Good afternoon,

The U.S. Federal Reserve cut interest rates this past week, joining other major developed central banks on the reduction cycle. Also this week, Canada’s inflation rate, rate reached the Bank of Canada’s target of 2% for the first time since 2021. Below, we take a closer look at the Fed decision and explore how lower interest rates may impact the economy, and markets.

The First Cut is (sometimes) the Deepest: The Fed cut by ½%, which was more than the ¼% cuts seen from other central banks. Chairman Powell said the move was needed to “recalibrate” the bank’s approach given the fall in inflation and increase in unemployment. In contrast to the past few years, when the Fed felt the balance of risks was skewed more towards inflation, it noted the risks between inflation and unemployment are now “roughly in balance”. The Fed telegraphed additional cuts through the remainder of the year, emphasized they are meant to preserve what it regards as a reasonably healthy economy. This is “soft landing” language par excellence -- but time will tell.

Lower rates translate to reduced borrowing costs for businesses and consumers. As with rate increases, there’s often a lag before it flows through meaningfully to consumers. Small businesses often hold floating-rate loans, and thus benefit right away, while larger companies often hold longer-term fixed rate debt, which is, in fact, a different market than the Fed played in today directly.

Credit card users should see modest early benefit as credit card debt rates float downward. Meanwhile, the impact to mortgages may be more mixed. For consumers looking to buy a new home, they may be encouraged by the decline in short term mortgage rates though they may also be tempted to wait given the telegraphed still lower rates to come.

While global equity markets have responded favourably to the cuts, caution is warranted. Overall, the range of historical outcomes for equity markets has been wide, and thus hard to predict after the first interest rate cut.

Our analysts view the path forward with cautious optimism. The cuts will take time to provide relief, and we are mindful that the first cuts can either extend the economic cycle or signal that it’s already too late.

And I’ll just add that there’s a measure of braille in this stuff, and we shouldn’t pretend to see it all too clearly. There’s a not insubstantial risk that inflation will tick upward if markets continue to interpret all things optimistically – “the wealth effect,” as they call it, could get busy nibbling on its own tale.

Here’s this week’s Global Insights:

Big bang

After biding its time, the Fed finally kicked off its monetary easing cycle with a strong start out of the rate cut gates. While investors may harbor some concerns the Fed is getting ahead of itself and that more aggressive cuts could reignite inflationary pressures, we highlight why we are encouraged by the Fed’s proactive move.

Regional developments: Headline Canadian CPI growth falls to 2.0% target for first time since 2021; Equity rotation continues as Magnificent 7 trade loses steam; Bank of England in wait and see mode; Asian equities rally after Fed rate cut

More here: Global Insight Weekly.

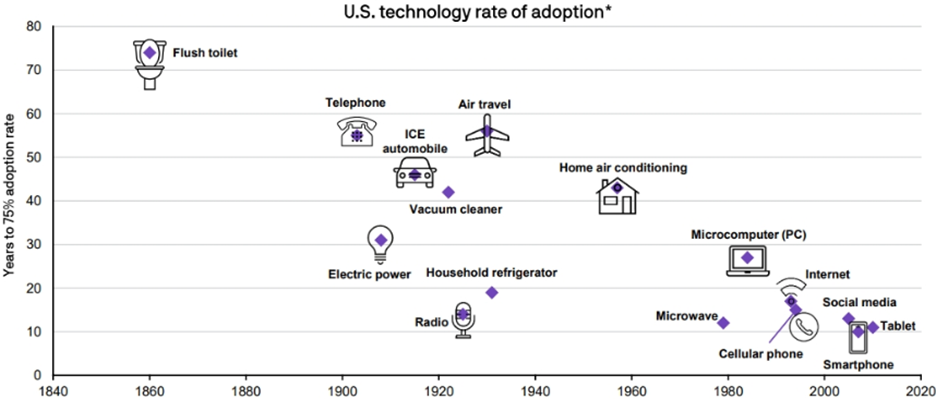

Innovation adoption timeline (see chart below from J.P. Morgan): “The exhibit below offers a timeline of many innovations that we now take for granted and the time it took for them to achieve a 75% adoption rate, signifying ubiquity.”

Note that in pretty well every case, the technology can’t be broadly adopted until sufficient infrastructure is built to support it.

Also, I am ever so grateful for working toilets. Soooooo grateful

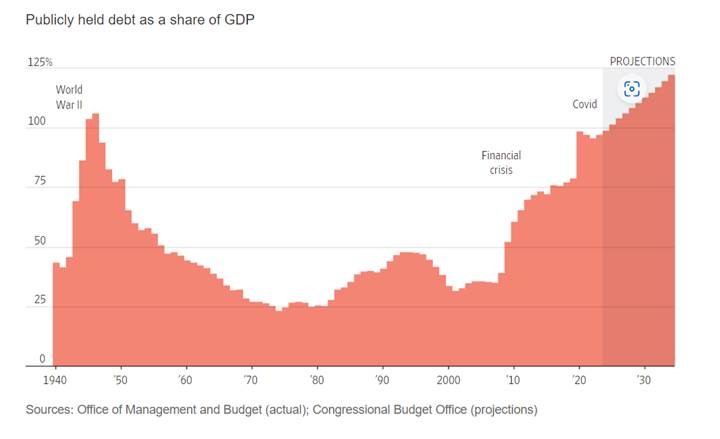

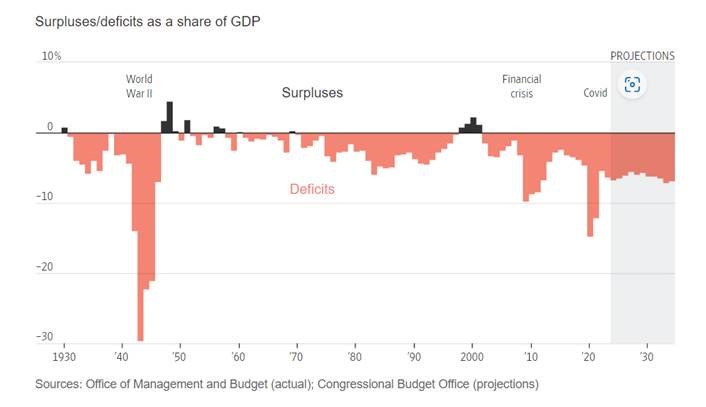

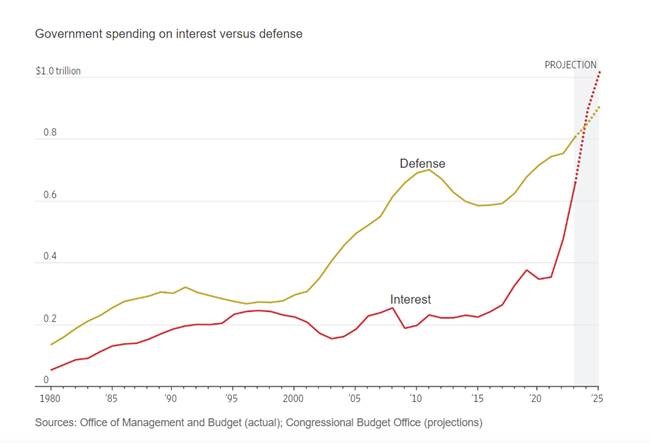

A look at US debt. The following three charts from the US Congressional Budget Office are soberingly telling. This is not to pick on the USA, mind you. We’re no better in Canada, nor is most of the world. We can consider this runaway data largely applicable to us and others.

The infamous Hemmingway quote comes to mind: “How did you go bankrupt? Gradually, then suddenly.”

It will take a now-absent collective will to turn it all around – or, short of that, (and more likely) a wake up call from a cranky bond market. Those of us who remember the 90’s know it’s possible, if difficult.

And at some point, we may be compelled to choose -- quite literally --between guns and butter

We woke up to this morning to the first frost of the season today at our place. It may have wiped out our fresh garden flowers, squash and beans, and l

Those luscious, beautiful blueberries. We’ll see, but we’ve had a good run!

Enjoy your weekend!

Mark