1. Why Volatility Isn’t The Real Risk

There is a distinction between risk and volatility, and understanding this difference is central to long-term investing success:

-

Risk is the permanent loss of capital, including the slow erosion of purchasing power from inflation.

-

Volatility is simply the day-to-day fluctuations in an asset's price.

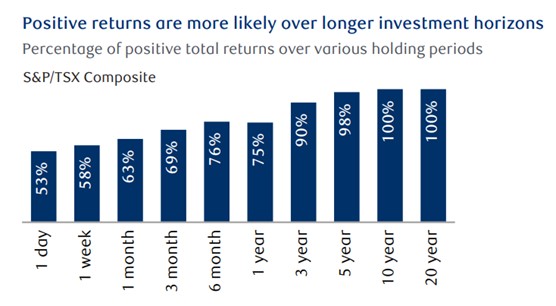

The key takeaway is that an investment’s true risk is closely tied to its time horizon. Over time, a carefully chosen portfolio of high-quality, conservatively financed businesses has rewarded patient investors with real wealth creation. In the short term, however, anything can happen – even the strongest companies can see their stock prices fall when markets decline.

Source: RBC Wealth Management, Bloomberg, data through 06/30/2025

While this volatility makes equities inappropriate for short term needs, they tend to be the safer path to compounding wealth over time. Conversely, cash looks safe at first glance – it rarely moves in value – yet it is one of the riskiest long-term holdings since its purchasing power declines because of inflation.

So, what appears risky in the short term can be safe over decades, and what seems safe in the short term can be deeply risky over time. For thoughtful investors, the real risk isn’t volatility – it’s failing to protect purchasing power. Embracing these short term market swings is the cost of capturing long-term growth.

2. The 4% Rule: A Sustainable Approach

One of the most common retirement planning questions is: “How much can I safely withdraw from my portfolio each year without running out of money?”

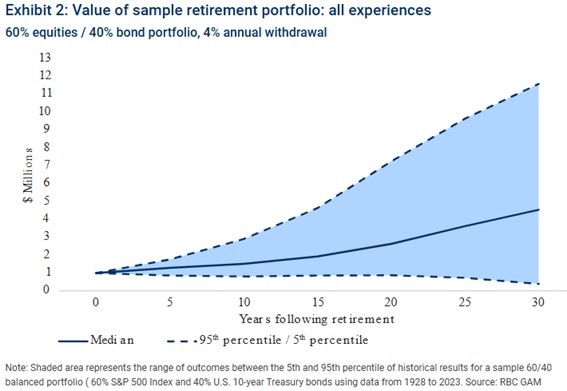

In 1994, William Bengen introduced what is now known as the “4% rule”. His research showed that retirees could withdraw 4% of their portfolio in the first year of retirement, adjust that dollar amount for inflation each year, and expect their portfolio to last at least 30 years.

The principle is simple: to sustain wealth, you must consistently withdraw less that your portfolio earns, on average. Over a multi-decade retirement, 4% has historically been a reasonable and conservative hurdle rate for a properly managed portfolio.

The nuance, of course, is that returns are not linear. Some years are strong; others are weak. This underscores the importance of diversification – across companies, industries, and asset classes – in a retirement portfolio. Notably, having a portion of the portfolio in high-grade, short-term fixed income provides stability, helping to fund your spending needs when the markets are down.

Bengen’s research provides a helpful rule of thumb for sustainable portfolio withdrawal, but the “right” withdrawal number should be personalized in the context of your financial goals and retirement plan. Ultimately, pairing a disciplined withdrawal strategy with a disciplined portfolio gives retirees both confidence and peace of mind for a sustainable retirement income.

3. Quick Quotes

“Invest for the long haul. Don’t get too greedy and don’t get too scared” – Shelby M.C. Davis

“All of humanity’s problems stem from man’s inability to sit quietly in a room alone” – Blaise Pascal

“Nothing in this world can take the place of persistence. Talent will not; nothing is more common than unsuccessful men with talent. Genius will not; unrewarded genius is almost a proverb. Education will not; the world is full of educated derelicts. Persistence and determination alone are omnipotent” – Calvin Coolidge

Please feel free to reach out if you have any questions about your portfolio.

Sincerely,

Luke Charbonneau