- The political equation as it applies to the Health Care sector looks to be unusually benign this cycle.

- COVID-19 has focused investors on the importance the sector plays in keeping the economy growing and productive.

- Long-term themes of ageing demographics, the need to get value for health care spending, and the convergence of health care and technology offer many opportunities for sector growth, in our opinion.

Vince Lombardi, the legendary American football coach once said, “It’s not whether you get knocked down, it’s whether you get up.” We suspect Lombardi would have liked the look of the Health Care sector today—it has taken its fair share of hits over the past year but has kept getting up, shrugging off the blows, and moving forward.

Much of the Health Care focus last year was on the possibility of some iteration of Medicare for All (M4A) legislation being enacted should a progressive Democrat clinch the 2020 U.S. presidential election, as M4A could have seriously impacted operating models of the managed care sector. However, Joe Biden, a more traditional Democrat, is the presumptive nominee for his party, and given his involvement in crafting and ushering through the Affordable Care Act (ACA), which was supportive of private insurance companies playing in the same sandbox as the government, we think the likelihood of M4A rearing its head and rattling the sector has receded.

Also helping the sector has been the arrival of the COVID-19 pandemic which has created an awareness that viruses and diseases have not been eradicated and that companies doing novel research will be able to drive new medical discoveries and can get rewarded for their success. The combination of fading M4A fears and growing optimism over a potential vaccine for treating COVID-19 has provided support for Health Care stocks, with the group outperforming the S&P 500 year to date to become the index’s fourth-best performing sector.

Year-to-date S&P 500 performance by sector

Returns for the Health Care sector have outperformed the S&P 500 year to date.

Source - FactSet; data as of 6/19/20

With the election less than four months away, politicians may start shifting their attention and begin addressing the rising costs of prescription drugs, a topic of importance to the American electorate. In the 2015–2016 election cycle the Health Care sector was volatile as all three leading presidential candidates made drug pricing a focus of their platforms following the notorious 5,000 percent retail price increase for the anti-parasitic drug, Daraprim. At the time (July 2015), the NASDAQ Biotechnology Index was at an all-time high before selling off on fears legislation would be introduced to cut and/or cap drug prices. Donald Trump won the election but his promise to provide drug price relief never materialized as legislation.

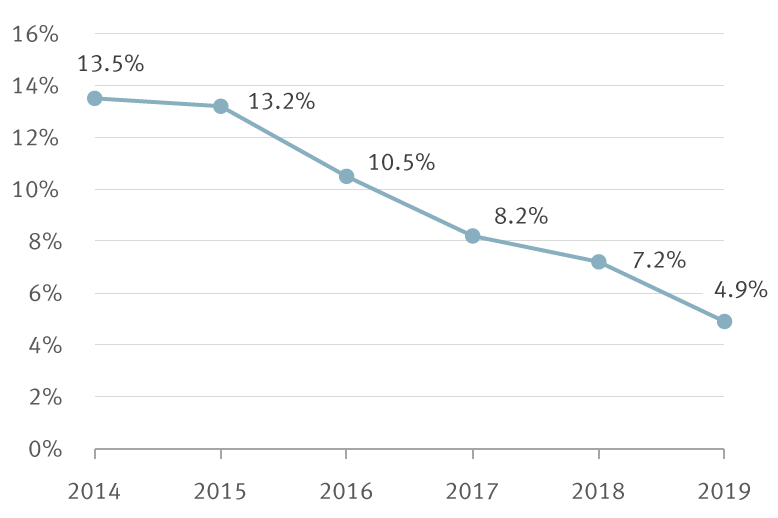

Average annual list (gross) price increases for brand-name drugs

Pace of annual drug price increases continues to moderate

Source - Drug Channels Institute analysis of SSR Health data; based on approximately 1,000 brand-name drugs with disclosed U.S. product-level sales from approximately 100 currently or previously publicly traded firms

Take two pills and call me in the morning

Over the past five years the pharmaceutical industry has acknowledged the concerns raised by elected officials, regulators, and patient advocacy groups. While list prices of drugs continue to rise, the annual pace of increases has moderated somewhat as a number of companies have attempted to keep prices in check. In 2015, the average annual price increase for brand-name drugs in the U.S. was roughly 13 percent, but has decreased each year to about five percent in 2019. We expect the trend to continue.

While initiatives designed to scuttle escalating drug prices are popular across the Democratic and Republican Parties, we don’t anticipate any policies being passed into law this year given the gridlock in Congress and current focus on reopening economies. Nevertheless, we have highlighted the main proposals to address rising drug costs.

Summary of key drug price reform proposals

Part B International Pricing Index Pilot Program

Prescription Drug Pricing Reduction Act (PDPRA) (S. 2543)

Elijah Cummings Lower Drug Costs Now Act (H.R. 3)2

Lower Costs, More Cures Act (H.R. 19)

Notes: (1) Medicare Part B covers doctors’ services and outpatient care. (2) After passing the House in December largely along party lines, Sen. McConnell (R-Kentucky) declared H.R. 3 “dead on arrival” in the Senate, and the White House has threatened a veto. (3) The Medicare Prescription Drug, Improvement, and Modernization Act (MMA) established a prescription drug benefit under Medicare Part D and prohibited the government from negotiating the price of prescription drugs on behalf of Medicare beneficiaries.

Source - Centers for Medicare and Medicaid Services, RBC Capital Markets, RBC Wealth Management

Health Care investment fundamentals appear attractive

Despite the S&P 500’s impressive roughly 40 percent advance from its March lows, we believe the Health Care sector appears attractively valued relative to the index. The current forward (2021E) price-to-earnings (P/E) multiple for Health Care is roughly 15x, a discount to the S&P 500, while offering reasonable earnings growth compared to other sectors. While the Health Care sector can be volatile in an election year, we believe a number of investment themes exist that are supportive of the sector’s long-term growth prospects regardless of the policy environment.

- Aging demographics: According to the Census Bureau, 2030 will mark a turning point in the U.S. as all Baby Boomers will be 65 years of age and older, expanding this demographic to 21 percent of the population from 17 percent currently. Furthermore, by 2034 the number of senior citizens in the U.S. will outnumber children for the first time in history. Given the higher per-capita health spending for people age 65 and older, we expect an aging population to drive utilization for prescription drugs, medical procedures, and hospital stays.

- Adoption of value-based care: Health care spending in the U.S. is rising at what we believe is an unsustainable rate. In 2019, the U.S. spent roughly 18 percent of its GDP or almost $4 trillion in total spend on health care, far exceeding that of other developed countries which routinely spend around 10 percent to 11 percent and often deliver better outcomes. While per-capita spending on health care in the U.S. is higher, the quality delivered is not much better. Rising health care costs are driving a reorientation of the health care system away from fee-for-service models toward value-based care which puts the patient in the center with care providers such as hospitals and doctors being paid based on patient outcomes against the cost of delivering care. We think managing the treatment of chronic diseases more effectively will not only help patients recover faster from their illnesses at lower costs, but will force providers to employ technology solutions and become more efficient in the process.

- Telemedicine: The convergence of securing data in the cloud, high-quality video conferencing, and social distancing has accelerated a shift toward telemedicine. Virtual visits with a physician provide the dual advantages of faster diagnosis and convenience for patients. Telemedicine is a practical option for people on the go and those who are either house-bound or live in underserved areas lacking access to quality care. Moreover, telemedicine allows hospitals and doctors to easily follow up with patients to monitor their progress, change their course of treatment as required, and determine if in-person attention is needed for more urgent care. Given the frequent monitoring, health issues can be detected earlier in the process thereby keeping treatment costs down.

- Vertical integration: Another emerging theme is vertical integration across the health care delivery network as companies come together through acquisitions to offer a variety of services such as health insurance, pharmacy, acute care, nursing care, home health, and data analytics under one roof. A company that is vertically integrated across the services channel can better leverage its infrastructure and offer a greater level of coordinated care to improve treatment and enhance the patient experience. Furthermore, the benefits from combining medical and pharmacy claims as well as data and analytics will help address escalating health care costs and reduce waste across the system.

Earnings growth and forward P/E multiples for the S&P 500 by sector

| EPS growth (y/y) | Forward P/E | |||

|---|---|---|---|---|

| Sector | 2020E | 2021E | 2020E | 2021E |

| Energy | NMF | NMF | NMF | 37.0x |

| Consumer Discretionary | -57.4% | 115.4% | 63.7x | 29.6x |

| Real Estate | 1.5% | 7.6% | 24.6x | 23.1x |

| Information Technology | 1.1% | 15.2% | 26.0x | 22.6x |

| Communication Services | -15.5% | 23.0% | 25.1x | 20.4x |

| S&P 500 | -22.1% | 29.0% | 24.8x | 19.2x |

| Consumer Staples | -2.6% | 7.9% | 20.7x | 19.2x |

| Materials | -21.2% | 28.3% | 24.1x | 18.8x |

| Industrials | -47.6% | 77.4% | 32.3x | 18.2x |

| Utilities | 1.0% | 6.1% | 18.4x | 17.3x |

| Health Care | -1.4% | 15.9% | 17.6x | 15.2x |

| Financials | -36.9% | 37.5% | 17.1x | 12.4x |

Source: FactSet; data as of 6/19/20; data for Real Estate captures adjusted funds from operations (AFFO) and price to adjusted funds from operation (P/AFFO)

Long-term tailwinds + reduced political risk = outperformance

Enacting meaningful legislation to control drug prices is not a slam dunk even were one political party to control both the White House and Congress given opposing viewpoints held by members of the same party and the health care industry’s previous track record of helping to shape legislation. While we have no insight as to who will win the presidential election, we believe neither a Biden nor a Trump victory would be troublesome for the health care industry or pharmaceuticals in particular. We think a Trump re-election would largely result in status quo (the rate of growth in prices would come down due to political pressure and industry self-regulation). A Biden victory would likely result in the expansion of the ACA coverage to provide uninsured Americans with greater access to prescription drugs, which we believe would offset some of the pricing headwinds.

While we expect prescription drug pricing to be a focus in this election, as it has been in previous election cycles, we believe the headline risks should not be a reason to avoid the Health Care sector as the fundamental outlook remains strong and underpinned by the powerful long-term trends outlined above. With political risks judged to be lower than in past election cycles, we see the sector offering an attractive combination of a below-average P/E ratio and double-digit earnings growth with very little if any exposure to the COVID-19-induced business cycle swings much of the rest of the market may be vulnerable to.

Non-U.S. Analyst Disclosure: Gopa Nair, an employee of RBC Wealth Management USA’s foreign affiliate RBC Dominion Securities Inc., contributed to the preparation of this publication. This individual is not registered with or qualified as a research analyst with the U.S. Financial Industry Regulatory Authority (“FINRA”) and, since he is not an associated person of RBC Wealth Management, may not be subject to FINRA Rule 2241 governing communications with subject companies, the making of public appearances, and the trading of securities in accounts held by research analysts.

In Quebec, financial planning services are provided by RBC Wealth Management Financial Services Inc. which is licensed as a financial services firm in that province. In the rest of Canada, financial planning services are available through RBC Dominion Securities Inc.