Meeting the challenges of a changing world

As the world moved increasingly online during the early days of the pandemic, we helped our clients stay connected by launching new digital tool. This includes our new secure client website and applications to help clients open accounts and sign documents safely from home. We received top marks in a new category, Client Onboarding Tools.

Providing strength and stability in difficult times

Especially during times like these, it's important to have the support and resources of a highly stable wealth management firm. In addition to investing in new digital capabilities, we have continued to invest in our industry-leading wealth management services.

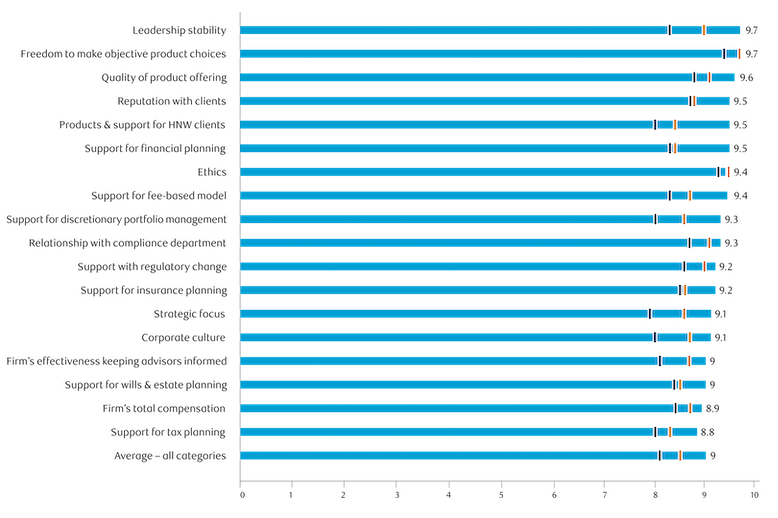

In the report card, we received the highest scores among bank-owned firms in all wealth planning categories, including support for: Developing a Financial Plan for Clients (9.5), Wills & Estate Planning (9), Tax Planning (8.8) and Insurance Planning (9.2). We also led in two key categories important for servicing clients with more complex financial situations: Products & Support for High-Net-Worth Clients (9.5) and Support for Discretionary Portfolio Management (9.3).

See the full set of results listed here:

Top marks in 2021 Investment Executive Brokerage Report Card

Average (bank-owned excluding, RBC DS) Source: 2021 Brokerage Report Card, Investment Executive