The Most Important Risk

“The essence of investment management is the management of risks, not the management of returns.” – Benjamin Graham

An investment’s true risk is closely tied to your time horizon. Cash may feel safe in the short term, but inflation makes it a terrible long-term “investment”. At just 3% inflation, the real value of your cash is cut in half in about 24 years – yet underestimating this impact is one of the most common mistakes investors make in their retirement plans.

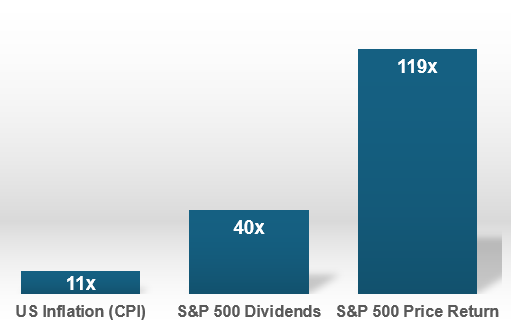

On the other hand, stocks have a great track record as a long-term inflation hedge, because the companies behind them grow their profits and dividends. The below chart shows US stock prices and dividends, compared with inflation, since 1960:

Data source: “The S&P 500 at Your Fingertips” on politicalcalculations.com

As you can see, stocks and their dividend payments have been growing faster than inflation for 65 years. And, there are no guarantees in life, but if you believe – as I do – that our society, and the economic system on which it is based, will continue, then there’s every reason to suppose that stocks can continue growing.

But, as Peter Lynch puts it, “a stock market decline is as routine as a January blizzard in Colorado.” The markets drop by 10%, on average, about once a year. They drop by double that, 20%, about once every 5 years. These frequent pullbacks test your intestinal fortitude, and stress the need for a personalized portfolio that you can be comfortable with. And, even for investors that can stomach these steep market declines, stocks may be inappropriate for your shorter term needs.

Source: First Trust, Bloomberg. Data from 4/29/1942 – 9/30/2025

According to Jeremy Siegel of Wharton, since World War II, the worst time to jump into US stocks was in 2000, at the very peak of the “Dot Com” bubble. With this perfectly terrible timing, it took a painful 5 years and 8 months, with dividends reinvested, to claw back to your initial investment amount. This informs our stance that stocks are generally best for 5 years out, and beyond.

Many “investors” should be described as “speculators”, because their portfolio decisions are based on macroeconomic and market predictions. These ideas may make for interesting comments at a cocktail party, but likely won’t add value to your retirement plan. Rather, leaning on these unreliable forecasts can lull you into a risky, false sense of precision about your investments.

(And, to be completely cured of speculating on market predictions, go and look at last year’s market predictions).

By comparison, we prefer a fundamentally driven approach and own great businesses for the long haul, and hold short-term fixed income to smooth out your ride and deliver near-term income. By investing with humility and respecting the markets’ unpredictability, we work to put you in a position to weather any storm.

Simply put, our philosophy of investment advice is plan-driven and long-term, as opposed to an approach that is driven by the latest headlines or market moves:

- We are plan-driven investors. Our investing decisions are grounded in your goals, cash flow needs, tax considerations, and risk tolerance. We do not act based on the market fears or fads of the day.

- We think of stocks as businesses, not as chips for the casino. This perspective, influenced by Warren Buffett, leads us to own well-run, profitable businesses for many years.

- We take a differentiated view toward market fluctuations. As challenging as it is, we aim to put you in a position to either ignore market pullbacks or view them as a buying opportunity.

- We carefully manage risk in our portfolio of great businesses. Through periodic re-balancing, disciplined position sizing, thoughtful diversification, and ongoing due diligence of our holdings.

My investing philosophy is singularly dedicated to minimizing the risk that my clients and I fail to achieve our most important financial goals. In summary:

“Those who judge their portfolio by its performance relative to some narrow benchmark are focusing on an issue that is largely irrelevant to their ultimate financial success.

The only benchmark that you should care about is one that indicates whether or not you’re on track to accomplish your financial goals.

Risk is measured as the probability that you won’t meet your financial goal. Investing should have the exclusive objective of minimizing this risk (emphasis added).”

- From Adaptive Asset Allocation by Butler, Philbrick and Gordillo

Please let me know if you have any questions about your portfolio. I wish everyone a safe and enjoyable holiday season.

Quick Quotes

“The only thing new in the world is the history you do not know” – Harry Truman

“The aggregation of marginal gains: The whole principle came from the idea that if you broke down everything you could think of that goes into riding a bike, and then improve it by 1 percent, you will get a significant increase when you put them all together” – Dave Brailsford

"Life is what happens to you while you're busy making other plans" – John Lennon

Sincerely,

Luke Charbonneau