Good afternoon,

A late Friday rally kept a weak week from worse numbers, largely in response to high overall prices amidst data uncertainty and a US government shutdown.

Also… diamonds. Lots of them. More on markets further below, but first...

The Empress Zita (left) and her husband, Emperor Charles, fled Austria around the end of WW1. She eventually landed in Quebec with her younger children.

Her husband, (younger cousin of the Archduke Ferdinand) died of pneumonia in 1922, after being married to Zita for about ten years -- fathering eight children!

The last emperor’s dying last words (you can’t make this stuff up) to his beautiful, beloved young wife seemed right out of Jane Austin:

“…I love you so much!”

Several years later the Nazis had cut her off from the family fortune (her brothers opposed them) and the Empress fled, ultimately to Canada.

Money was tight as a single mom with more humble pride than income.

While in Canada:

While in Canada:

“They lived in a dreary little house with no curtains, no pictures and floors covered with linoleum which had been a priests' convalescent retreat. I felt very sad for her [Zita] and her eight children, and I thought they seemed very poor. She was strict with the girls, so that they knew no one and were always chaperoned by the lady-in-waiting to and from the university… We sat down to a typical German tea of butterbrod and little square cakes and biscuits. Only [a friend] and I were allowed cups of tea - the others, tumblers of water.”

“The Empress led an austere and secluded existence, (occasionally feeding her children dandelion salad) and as a consequence the girls, although they were old enough to attend university, had little experience of social life. I well remember their excitement when we took them out to dinner and a movie in Quebec!” (Princess Alice, Countess of Athlone, wife of the Governor General at the time).

And yet, through all of this, she was literally hiding a priceless fortune in precious jewels, which she had smuggled away from Austria in a cardboard briefcase

A cardboard Briefcase and a quiet Quebec bank:

Earlier, the Empress had worn the royal jewelry loudly while being transported to safety by a friendly British vessel, so adorned, she looked “like a Christmas tree” perhaps to shield her from the impending poverty she knew she faced.

In contrast, she later hid the jewels, perhaps worried they would bring her more harm than good, in the midst of seemingly continuous war and revolutionary fever over the first half of the 20th century.

Is that a Diamond or a Gum Drop? One gem in the collection was a particular prize, a massive 137-carat diamond admired not only for its pear shape and yellow hue but also for its illustrious history. (See photo left).

The diamond was thought to have disappeared -- for about 100 years. But it’s been in a bank vault in Quebec since the family fled there in the midst of World War II, only to be revealed this past week.

Empress Zita lived humbly as a doting, modest single mom while she was in custody of perhaps some of the most priceless jewels on earth. Still more valuable to her, the safety of her little ones.

Still more suspicious, sort of:

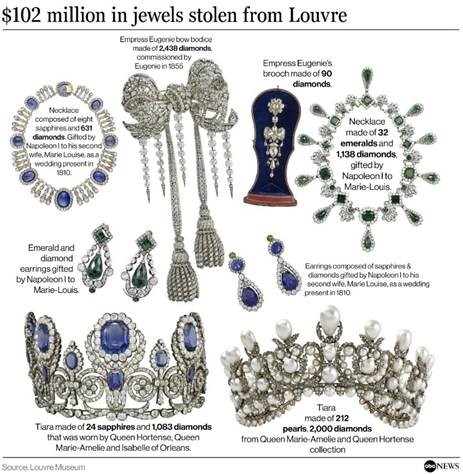

And somewhat less impressively: At the time of the Louvre heist of $102

million

in jewels last month, the password to the world-famous museum's video surveillance

system was reportedly "Louvre.” This is according to a museum employee with

knowledge of the system.

Thieves made there way into the sealed jewlry case with a grinder and a body check,

while guards watched nervously.

Ahhh my French cousins.

Here’s this week’s RBC Wealth Management's latest investment newsletter

The U.S. dollar in transition: Cyclical volatility meets structural shift

The greenback’s volatile year underscores the interplay between cyclical drivers and longer-term valuation challenges—factors that could have implications for global equity leadership

Regional developments: Carney’s federal budget nearly doubles Canada’s deficit in response to significant global shifts; October job cut announcements fuel U.S. labor market concerns; Bank of England leaves the Bank Rate unchanged, and policy is on a “gradual downward path”; Japanese equities continue to rally under the new administration

More here: Global Insight Weekly.

Feel free to contact me with any questions and/or to discuss investment ideas.

Enjoy your weekend!

Mark