Is AI driving a market bubble?

As enthusiasm for Artificial Intelligence has driven markets higher, some investors have begun to worry that we’re in a market “bubble”. We agree that sentiment has stretched in some pockets, and point to selectivity and patience as great tools for navigating this market environment.

Lately, markets have advanced with corporate profits, and bond yields have come down. But, market prices may have jumped too much, too soon: the charts below show that US equity valuations (measured here by forward P/E ratios) have reached high levels, by historical standards.

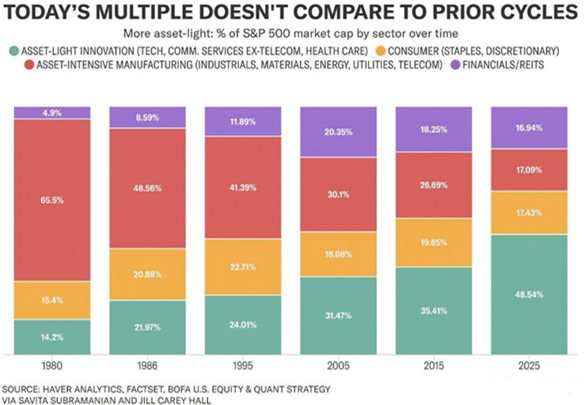

With valuations clearly on the high side, they aren’t crazy, as there’s more nuance to this puzzle. Importantly, many market-leading stocks in the US are of a higher quality (judged by high returns on capital, strong earnings growth, economic moats, asset light, etc.) than market leaders of the past. This means, to some extent, it’s like comparing apples to oranges when we look at today’s market multiple vs. its history.

AI has been a driver of higher market valuations, as it is changing the way we live and work. As a result, there are many blue-chip companies that haven’t fully participated yet, so their stocks remain at reasonable prices – notably in our Canadian market. Today, we believe these are attractive investments.

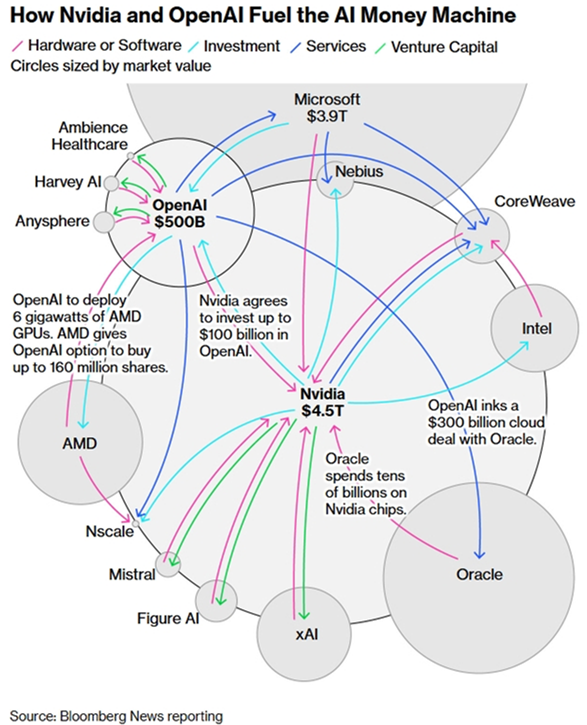

We continue to have select exposure to AI in our portfolios, because we view it as a great long-term opportunity. But, we intentionally limit this, as the “AI trade” may unwind – either from a valuation reset or another, to-be determined risk. One such risk may relate to the “circularity” of cash flows from these AI-related companies, as it calls into question the quality of their earnings. The below graphic, from Bloomberg, illustrates this well:

Caution is warranted at this time, but comparisons to the “dot-com” bubble in 2000 don’t line up yet, in our view. Keep in mind, however, that the markets could turn hard at any time, for any reason. We expect – some day – a market correction, we just don’t know when. So, in good times like this, it’s prudent to prepare for a dip.

Proceed, with caution. While the markets might appear expensive, they aren’t at such extremes that we’re making wholesale portfolio changes. However, there are 3 risk management levers worth highlighting:

-

Re-balancing. We watch for specific chances to trim equity, sector, or individual name holdings to portfolio target weights.

-

Dollar-cost averaging.

-

For “net savers”, continuously investing your savings across time periods is a fine approach through market cycles – you can view market pullbacks as chances to buy shares of great companies, on sale.

-

Meanwhile, for retirees, your portfolio paycheque is built for tough times – we hold plenty of short-term fixed income and cash to insulate your portfolio from a market shock.

-

Portfolio quality. A diversified collection of quality, cash flowing businesses is a tried-and-true way to build wealth across the market cycles. We believe good opportunities remain across our portfolio companies, especially those that haven’t fully participated in AI-enthusiasm.

Please feel free to reach out if you have any questions about your portfolio.

Quick Quotes

“The idea that a bell rings to signal when to get into or out of the stock market is simply not credible. After nearly fifty years in this business, I don’t know anybody who has done it successfully and consistently. I don’t even know anybody who knows anybody who has.” – Jack Bogle

“The hard way is the right way.” – Jerry Seinfeld

“Waiting helps you as an investor and a lot of people just can’t stand to wait. If you didn’t get the deferred-gratification gene, you’ve got to work very hard to overcome that.” – Charlie Munger

Sincerely,

Luke Charbonneau