LOONIE SWOON

That swooning you feel is not just our hot summer. Unfortunately, the Canadian economy is not performing as well as its US counterpart. Here are two consequences:

First, between the end of June of this year and the end of next year, we anticipate interest rates will drop more in Canada than in the United States. On this side of the border, we anticipate they will drop a total of 1.75% over 18 months vs a total of 1% for our American friends.

Second, we expect that the American dollar will continue to strengthen compared to ours. It was at $1.33 a year ago, is now at $1.39, and we see it at $1.40 – possibly even stronger – by year-end.

As I said in May, the American portion of our portfolios has been outperforming the Canadian, but we still expect this performance gap to narrow. We have nevertheless been prudently looking for opportunities to continue increasing our exposure to American companies, and to Canadian companies with US earnings.

Note that the US overnight interest rate is referred to in the below chart as *Fed funds.

FLIP FLOP

The Bank of Canada cut interest rates in June and July. I see it as simply a reversal of their poor decision in June and July of last year to raise them by the same amount. In other words, rates were at 4.75% before last June, and as of this July, they are back at that same figure.

Last July, I explained my thinking this way:

“The BOC’s stated inflation target is 2%. Here’s the thing: if you remove from inflation figures the increase in mortgage carrying costs, which were driven by the increase in interest rates, inflation is, in fact, 2%. Their target has been achieved.”

When I wrote that blog last summer, our economy already had more supply than demand and we do not anticipate that changing through the next year.

DIVIDENDS UP

Consider the stock price performance during the month of July for these companies in our portfolios:

The above are all dividend-paying stocks. Now consider the July performance of these three tech companies we own:

As you can see, after two years of tech stocks driving the majority of gains in our portfolios and in the overall stock market, dividend stocks are outperforming in July, and growth stocks are underperforming.

Part of what we are seeing is a classic “sector rotation,” where large-cap tech stocks have sold off, while other sectors have seen gains. More to the point, as I said in last December’s issue of Marche Monthly, the outlook for dividend stocks, bonds and GICs is more favourable in 2024 because inflation is in decline, and thus central banks should start reducing interest rates, which would lead to a decline in bond yields. This increases the attractiveness of dividend-paying stocks relative to bonds, causing their price to rise along with bonds and other fixed income investments such as GICs.

As well, second-quarter earnings season is now underway, and the market’s high expectations for tech have left little room for disappointment. Unfortunately, updates from a few high-profile tech companies were not well-received by investors. The concern has not necessarily been the earnings reports themselves, but instead the significant sums being spent on artificial intelligence-related research and development, and growing scrutiny around the future returns on those investments.

DO THE US ELECTIONS MATTER TO US?

Financial markets have not responded very strongly to the dramatic twists and turns of US federal politics. However, the standing down of Joe Biden and the appointment of Vice President Kamala Harris as the Democratic nominee, set to be made official at the party’s national convention in August, has introduced new uncertainty with respect to the outcome of the November elections.

Markets tend to focus on policy and priority differences among the parties, the likelihood of meaningful legislation being passed, and any potential impact on the country’s growth and fiscal position. While the potential President-elect understandably gets the lion’s share of media attention, congressional elections are also important. The U.S. Congress is deeply involved in making and changing legislation, and the president must sign its bills in order for something to become law. Therefore, Congress shares authority over financial and budgetary policy and national defense, among other federal government functions.

Currently, of the two chambers of Congress, the Democrats control the Senate, and Republicans control the House of Representatives, both with razor-thin margins. This configuration is often referred to as “gridlock” or “divided government” because passing meaningful legislation becomes more challenging, as laws must pass both chambers and be signed by the president to be enacted. Gridlock has been much more common in recent decades. Since 1953, one party has controlled both chambers of Congress and the presidency only 37% of the time, compared to 85% of the time from 1900-1952.

We will continue to pay close attention to the elections, to get a better sense of any major policy shifts and their implications for future growth and government debts and deficits.

All of that said, here is the most important point: Whatever happens between now and November will not change our long-time investing strategy of owning companies that will thrive under all conditions.

Should you have any questions, feel free to reach out.

THANK YOU

We have received many referrals so far this year. Thank you for your continued trust and confidence. Do you know someone – or a business, or a charity – who is wondering whether their investment strategy is still the right one, or how they could be doing better? Those are exactly the reasons for many of the referrals we receive: people wondering if their advisor is getting them the best possible returns.

There is a very good chance we can do better for them. We would welcome an introduction from you, and would provide a completely confidential, complimentary and no-obligation review.

I hope you are enjoying summer!

--

We don’t speak jargon. We’re all about uncomplicating your life, so we speak plain English. If there is someone you care about – someone who would appreciate this simple and straightforward approach – please feel free to share this message with them or put us in touch.

Want to discuss any aspect of this month’s blog, or any other issue on your mind? Have a story idea? I am always happy to receive your call or email.

WHO WE ARE

**To learn about our unrivalled team of experts, delivering Canada’s widest array of wealth management services to our clients, visit our website, here and here.

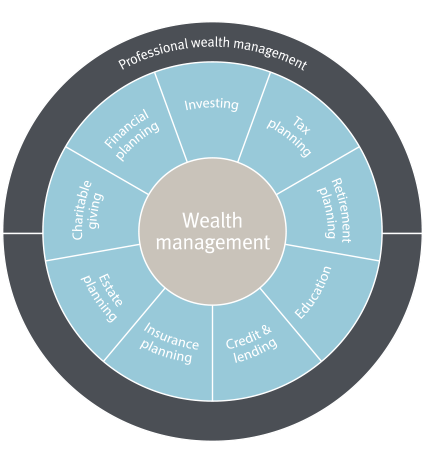

WHAT WE DO