HIGHS

North American equity markets continue to push to record highs, encouraged by a promising start to the third-quarter earnings season in the United States. The results from major banks indicate a healthy US consumer, supported by a resilient labour market. Historically, periods of declining interest rates – especially when the economy continues to grow (what we call a “soft landing”) – create favourable conditions for investment returns.

THE DETAILS

Canada’s inflation report for September was recently released, indicating that inflation declined more than expected, with the overall Consumer Price Index (CPI) dipping below the Bank of Canada’s 2% target for the first time since early 2021. That there is a diminishing need to dampen spending is one reason we expect the BOC to continue its program of rate cuts; the consensus view is that the Bank will cut interest rates by 0.25% when it meets next in December. Some economists, including at our firm, expect Canadian policymakers to remain aggressive through the end of this year and into the next.

Meanwhile, US economic indicators continue to be stronger than Canadian. While the US Federal Reserve has also started to cut interest rates and is expected to continue to do so, there may be less of a case for the kind of aggressive approach that is expected from the Bank of Canada. So, at some point next year, there is the potential that interest rates in Canada could sit meaningfully below interest rates in the US.

This difference has been propelling the US dollar higher vs the Canadian, a divergence that could continue. For now, we continue to view US dollar exposure in our clients’ portfolios as offering important diversification and protection in today’s environment.

THE BOTTOM LINE

Everything we have done very strategically over the past number of years is now reflected in our performance, which, despite the market doing so well, is in fact outpacing that market. As a disciple of Warren Buffett and his many famous maxims, I remind myself especially of this one: "A simple rule dictates my buying: Be fearful when others are greedy, and be greedy when others are fearful."

Here at Marche Wealth Management, we are practicing that maxim to the letter. We are now being more cautious than at any point over the past few years.

Please see the Cycle of Market Emotions, below.

My belief is that the market is now approaching Euphoria. Which means the risk-reward tradeoff is not nearly as favourable as it was only a year ago. Especially at this moment, we must remind ourselves that investing is a process. There will be ups and downs, and over time – in large part by being fearful when others are greedy – we will continue to generate above-average returns.

YEAR-END TAX PLANNING

We are constantly on the lookout for opportunities to maximize after-tax returns. This includes implementing strategies such as tax-loss selling.

Because our portfolios are having a strong year, candidates this year are few. However, it has always been our philosophy to manage concentrated portfolios composed of quality businesses that we want to own for many years. This is because we believe this strategy will maximize long-term performance, improve after-tax returns and keep costs to a minimum.

Let us know if there are other strategies we’ve discussed in the past that you would like to explore further, such as income splitting, the use of trusts, credit swaps, and using life insurance to generate tax-free returns.

TRANSITION UPDATE

As we announced in the September issue of Marche Monthly, Joy Loewen is retiring after 37 years of providing exceptional client service in our industry, the last nine at Marche Wealth Management. Her last day will be December 20th. Thank you Joy – and congratulations!

(Please read last month's issue for the full announcement)

Client experience being so fundamental to what we do, the unparalleled depth and breadth of RBC resources will ensure that this transition will be seamless and that everything will be business as usual.

Another reminder from last month’s blog: I am truly pleased to introduce a new member of our team whose impressive credentials, designations, knowledge and experience will help take our clients’ experience to the next level. That person is Tanvir Howlader, our new Associate Wealth Advisor, who is working alongside both Joy and I over the next couple of months, to gain a holistic understanding of our business – before transitioning to work alongside me on investment management and financial planning.

US ELECTION UNCERTAINTY

The markets do not like uncertainty. The US election is creating considerable uncertainty as to who will win and whether the outcome will be contested. What is the upshot for our clients?

Simple: Regardless of who wins or how long it takes to determine the result, none of the businesses we own will be materially impacted in their ability to earn profits.

It is still worthwhile to have a look at the differences in the candidates’ platforms, for context. For example, Harris proposes to raise the capital gains tax, which historically suggests weaker corporate profits, which suggests weaker share prices…except that, for example:

-The US federal government has a system of checks and balances that constrain the president from fulfilling a full slate of policy goals

-Factors other than a president’s policies have typically had greater impacts on US stock market performance than federal election outcomes

Plus, the accountants for publicly-traded companies are skilled at reducing the impact of tax hikes on the bottom line, while maximizing the benefit from tax reductions.

Take all of that into account when looking at this chart, which shows an average gain in the S&P 500 of 3.7% in the year following a capital gains hike.

Another point of comparison is the estimate that Harris’ proposed increase to corporate taxes would cause a one-time decline of 8.6% in earnings, while Trump’s proposed tax cuts would generate a 4.6% lift.

Again, there are many caveats to these theoretical scenarios. Here is what we know for sure: to the companies we own, it does not matter who occupies the Oval Office, because those companies will thrive and prosper under either candidate.

To that I would add that should any market volatility arise – related to the election or anything else – we are in position, as always, to take advantage by finding companies we believe are undervalued and buying them at a discount, with a margin of safety.

Happy Fall!

--

We don’t speak jargon. We’re all about uncomplicating your life, so we speak plain English. If there is someone you care about – someone who would appreciate this simple and straightforward approach – please feel free to share this message with them or put us in touch.

Want to discuss any aspect of this month’s blog, or any other issue on your mind? Have a story idea? I am always happy to receive your call or email.

WHO WE ARE

**To learn about our unrivalled team of experts, delivering Canada’s widest array of wealth management services to our clients, visit our website, here and here.

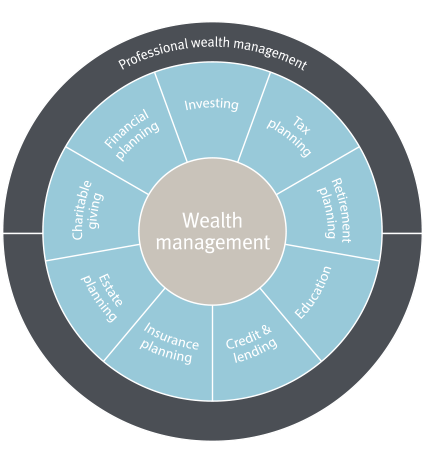

WHAT WE DO