With financial markets stumbling in the last quarter of 2018, we are glad to see a bounce back to start off the 2019 year. The early year rally has likely been caused by positive fourth quarter earnings, dovish interest rate hike stances in both the U.S. and Canada, and investors anticipating some resolution on pending trade wars. At market close on February 14th, both the S&P/TSX and the S&P500 are in positive territory, year to date.

Our view going forward through 2019 still remains unchanged though, as we see the global economy expanding, but at a slower pace than previous years. It is important for investors to remember that during times of heightened volatility to keep your emotions in check and to avoid making quick knee-jerk reactions, will better serve you over the long term.

In addition to our early viewpoint of the 2019 markets, we believe it is a good time to think about your RRSP and TFSA contributions for this year. Please take a few minutes to read some of our quick tips on RRSP’s and TFSA’s to help you plan accordingly.

Registered Retirement Savings Plan (RRSP)

As we hit the midway point of February, we are approaching the deadline, March 1st, 2019 for making a contribution to your Registered Retirement Savings Plan (RRSP) that can be claimed on your 2018 tax return.

The contribution limit for 2018 is 18% of your 2017 earned income, with a maximum contribution limit of $26,230.

The contribution limit for 2019 is 18% of your 2018 earned income, with a maximum contribution limit of $26,500.

Click here to read RRSP Quick Tips for 2019

Tax Free Savings Account (TFSA)

In addition to your RRSP, you should consider making your 2019 contribution to your TFSA as soon as possible in the calendar year in order to maximize the tax-free growth of your money. In addition the tax-free growth, you are able to make withdrawals from your TFSA without paying tax at any time.

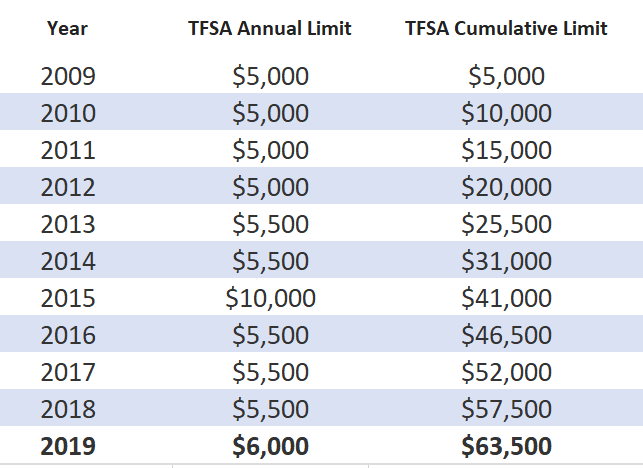

The TFSA limit has increased by $500, bringing the 2019 contribution limit to $6000. This brings the maximum contribution to someone who has never contributed before and has been eligible to $63,500. Please see the chart below with a summary of maximum contributions each year

Click here to read TFSA Quick Tips for 2019