STRONG PERFORMANCE

Our clients’ portfolios performed well in the most recent quarter, despite elevated volatility driven by economic data.

As we anticipated in the July edition of Marche Monthly, the Bank of Canada is dropping interest rates faster than the US Federal Reserve. The BOC has implemented three consecutive cuts of 0.25%, while the Fed kept rates unchanged, although the markets are expecting a US cut of 0.25% this month as inflation continues to trend lower.

STICKY INFLATION

Indeed, this July marked the slowest growth in Canada’s inflation rate since March 2021. However, the high cost of mortgage interest is making it difficult for inflation to go lower, and is a key challenge to the Canadian consumer and economy. It is a challenge the US is not grappling with to nearly the same extent; one reason is that Canadians must renegotiate their terms, possibly several times, over the life of a mortgage, whereas Americans’ rates are unchanged over the entire amortization period, which protects them in a rising / high interest rate environment.

THE BOC’S BLUNDER

I want to draw special attention to the fact that the high cost of mortgage interest rates is largely the fault of the Bank of Canada. This is something I have been saying since July 2023. Their mistake has been hurtful to the Canadian economy and can be explained simply: after a campaign of interest rate hikes that began in March 2022, they raised interest rates twice, in June and July of last year, when they didn’t have to. Then they didn’t start cutting rates until June of this year.

Their errors have been far from helpful amid employment markets that continue to weaken in both Canada and the US, renewing fears of a recession.

WE REMAIN CONFIDENT

But the most important part of our message is this: we remain confident with the stocks and bonds we own in your portfolio and continue to trust their ability to thrive in any economic environment. In addition, we are constantly monitoring the markets and are always positioned to find investments that are trading below their intrinsic value, a key pillar of our long-time investing philosophy.

In the equity portion of our portfolios, the biggest contributors to our gains so far this year continue to be technology and energy companies. Although there has been relative weakness in our financial stocks – banks and insurance companies, for example – we continue to expect that portion of our portfolios to outperform moving forward, as interest rate cuts make their dividends more attractive and increase the price that investors are willing to pay for their shares. Rate cuts also make bonds more attractive, and thus we expect bonds and dividend stocks alike to contribute more positively to our performance than they have in the past couple of years.

TAX PLANNING

Labour Day has come and gone, and as we turn the corner toward year-end, we are heightening our focus on finding tax planning opportunities. Because our portfolios have performed strongly so far this year, there are not an abundance of opportunities, but as always, we will be looking relentlessly for every way to minimize your taxes. If you or your accountant would like to discuss strategies in detail, please let me know.

OUTSTANDING ADDED VALUE

Speaking of which, careful will and estate planning could be a big tax-minimization opportunity. And so, this summer I have been especially busy working with two key members of our team here at Marche Wealth Management: Alleen Sakarian and Andrew Sipes.

Alleen, a lawyer, is our Will and Estate Planning Specialist. I have observed that every single one of our clients who has met with her, gets something positive out of it. Whether you haven’t updated your will or powers-of-attorney in years (which definitely calls for a meeting with Alleen and I in the very near future), or have made a change quite recently, Alleen inevitably raises something you have not considered. Are these crucial documents fully aligned with your objectives? Are there any executor issues that need attention? Are there any family dynamics at play? (Hint: there are always family dynamics at play.)

I have also been alongside our clients in many meetings with Andrew Sipes, our Insurance and Estate Planning Specialist, discussing and implementing strategies that use life insurance as a tool to get money out of corporations on a tax-free basis – a rare opportunity in such a heavily-taxed country as Canada, especially after the recent capital gains tax increases.

THE REALITY

Many advisors do not offer these value-added services, which we offer as part of the all-inclusive cost of managing your portfolio. Are you ready for a conversation on these important matters – or do you know someone whose advisor is not offering such opportunities?

We are always ready to talk.

Enjoy the remaining days of summer!

--

We don’t speak jargon. We’re all about uncomplicating your life, so we speak plain English. If there is someone you care about – someone who would appreciate this simple and straightforward approach – please feel free to share this message with them or put us in touch.

Want to discuss any aspect of this month’s blog, or any other issue on your mind? Have a story idea? I am always happy to receive your call or email.

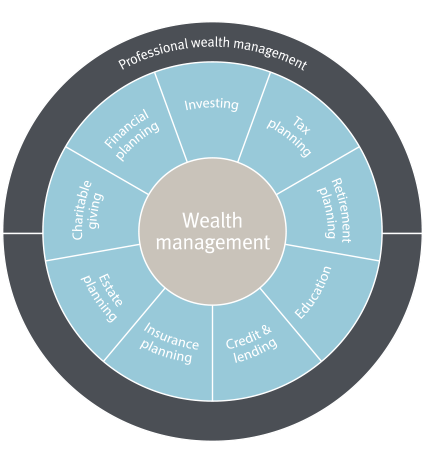

**To learn about our unrivalled team of experts, delivering Canada’s widest array of wealth management services to our clients, visit our website, here and here.

WHAT WE DO