Good afternoon,

It's when we slurp those last few drops of chocolate milk, then set the carton down to wait for the milky film stuck to the inside walls to accumulate at the bottom, then slurp it again. Then we repeat the move a bit later, but we stop short of ripping the carton open and licking out the inside. Not because we don’t want to, but because she already disapproves of us licking the gravy off the plate, and… I mean… you know… dignity and all. We lick out chip bags, yes, but not milk cartons. It’s inappropriate.

But now reimagine the scene. You were savoring that sweet cold burst of happiness, placing it down for a minute to flip the pages of your economics journal, only to pick it up and see that the last soulful gulp of the delicious stuff had just vanished.

Now someone must suffer for this.

More seriously, in 2022 the inflation rate clocked in at around 7%. If a typical worker clocked in 49 weeks that year, (allowing for 3 weeks of vacation) expecting the effort to just pay for living expenses, he’d be disappointed to find out that in fact he would have needed to work through his entire vacation to break even. Here’s the admittedly over-simplified math, ignoring stat holidays:

- 49 weeks at 5 days per week = 245 days

- If he broke even the year before, then in 2022 he found that life cost him about 7% more, he’d be short-changed by the unexpected inflation.

- 7% x 245 = 17.15 days or about 3 ½ weeks’ worth of workdays.

Gulp.

Meanwhile, if he is among our younger souls, he’s probably not so fortunate to own a sizable stock portfolio or real estate, all of which inflated more than the basket of goods over the decade. And thus, inflation tends to hurt the lower-earning segments of society more.

And that’s tough to swallow, and at best, a rough introduction to the topic. Inflation is, blessedly, lower than that now, but still higher than it needs to be. At 3%, the cumulative impact is a real stinker over a lifetime, again, especially for younger and lower-income segments.

This Week’s Numbers: 500 / 267,000 / 80,000/ 7 /2

- Expanded electricity generation gives China a head start in the global AI race. China this year will deploy about 500 gigawatts of solar alone. The U.S. will deploy 50. So, just an order of magnitude difference. There are 33 nuclear power plants under construction in China right now. There’s zero under construction in the U.S.

- Canadian heavy oil is making inroads in China. Canadian oil exports to China rose to 267,000 barrels a day in September, their highest level since April. The newly-expanded Trans Mountain pipeline is allowing oil producers to shift as much as 890,000 barrels a day to Asia, away from the U.S. market.

- The number of phones stolen in London has almost tripled in the last four years, from 28,609 in 2020, to 80,588 in 2024, making it Europe’s crime capital. Police are finally cracking down on brazen thieves, often masked and on e-bikes, reportedly linked to international gangs.

- Is this America’s secret edge? (the ability to fire workers). In many European countries, it’s too expensive to let employees go. The cost of firing in America is roughly seven months of that employee’s wages. In Germany and France, the cost is 31 and 38 months of wages, respectively. That’s over two and a half years.

- Wins away from a World Series birth for the Blue Jays: 2

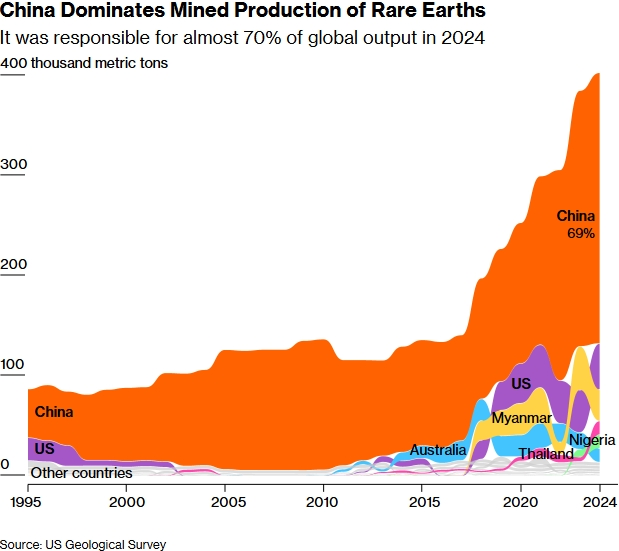

China’s rare earth leverage (see chart below from Bloomberg): “China last week shocked the world when it announced fresh curbs on rare earths, this time limiting exporters in third countries from shipping items containing even traces of its metals without getting Beijing’s permission first. The move mirrored constraints Washington has imposed on high-end chips for years and came after the U.S. widened its own tech controls. The spat underscores the fragility of the U.S.-China trade truce, which is set to expire Nov. 10. There are now signs of de-escalation. The latest threats would apply only after the leaders’ meeting, leaving plenty of time for climb downs.”

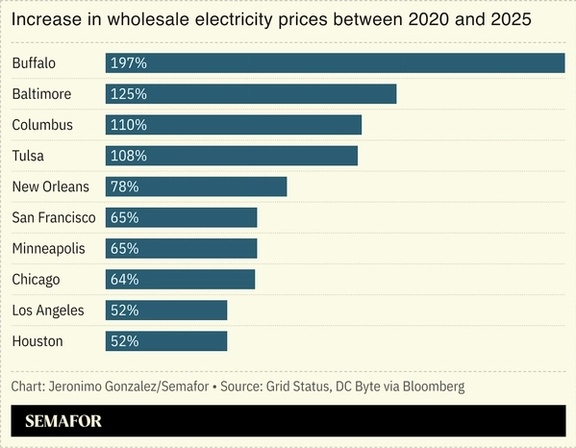

Will electricity become a major constraint for U.S. data centre growth? (see chart below from Semafor): “Anger over growing electricity bills in the U.S. caused by the proliferation of AI data centers became a rare rallying point for politicians on both sides of the aisle. The Republican and Democratic candidates in a local Virginia election called for curbs on data center construction, an issue that has become ‘an overwhelming source of debate,’ and could become a flashpoint in statewide races. Energy costs have risen at twice the rate of inflation since 2020; the key driver is the aging grid, but data centers are a more politically salient talking point.”

Here is RBC Wealth Management's latest investment newsletter.

Executive summary: AI’s big leaps in 2025

Artificial intelligence is seldom out of the headlines in 2025, with defining developments coming one after another. We look at where AI is today and how its promise is matched against technological, economic, and geopolitical challenges.

Regional developments: Canada’s labour market surprises to the upside in September; U.S. stock indexes rebounded after last week’s tariff-related selloff; Luxury turns a corner, semi equipment momentum continues, French political crisis eases; U.S.-China trade tensions heightened

More here: Global Insight Weekly.

Feel free to contact me with any questions and/or to discuss investment ideas.

Ballcaps off to Bluejays pitcher, 41-year-old Max Scherzer, who chucked a stellar game last night, taking the Mariners to a clinic of sorts. They’re making me a fan again. I haven’t watched more than an hour of sports per year in the past few years.

Enjoy your weekend!

Mark