I love everything about the TFSA (Tax Free Savings Account) except the name.

It should not be called a “Savings” account, because it opens a bigger opportunity than just putting money aside.

It should be called an “Investing” account.

The ability to invest and grow your money, and never pay tax on the gains, is where the action is.

Why not aim for an 8-10% annualized return and have over $1million in 20 years?

This is an entirely realistic goal. The US stock market has returned that amount compounded over the long term. In the past 10 years, the annualized return has been 14%.

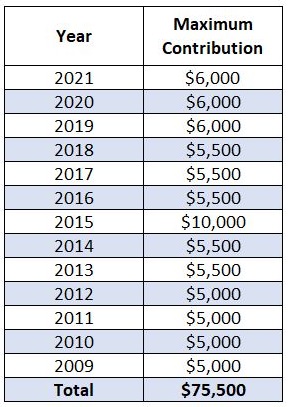

If you have never opened a TFSA, you can contribute up to $75,500 today.

If you maxed out your contribution every year for the last 12 years (the TFSA was introduced in 2009) AND achieved a 9% compounded average return, your TFSA would currently be worth $124,000.

Let’s look ahead and see how these numbers look.

The 2021 contribution room is $6000.

If we assume the CRA raises this amount modestly over time (the contribution limits are indexed for inflation) and you continue to add the maximum every year, in 20 years your TFSA will be worth over $1million TAX FREE!

A big caveat. If you swing for the fences and miss, you can’t put that money back in. So, be diversified to reduce your risk. The Vanguard Total Stock Market ETF (VUN) is a good choice and make sure you reinvest the dividends.

Being smart about how you use your TFSA will give you the best odds of building wealth.

Don’t waste this opportunity.

Lori Livingstone

TFSA Contribution Limits