HALF-TIME REPORT

Here we are, already past the year’s halfway point – so a summary of the first six months is in order.

There has been encouraging progress on inflation this year – despite the Canadian inflation report for May, which was higher than expected for the first time this year. Fading inflationary pressures have allowed a few central banks to begin cutting rates. The Bank of Canada has done so, and we expect that before the year is over, they will again. We also see a potential rate cut in the US this year (but, see the caveat in the Biden-Trump section below).

On the growth front, things have been arguably better than anticipated, given many investors were expecting a recession to have already begun. We believe that a soft landing, where the economy slows but avoids a meaningful deterioration in employment, is now more likely for many economies, particularly the US.

The above backdrop has driven global equity markets higher this year, with the US leading the way. But, as has been the case for some time, US gains have been heavily influenced by the big tech companies, and more specifically, anything related to artificial intelligence (AI).

The S&P 500, which we would normally consider the authoritative indicator of how the markets are doing overall, is up more than 16% year-to-date, although the New York Stock Exchange and the Toronto Stock Exchange are up only 3% and 4%, respectively.

Why the difference? Because the majority of the S&P 500s returns are driven by tech and AI stocks, in particular the “Magnificent Seven” of Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta and Tesla. The S&P 500 Equal Weighted Index which gives every company the same % weighting in the index is only up 3% this year.

The S&P 500’s momentum may continue for some time, but we are exercising particular caution for a few reasons:

-The U.S. market has become more expensive over the past year, driven by tech and AI companies. We are always very careful, and now are even more so, to ensure that any purchases we make are at prices below what we believe is a stock’s intrinsic value in order to provide us with a margin of safety. We see AI as a very positive long-term investment opportunity, are positioned as such, and are also finding value in other areas of the market (see our caution on AI here, in the May edition of Marche Monthly).

-We tend to believe that a bull market is more sustainable if it is driven by a broad range of stocks and sectors. Outside of the big tech and AI companies, and as demonstrated by the lacklustre New York and Toronto numbers, the market is not performing that well.

-The risk of recession remains above average based on various factors we monitor. As a result, we believe the range of possibilities for equities is wider than normal, despite the market strength to date.

On the fixed income front, yields remain attractive in our view, and higher exposure to high-quality bonds can act as a stabilizer in portfolios, in the event that volatility returns to equity markets, which were unusually calm in June.

Overall, our time-tested approach to managing portfolios remains a bit more cautious at this time, given the range of potential outcomes. However, we remain committed to owning companies that we want to own for many years in order to generate above average returns, improve after tax returns and keep costs at a minimum.

Have any questions at all? Please do not hesitate to reach out.

A CANADIAN TSUNAMI?

Canadian households have had a challenging past two years, due especially to rising prices and increased borrowing costs. Of particular concern are higher interest rates as they relate to upcoming mortgage renewals. The CBC sees the risk as a potential “tsunami of mortgage renewals about to crash into the economy.”

We will not be so dramatic. We prefer the language of the Bank of Canada, which puts it this way: "The large number of households renewing mortgages at higher rates and with higher payments in 2025 could curb spending and dampen economic activity and inflation more than expected.”

We also note that because the banks are so highly integrated with our domestic economy and housing in particular, their stocks can be seen as a proxy for the Canadian market overall. Unsurprisingly, therefore, Canadian bank stocks have been below-average performers for the past couple of years. We believe that before too long, they will return to their regular growth pattern and be positive contributors to our performance.

BIDEN-TRUMP

There have been many opinions shared in Canada about the recent US presidential debate. We stay out of them, except as they relate to your wealth. On that note, we see that after the debate, interest rates and the market both went up, a sign that the market is expecting – is “pricing in” – the probability of a Trump victory in November.

It is believed that if elected, his policies will lead to more inflation, because he will work to stimulate the economy. Thus, although we still see potential for interest rate cuts in the United States later this year, the likelihood is now lower.

WHAT WILL YOUR LEGACY BE?

Every summer, we find that our clients, whether still working or retired, tend to think more about the future. Warmer weather and summer vacation give us the opportunity to spend time with loved ones, reflect upon our family relationships and look ahead – especially as it comes to intergenerational wealth and estate planning.

We are having great success working with multiple generations of our client families, reviewing their wills and estate plans and implementing strategies to mitigate or even eliminate the taxes that would be due upon their passing – something that is especially critical in light of the higher capital gains tax inclusion rate that became effective June 25th.

Financial literacy, across generations, plays a vital role in understanding the opportunities and risks inherent in will and estate planning. That is why we’re always here to answer any of your questions and concerns, no matter how insignificant they may seem. Many times, clients will tell us about changes in their family without realizing it could have significant implications for their estate plan.

We are reminded that financial literacy through the generations is not just about money. It is also about leaving our children and grandchildren a non-monetary inheritance in the form of a family culture on how to prudently manage money and wealth.

A truly great legacy, therefore, includes leaving both money and the knowledge to use it wisely – something we are always here to coach you, or any of your family members, on.

Just reach out. And have a happy summer!

--

We don’t speak jargon. We’re all about uncomplicating your life, so we speak plain English. If there is someone you care about – someone who would appreciate this simple and straightforward approach – please feel free to share this message with them or put us in touch.

Want to discuss any aspect of this month’s blog, or any other issue on your mind? Have a story idea? I am always happy to receive your call or email.

WHO WE ARE

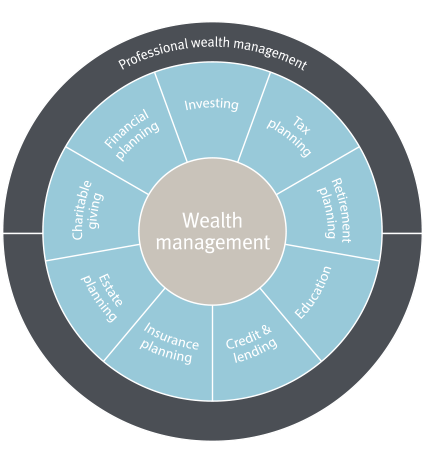

**To learn about our unrivalled team of experts, delivering Canada’s widest array of wealth management services to our clients, visit our website, here and here.

WHAT WE DO