For Canadians, these are uncertain times. For our clients, not as much.

True, it is not possible to know what President Trump is going to do next. Tariffs might be coming, and they might not. So there might be a recession, and there might not be. But our clients – along with readers of this blog – know some things for certain:

-At Marche Wealth Management, we are always prepared for the volatility that may come with uncertainty and in fact are always ready to take advantage of it where appropriate, by buying great companies we believe are trading below intrinsic value.

-The performance of our clients’ portfolios will not be determined by economic events, but by the quality of the companies we own. We focus on companies which have a track record of creating shareholder value, management that treats shareholders as partners, and a simple, easy-to-understand business model.

YOUR LIFE, UNCOMPLICATED

Our proven, long-time investment philosophy is founded on our core belief that wealth management doesn't need to be complicated. It needs to be simple. In this vein, we follow the principles of Warren Buffett and Berkshire Hathaway, in that we only provide investment solutions we understand fundamentally.

We tend to manage concentrated portfolios composed of quality businesses we want to own for many years. We believe this approach will maximize long-term performance, improve after tax returns and keep costs to a minimum. This disciplined, strategic approach also avoids knee-jerk reactions to headlines and instead stays committed to realizing your financial plan – which we remain fully on-track to do, especially given our outperformance of the market over the long-term.

HOW HAVE MARKETS REACTED?

How have the markets reacted to the threat of tariffs? Not with any dramatic movement. It could be that the market views tariffs and counter-tariffs as unlikely to last very long, if they come at all, and when they might begin. The Canadian equity market has not done any worse than other major developed markets, and our dollar has rebounded following some initial weakness, although it is sitting near a five-year low. Meanwhile, Canadian government bond yields are lower (meaning prices are higher) and the difference relative to US government bond yields has widened somewhat.

Your team at Marche Wealth Management is the deepest and broadest in Canada, with unparalleled resources to serve you. Our bench strength includes the RBC Economics unit, which has produced an update worth reading. In it, they discuss their framework for assessing how US tariffs would flow through Canada’s economy. They mention the difficulty in trying to pinpoint the exact economic impact, given a number of variables that are hard to predict – including retaliatory measures, how the Bank of Canada might respond, and fiscal support provided by government to businesses and households.

They acknowledge that US tariffs of the magnitude proposed create the risk of recession in Canada. While industries that produce goods – such as the automotive sector – are most directly exposed, there could be ripple effects that impact other industries as well.

US growth will also be impacted via retaliatory tariffs and the disruption of the highly-integrated supply chains we enjoy on this continent. However, the US economy is starting from a place of relative strength vs. Canada, and is less dependent on trade than we are – so the impact on their growth should be less than on this side of the border.

Our view is that if tariffs last for three months or more, the risk of a recession in Canada becomes more significant. As well, the longer that tariffs last, the higher the potential for more permanent damage to the economy due to lower business investment and a reduction in Canada’s longer-term economic potential.

If tariffs end up being short-lived, there is potential for the Canadian dollar to recover somewhat. And, even though the Canadian equity market has so far done well in the face of the tariff threat, it is vulnerable – but, as explained in this recent piece produced by our firm’s investment team, it may weather some challenges better than some investors may expect.

A REMINDER

I want to return to my message from the start of this blog: our portfolios are strong and well-positioned not just to weather any storm but actually to take prudent advantage of whatever volatility comes our way. We are guided every day by our long-time investing strategy, explained above – and our clients’ financial plans remain firmly on track.

If you have any questions, please feel free to reach out.

ANOTHER REMINDER

Two more things we are certain about:

-Regardless of who wins our next provincial and federal elections, taxes are going to remain high.

-Tax planning, therefore, is more important than ever.

Because of the power of tax-sheltered compound growth, your registered plans are one of the most important components of your financial plan. A strategy of careful planning, consistent management and making your maximum allowable contributions on a consistent basis is essential to maximize the value of these vehicles.

Tax season is here. The deadline for RRSP contributions is almost here. So we want to remind you of the details on using tax-sheltered savings plans as an effective way to grow your savings.

Here is a very handy document that summarizes the below and has considerable additional information for your convenience:

2025 Handy Financial Planning Facts

And now, some especially key details.

RRSP Deadline and Contribution Limits

The 2024 RRSP contribution deadline is March 3, 2025 and the RRSP contribution limits are $31,560 for 2024 and $32,490 for 2025.

If you have the funds available, consider making your 2025 RRSP contribution early in 2025, rather than waiting until the deadline in 2026. The simple act of contributing early maximizes the tax-deferred growth of your investment portfolio.

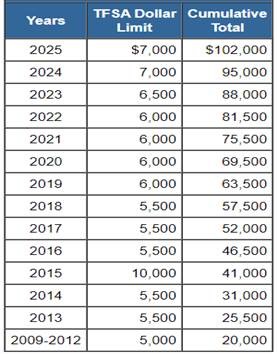

TFSA

You are allowed to contribute $7000 to your TFSA in 2025. If you did not contribute to a TFSA in prior years, with the contribution room from 2009-2025, you will be able to contribute up to $102,000 to grow tax free.

FHSA

The First Home Savings Account is a new registered plan that gives eligible Canadians the ability to save up to $40,000 on a tax-free basis, for the purchase of their first home. It combines the features of a RRSP and TFSA where contributions are tax deductible (like RRSP) and withdrawals, including earned income are tax free (like TFSA) provided funds are used to purchase a qualifying home. The annual contribution limit is $8,000 with a maximum lifetime contribution limit of $40,000 (see attachment for more information).

Determining your available contribution room

Check your latest Notice of Assessment, RRSP Deduction Limit Statement (Form T1028), or log on to your Canada Revenue Agency account here.

Please give us a call if you would like to explore these strategies and we will help you develop a plan that makes the most sense for your situation.

You can also make a contribution by transferring funds to your RBC Dominion Securities account directly from any RBC Royal Bank account through DS Online. For DS Online help or more information on transferring funds, contact Tanvir at 416-974-4811.

--

We don’t speak jargon. We’re all about uncomplicating your life, so we speak plain English. If there is someone you care about – someone who would appreciate this simple and straightforward approach – please feel free to share this message with them or put us in touch.

Want to discuss any aspect of this month’s blog, or any other issue on your mind? Have a story idea? I am always happy to receive your call or email.

Tyler Marche, MBA, CFP, FCSI

Your life, uncomplicated

tyler.marche@rbc.com

1-416-974-4810

www.tylermarche.com

WHO WE ARE

Tyler Marche, MBA, CFP, FCSI – Senior Portfolio Manager and Wealth Advisor

Tanvir Howlader, B.Comm, MBA, CIM®, FCSI – Associate Wealth Advisor

Tracy McClure, CPA, CA, CFP – Financial Planner

Karen Snowdon-Steacy, TEP – Senior Trust Advisor

Steve Mogdan, CPA, CA – Financial Planning Specialist

Andrew Sipes, CLU, CFP – Insurance and Estate Planning Specialist

Alleen Sakarian, LL.B., TEP – Will and Estate Specialist

**To learn about our unrivalled team of experts, delivering Canada’s widest array of wealth management services to our clients, visit our website, here and here.

WHAT WE DO