Good afternoon,

Blue Suasion Shoes: In macroeconomics 101 students learn that, although a central bank is technically independent, the government may use something called “Moral Suasion” to influence interest rates. The federal cabinet is an influencer, if not a direct decision-maker. It’s meant to be fuzzy, but something far short of “if you know what’s good for you…”

In China there’s a whole ‘nuther meaning. Since the Party is infallible, mistakes can only be interpreted as gross negligence or corruption, and capricious jailtime can follow. Business success can be dangerous too -- when the party gets jealous, CEOs tend to inexplicably vanish. So, um… don’t fail. And don’t succeed too hard.

This week, a clash of values impacted financial markets as the Chinese leadership tried to use its influence to pressure the world market for its own bonds. And then Dogbert’s tail wagged involuntarily.

Price Controls: The idea that a government would know what a price should be in a healthy, open marketplace begs a more robust scrutiny than we will get on a typical news scroll – and more space than we have today.

But this headline (left) shows the CCP trying to fix the price of their own treasury bonds in a world bond market that it can’t throw in jail if it disobeys. The party worries the current appetite for Chinese bonds will cause problems down the road for its banks, similar to what happened with Silicon Bank last year.

What are they going to do if the open market disobeys, hold their breath?

Here’s this week’s global insights articles:

Generative AI: enablers and adopters

The second article in RBC Wealth Managements “Innovations” series examined generative artificial intelligence (GenAI). This an executive summary of that article which focused on the GenAI ecosystem, both enablers and adopters, and zeroed in on those which might be most impacted. We also explored investment strategies we expect to benefit from the GenAI era.

Regional developments: Canadian housing market activity stagnates; U.S. equities recovered to within 1% of all-time highs, as data underscored the soft-landing narrative; Euro strength, resilient UK economy; Japan’s July export data likely received boost from weak yen

More here: Global Insight Weekly.

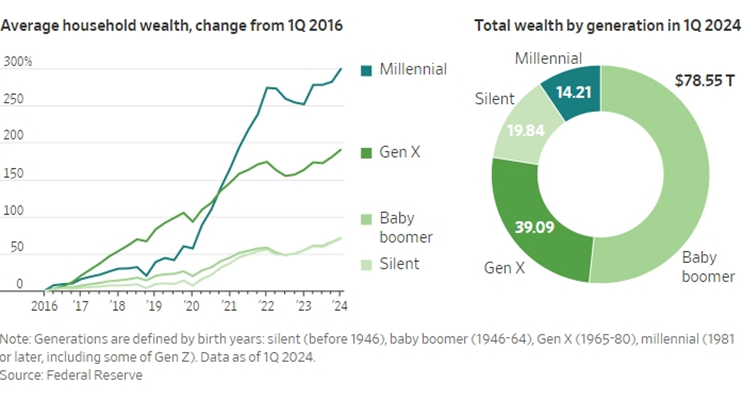

Millennials are catching up (see chart below from the Wall Street Journal): Despite all the whining, the data shows that “Millennials are now wealthier than previous generations were at their age. The median household net worth of older millennials, born in the 1980s, rose to $130,000 in 2022 from $60,000 in 2019. Median wealth more than quadrupled to $41,000 for Americans born in the 1990s, which includes the generation’s youngest members, born in 1996.”

In early 2024, millennials and older members of Gen Z had, on average and adjusting for inflation, about 25% more wealth than Gen Xers and baby boomers did at a similar age.”'

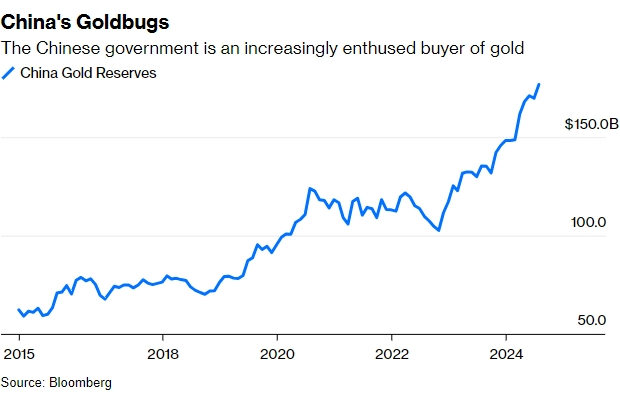

China’s goldbugs (see chart below from Bloomberg): “It’s also possible that (part of) gold’s strength emanates from China. In part, that’s because the country has been steadily raising its gold reserves as it aims to reduce dependence on U.S. bonds.”

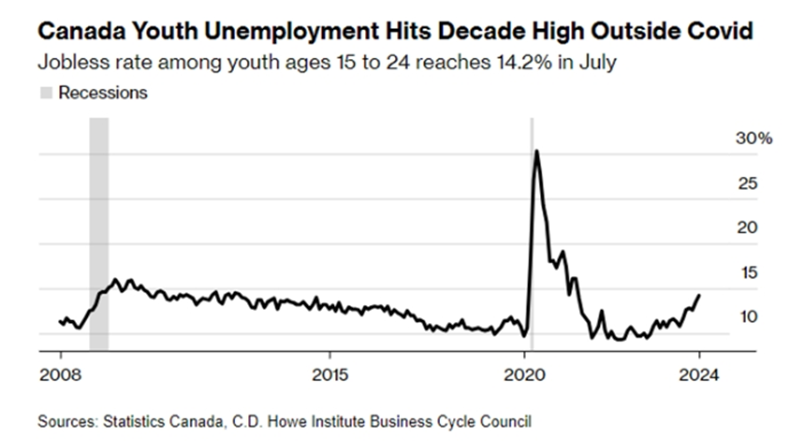

Youth Unemployment: Canada’s unemployment rate held at a 30-month high of 6.4% in July 2024, up from 5.5% in July 2023 and 4.8% in July 2022. A significant factor is a surge in youth unemployment, at 14.2% in July 2024 – the highest in over a decade, excluding the pandemic. (See the chart below.)

Supply & Demand: It’s controversial, but should we mention that we might have seen this coming when we raised the minimum wage over that same period? We shouldn’t expect a “living wage” at the bottom of the labour pool, mostly filled with youth from middle class families. These are nearly always transitional jobs.

September looms: From personal experience, every time I worked at one of those crummy jobs as a kid, I remembered Cheech & Chong’s “I’m not going to school sketch:” “What’s wrong with you now Prince Charming!? …what do you mean you’re not going to school!? … get your little fanny perpendicular and get ready for school!”

Enjoy your weekend!

Mark