharp focus.” (William F Buckley – “Why Don’t we Complain?”)

In the voice and tone of Buckley, maybe we should complain more about taxes.

Hot waxing:

We should probably wax on much more about tax.

But we’re easily led by political hacks.

Whose promises add to the sweat on our backs.

They feed at the troth of our maximized laxity.

While taxes exasperate, metastasize, calcify.

Sometimes, I swear.

There’s a definite whiff of Pierre in the air.

Pirouetting Pierre, the first PM to swear.

The one with the heir who has nice wavy hair.

That Westerner’s foe of such fetching fuddle-duddle.

It’s all so befuddling, our lack of rebuttal.

It’s not like we get a good bang for our bucks!

When they back up their trucks, we should shuck off those schmucks!

Make tracks of those lackies!

Send sorties of serious tactical masters,

sharpening axes and chopping down taxes!

Or just take a new tack.

Give them all a good swack!

Enjoy your long weekend!

Mark