The Wealth Management Process

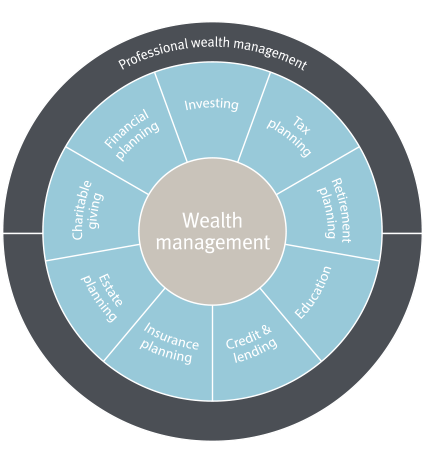

Wealth management extends beyond investment advice and money management, helping you protect your lifestyle, manage your nest egg, plan your retirement and create your legacy. We will guide you and your family through each life stage by helping you understand the various financial issues, concerns and opportunities you face.

Here’s how it works:

Step 1 : Understanding your needs and goals

Our first and most important job is to listen to you and understand your needs and dreams for the future. We will take the time to understand your specific investment goals, such as saving for retirement or financing a business, and the timeframes available to achieve them. In addition, we will consider your return expectations and tolerance for risk. This “discovery process” doesn't end here—as time passes, and your situation changes, we will work with you to ensure that your investment strategy remains current.

Step 2 : Creating your Investment Policy Statement

With an in-depth understanding of your personal situation, we are able to create your Investment Policy Statement. This document provides the framework for managing your financial assets going forward. It clearly sets out your investment objectives, income needs, timeframes, asset mix guidelines, security selection criteria and review process. Your Investment Policy Statement helps keep your investment goals and preferences in clear focus.

Step 3 : Building your custom-designed portfolio

Once you've approved your Investment Policy Statement, we can structure your personal portfolio.

In building a personalized investment portfolio for you, we select from a universe of international investments. This includes:

- Investments for growth, such as Canadian, U.S. and international stocks

- Investments for income, including government and corporate bonds

- Investments for wealth preservation, including guaranteed investments

We also have access to innovative investment platforms, as well as leading-edge investment strategy and research provided by the RBC Investment Strategy Committee, RBC Capital Markets and third-party, independent firms.

You will have a diversified portfolio that conforms to the guidelines and direction you set in advance. This process means you will receive specific, appropriate investment recommendations, and each recommendation will be clear and well thought-out.

Step 4 : Managing your portfolio

The last step in the process is to monitor your progress towards your continued success. We will review your portfolio with you on a regular basis, and recommend appropriate changes to keep you on track. Depending on your individual needs, goals, and circumstances, we will determine if you would benefit from meeting with our professional financial planning experts, will and estate consultants, or insurance advisors to provide even further peace of mind.