THE STORY SO FAR

Our equity portfolios are up approximately 20% so far this year. Our fixed income portfolios are also outperforming. Last year, we were putting as much money to work as possible. Now that the market is doing so well, we are being extra careful (more on that below).

A significant driver of recent performance is declining interest rates. Related, a key pillar of our long-time equities strategy is to own stocks that pay dividends. As we have anticipated, declining interest rates in Canada (three cuts in a row, totalling 0.75%) and the United States (one cut of 0.5%) make dividends more attractive and increase the price that investors are willing to pay for such shares – which clearly benefits us.

On the fixed income side, rate cuts also make bonds more attractive. In total, then, bonds and dividend stocks are on their way to contributing more positively to our performance than they have in the past couple of years.

And yet – as always – we exercise caution.

While history shows there have been some periods of strong gains in the equity markets following interest rate reductions, there have also been some notably weak periods following a first interest rate cut (I am referring to the US cut, which was the first in four years).

Eventually – because the cuts will take time to provide relief to consumers, businesses, and the overall economy – lower interest rates will lead to improved financial conditions.

In the meantime, we keep in mind this history lesson: the start of interest rate cuts can either extend the economic cycle (think: the bull market continues) or create indications of an economic downturn. As always, we will be watching closely for signs of either scenario unfolding.

DOES THE US ELECTION MATTER?

Does it matter who wins the US presidential election in November?

Regardless of your political views, I will repeat something we have said many times in the past (about American and Canadian elections both): it does not matter to our portfolios.

The federal government in the United States has, built into its structure, a system of checks and balances that constrain the next president from fulfilling her or his full slate of policy goals, however positive or negative one might think those goals are in theory. And, historically, it can be shown that those checks and balances have often worked in the stock market’s favour.

In addition, other factors have typically had greater impacts on US stock market performance than federal election outcomes – factors such as the natural ebb and flow of the business cycle, the monetary policies of the US Federal Reserve, and industry innovation.

This graph tells the tale. The bottom line is that the market has gone up under both parties’ presidential leadership, and its overall performance often had little to do with who occupied the Oval Office.

If you would like to read some in-depth research on this topic, click here for a dedicated piece by RBC Wealth Management. Our clients have found the Appendix, on pages 14 and 15, to be an interesting summary.

CONGRATULATIONS JOY!

After 37 years of providing exceptional client service in our industry, the last nine at Marche Wealth Management, Joy Loewen is retiring. Her last day will be December 20th.

We are very excited for her. Already active in her community, Joy plans to be even more so. She is president of her community association, and treasurer of the Community Police Liaison Committee for 43 Division of the Toronto Police Service. She plans to get her dog certified as a therapy animal and focus on working with seniors. She is also interested in taking up gardening. Together with her husband, she has been an avid kayaker and camper, and will now have time for even more adventures.

Joy has been integral to the client experience we deliver. I am very grateful for that, and so are our clients. Thank you so much, Joy, and many happy adventures!

DEPTH AND BREADTH

Client experience being so fundamental to what we do, we are in the process of finding a replacement for Joy who will live our brand promise of Your life, uncomplicated. The unparalleled depth and breadth of RBC resources will ensure that this transition will be seamless and that everything will be business as usual…

INTRODUCING TANVIR HOWLADER

…With one exception, since I am truly pleased to introduce a new member of our team whose impressive credentials, designations, knowledge and experience will help take our clients’ experience to the next level. Introducing Tanvir Howlader, our new Associate Wealth Advisor, who will be working on investment management and financial planning alongside me.

Tanvir’s phone is always ringing. The calls come from clients, and from people in the wider community.

“They know me,” he says. “They know that I am going to give them accurate and honest wealth management advice, delivered in a way that will be simple to understand.”

Uncomplicating clients’ lives starts with listening very carefully, to understand exactly what they want. As Tanvir puts it, “We work to understand every single word they say, and then we create their comprehensive financial plan on that basis.”

Tanvir holds a B.Comm in Finance and an MBA in Finance and Accounting, in addition to designations as a Chartered Investment Manager (CIM) and Fellow of the Canadian Securities Institute (FCSI).

Click here to read Tanvir’s full bio. Welcome Tanvir!

--

We don’t speak jargon. We’re all about uncomplicating your life, so we speak plain English. If there is someone you care about – someone who would appreciate this simple and straightforward approach – please feel free to share this message with them or put us in touch.

Want to discuss any aspect of this month’s blog, or any other issue on your mind? Have a story idea? I am always happy to receive your call or email.

**To learn about our unrivalled team of experts, delivering Canada’s widest array of wealth management services to our clients, visit our website, here and here.

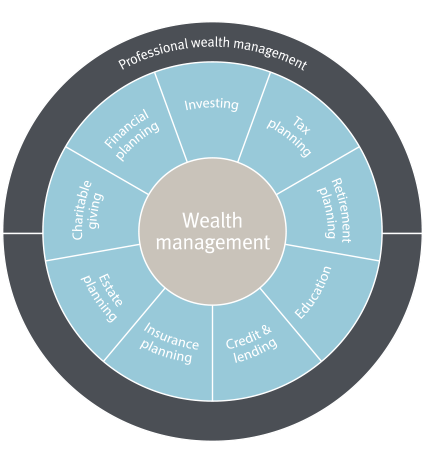

WHAT WE DO