BELIEVE IT OR NOT

Believe it or not, it’s only March. It has been quite the year already, given the policy shifts and turns of the US government. While many people are “tariff-ed” out at this point, I am going to discuss some of the early impacts from the trade war so far.

First and foremost, for all the talk of what the market is doing, our clients do not own it. Instead, they each own a customized portfolio of businesses and guaranteed investments in alignment with our long-time investing strategy and driven by our client’s comprehensive wealth plan.

The S&P 500, which we consider the authoritative indicator of how the overall market is doing, is down approximately 4% as of last Friday. Our clients’ portfolios, on the other hand, are still in positive territory, and their financial plans are ahead of schedule.

People are being bombarded with media noise about the volatility created by tariff uncertainty. We know that we own the right companies and are confident in our strategy, which has proven itself time and time again. We do not own any companies that we believe will be permanently affected by tariffs or any other US policy. We are closely monitoring the markets as part of our solemn duty to protect and build your wealth, and related to that, for opportunities to prudently capitalize upon the volatility by buying great companies at what we consider to be less than their intrinsic value.

We are always prepared for volatility, and therefore made some strategic adjustments before the tariff turmoil set in. We took some profits on companies that had done very well for us, such as Nvidia, Amazon and Alphabet, and added to our defensive dividend-paying companies such as TC Energy, Restaurant Brands International and South Bow Corp. We also sold all of our shares in Shopify and put the entire proceeds in Berkshire Hathaway, making it our largest holding.

It might not always feel like it, but we regard the current volatility as a normal part of the wealth management process, ultimately no different from any number of crises we have experienced in the past.

Despite everything I have said above, I always welcome you – and your family, friends and colleagues – to contact me with any questions or concerns. Because it is, after all…

…THAT TIME, *AGAIN*

February 2nd – Groundhog Day – has come and gone, and every year at this time, we get calls from our clients’ family, friends and colleagues with their concerns that they are not doing as well financially as they could be.

They are assessing their investment returns from last year. On top of that, they are in the midst of tax time, and many of them are facing the hard reality that when it comes to investing, it’s what you keep after tax that really matters. And so they are asking themselves: “Can I do better?”

Very often, as we tell many new clients, the answer is “yes.”

Do you know someone who should be talking to us? We would be happy to hear from you, or someone you care about, and as always will provide a complimentary analysis of the situation, with absolutely no cost or obligation. We are here.

TARIFF OVERVIEW

The tariff situation is fluid. Temporary exemptions and delays may move us further away from a worst-case scenario, which would be a recession in Canada and elsewhere. On the other hand, the constant policy changes have made an already uncertain environment even more unpredictable.

Consumers

A number of different surveys released in the United States over the past month have suggested that concerns about trade, tariffs and inflation are behind declining consumer confidence in future business conditions, the availability of jobs, and the prospects for higher incomes.

Businesses

On the business front, recent US economic reports suggest that some signs of weakness are starting to show, pointing to a slowing of growth through the first quarter of this year. There are also indications from the US Federal Reserve that some manufacturing and construction firms view tariffs as already raising material costs and creating uncertainty for long-term pricing and investment decisions.

Investors

Global equity markets have been weaker at least partly as a result, with signs that investors are getting increasingly uncomfortable, with an increase in the number of investors who have a negative outlook, and a decrease in the number who have a positive one.

In particular, the US stock market has underperformed other markets including those here in Canada, as well as in Europe and Asia, which may be explainable by the fact that US stocks were relatively expensive, and that in an uncertain environment, selling expensive stocks can be an easy source of funds.

LOOKING AHEAD

We are confident as always in our long-time investing strategy, part of which is to constantly be assessing our clients’ portfolios to ensure their exposure is appropriate, and monitoring the markets for opportunities to capitalize on volatility. I want to emphasize again that our clients do not own the market. All our client portfolios, customized as they are, are outperforming the market so far this year, and all client financial plans are on track.

TAX SEASON DATES

RRSP season, so important because of the power of tax-sheltered compound growth, ended March 3rd. Tax season continues, and we are working as always with our clients and their accountants. To help you with your filings, click here for 2024 Tax Preparation Reminders. The document summarizes important dates and information, and provides online access to tax slips, required to prepare your annual tax return. Key dates include:

-April 30, 2025: last day to file your 2024 tax return without penalty.

-June 16, 2025: last day to file your 2024 tax return without penalty if you are self-employed.

As well, here are 2025 Handy Financial Planning Facts, some key elements of which – including details on TFSA and FHSA contributions – were included in the January edition of Marche Monthly, here.

WE ARE HERE

As always, we are here for you, your family, friends and colleagues. If you have any questions or concerns whatsoever, please reach out.

--

We don’t speak jargon. We’re all about uncomplicating your life, so we speak plain English. If there is someone you care about – someone who would appreciate this simple and straightforward approach – please feel free to share this message with them or put us in touch.

Want to discuss any aspect of this month’s blog, or any other issue on your mind? Have a story idea? I am always happy to receive your call or email.

Tyler Marche, MBA, CFP, FCSI

Your life, uncomplicated

tyler.marche@rbc.com

1-416-974-4810

WHO WE ARE

Tyler Marche, MBA, CFP, FCSI – Senior Portfolio Manager and Wealth Advisor

Tanvir Howlader, B.Comm, MBA, CIM®, FCSI – Associate Wealth Advisor

Tracy McClure, CPA, CA, CFP – Financial Planner

Karen Snowdon-Steacy, TEP – Senior Trust Advisor

Steve Mogdan, CPA, CA – Financial Planning Specialist

Andrew Sipes, CLU, CFP – Insurance and Estate Planning Specialist

Alleen Sakarian, LL.B., TEP – Will and Estate Specialist

**To learn about our unrivalled team of experts, delivering Canada’s widest array of wealth management services to our clients, visit our website, here and here.

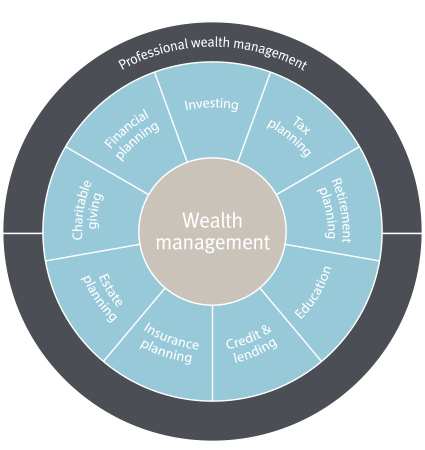

WHAT WE DO