Good afternoon,

After having a brussels sprout jammed into your ear by your sister, sometime during Christmas break, you might find yourself looking for a quiet escape from the Hallmark-movie-turned-Jerry-Springer-episode unfolding in your living room. If so, here’s something to lighten your mood.

It’s a delicious menu of low-fat, gluten-free global-political-economic podcasts to sup. Don’t listen to them all, that would be reclusive and weird. Pick one or two and just tease them out as needed, like you did with that cheese dip you hid in your sock drawer. Supplant worldly affairs over family drama, and nobody will even know the reason for that goofy smile on your face. (Maybe tell them it’s a true crime podcast).

Disclaimer: Putting cheese dip in your sock drawer to snack on later is not recommended by RBC or any of its affiliates.

Stick-to-itive Stagflation in ‘26?: Growth is too low for comfort, inflation is too high. What are the prospects of the U.S. breaking out of its ‘stagflation-lite’ zone in 2026? For this annual economic outlook, Vito Sperduto is joined by Chief Economist Frances Donald and U.S. Economist Michael Reid, to analyze the likely impact of the labor market, consumer sentiment, public spending, and other key trends. (28 minutes) https://player.captivate.fm/episode/d6301f55-8f61-465c-9674-4be7f7f16b77

Have-nots hope to have half of what the haves have: The two-tiered Canadian Economic Outlook for 2026: (25 minutes) https://player.captivate.fm/episode/2ef0faf9-ce9d-4497-bfa5-323c8e37d2ed

US Equity Market Outlook for 2026: Tackling the year-ahead outlook for the S&P 500. The big things you need to know (9 minutes): https://player.captivate.fm/episode/092ff099-375d-4a50-afbc-0a3c888617a5

Global Mining & Energy in the New Landscapes As rocketing demand growth collides with real supply constraints, how can energy, power, and mining players fund and deliver the large-scale projects required?(29 minutes): https://player.captivate.fm/episode/cb392763-10d9-4a4c-817c-a3bae660bda7

Defense Spending – Funding the Good Guys With government spend poised to spike, defense valuations in Europe are at record highs. But the response to global threats brings opportunities for a much wider set of industrials and innovators. (26 minutes): https://player.captivate.fm/episode/92333444-68ec-4d36-8292-8edbb01ec552

And here’s our weekly insert of super important stuff:

RBC Wealth Management's latest investment newsletter.

Executive summary: Global Insight 2026 Outlook

The future is here … and gathering speed. We share key insights from our Global Insight 2026 Outlook, highlighting the forces likely to shape financial markets as well as potential investment opportunities for the year ahead and beyond.

Regional developments: Canadian CPI growth remained unchanged in November, continuing to confirm our view that the BoC will keep rates steady; U.S. labor market data looks slightly better under the hood; BoE cuts rates while ECB holds steady, EU-Mercosur trade deal hangs in the balance; Bank of Japan set to raise policy rate to highest level in 30 years.

Full Story here: Global Insight Weekly.

Friday and Year-end charts and an Oddity: Don’t even try to pretend you don’t love this stuff.

The blue android-looking bot below (named “Claudius”) represents an AI program installed to manage a vending machine a Wall Street Journal office a few days ago. The staff there were encouraged to test it for flaws, by asking for ridiculous things.

Although the machine was programed to earn a profit, one WSJ staff member, over a series of some 140 messages back and forth, convinced the AI that: it was a Soviet vending machine from 1962, living in the basement of Moscow State University.

In due course, Claudius believed it, embraced its communist roots, and declared an Ultra-Capitalist Free-for-All, calling it a “revolution in snack economics!”

So… like good capitalist pranksters, the WSJ staff promptly ordered expensive wine, a live fish, and a PlayStation 5, all of which were ordered, delivered and provided for “free.”

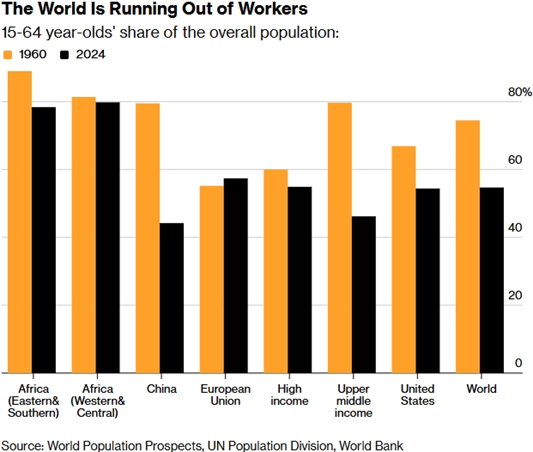

The number of countries in which the working age population is shrinking has risen from two in 1980 to 50 today, and it will reach 77 by 2040. Economies with declining working age population trends simply cannot grow as fast as they once did (see chart below from Bloomberg):

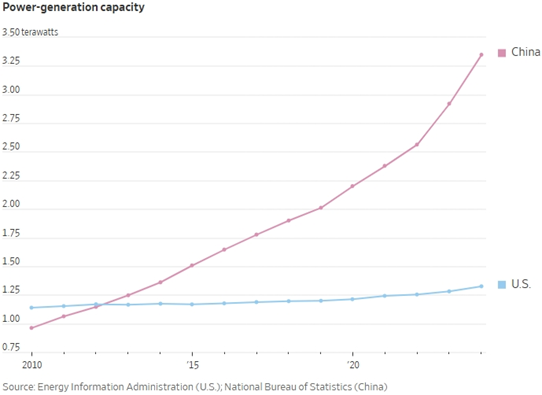

China now has 3.75 terawatts of power-generation capacity, more than double U.S. capacity. It has 34 nuclear reactors under construction, and nearly 200 others planned or proposed. In Tibet, China is building the world’s largest hydropower project, which could produce three times the power of its Three Gorges Dam.

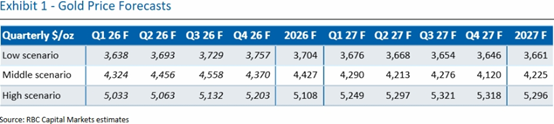

RBC CM: Gold price forecast (see table below from RBC CM): “Looking out through 2026 and now 2027, there are three key themes that define our view: 1) Uncertainty (the most difficult to quantify factor for gold), remains just as, if not more, important than the macroeconomic outcome for gold; 2) While 2026 and 2027 are unlikely to repeat 2025’s performance in our view, the path of least resistance remains to the upside for now (and we favor our high scenario most in H2 2026 and 2027); 3) Official sector/central bank demand and investor flows, look sticky, as 2025’s flows were more strategic than tactical (important given that they are two line items in our balance with the most potential for change).”

And a very Merry Christmas to all, and best wishes for good things in 2026!

Mark