At Hayes Vickers Private Wealth, May is a month that invites reflection. From closing the books on tax season to looking ahead at potential political shifts, it’s a timely opportunity to evaluate your long-term goals and the legacy you plan to build. Legacy and longevity are more than financial concepts, they’re about the values we carry forward, the relationships we nurture, and the impact we hope to leave behind. We believe these ideas are at the heart of every financial plan. As we move through May, it is an ideal moment to consider how your wellness and wealth can support not just your goals, but your story.

Tax Season Reflections

With another tax season wrapped up, many of us are using this time to reflect on how our financial plans are functioning today, and how they could be optimized for tomorrow. Tax time presents a strategic opportunity to improve efficiency, identify trends, and take proactive steps for the year ahead. Whether it’s refining income strategies, planning charitable giving, or managing complex transactions, small adjustments now can lead to meaningful long-term results. To support this process, we recommend the 2025 Handy Tax Planning Guide, a helpful resource from RBC Wealth Management to keep you informed throughout the year. With the 2024 tax season behind us, now is an ideal time to partner with your tax professional and with your team at Hayes Vickers Private Wealth, to turn insight into action.

Market Update

In a welcome turn, the month of May has brought more than just flowers – it delivered a notable shift in global trade dynamics, offering markets a moment of relief amid ongoing economic uncertainty. The U.S. continued to scale back tariff measures and signaled a greater openness to negotiate, marking a shift from its earlier, more aggressive trade stance. The U.S. and China agreed to temporarily reduce tariffs, creating space for broader negotiations. Meanwhile, the U.S. and U.K. reached a limited bilateral trade deal. Although some tariffs remain, the shift signals a more strategic U.S. approach. Lower tariffs overall have helped ease short-term economic risks, though the effective U.S. tariff rate is still at its highest level seen in decades which may contribute to inflationary pressures. There have been few signs of tariff-induced pricing pressures thus far, but they are expected to emerge over the next few months.

Markets have responded positively. U.S. stocks recovered recent losses, supported by strong earnings and investor confidence. However, elevated valuations suggest that future returns may be more modest. While developments on the trade front have improved the economic outlook, the risks have not completely disappeared. Given the heightened level of volatility it is important to stay grounded in a long-term perspective. Our approach is focused on a disciplined investment strategy built around quality, diversification and resilience. We view volatility as an opportunity to reposition and take advantage of dislocations in the market. Even as conditions continue to shift, maintaining these core principles ensure your portfolio is well-positioned to navigate uncertainty and capture long-term growth.

As a reminder, you are invited to join a timely webinar featuring Eric Lascelles, Chief Economist at RBC Global Asset Management, as he shares insights on trade, tariffs, and economic trends, happening Wednesday May 21st at 2pm EST click here to register. If you are unable to attend live, let us know if you would like to receive the recording.

Planning Your Legacy

This month's theme brings moments of reflection on family, personal values, and the long-term impact we hope to leave. Whether you’re thinking about future generations or honouring those who came before, it’s a meaningful time to consider your legacy in the broadest sense. Legacy planning goes far beyond financial matters. It’s about ensuring your wealth reflects your values, that your loved ones are informed and prepared, and that your intentions are clearly documented. RBC Wealth Management offers helpful insights on why it's important to have open dialogue with family members about Estate and Legacy planning. Here's a great podcast about this “Leaving a Lasting Legacy”. As you reflect this month, consider what intentional legacy planning might look like for you and let us know if you’d like to book a meeting to start the conversation.

Even the strongest Financial and Estate Plans need to be reviewed regularly. Family dynamics shift, tax laws change, and personal goals evolve. Taking time to revisit your financial and estate plan can help ensure your plans aligned with your wishes.

At Hayes Vickers Private Wealth, we help guide conversations, including; generational wealth transfers, business succession planning and philanthropy. If you’re exploring strategies like trusts or charitable giving, we’re here to support you with clarity and care. Together, we can review and consider strategies that align with your financial goals and transfer your future estate efficiently. Review this article to learn more about this 'Wealth Transfer Strategy' for individuals and business owners interested in the opportunity to enhance your estate and protect it from taxation.

Wellness & Wealth

May marks Mental Health Awareness month, true longevity isn't about only financial security or physical health, but also about our mental and emotional wellbeing. Prioritizing self-care is essential. Cognitive clarity, emotional resilience and mental focus all play a vital role in our ability to plan for the future, make confident decisions and to live your best life!

At Hayes Vickers Private Wealth, we believe mental wellness is foundation to a strong legacy. That's why we continue to support initiatives like the Women's Brain Health Initiative (IBHI) which promotes brain health for women, caregivers and their families. Building and maintaining habits of the six pillars below are an important form of self-care.

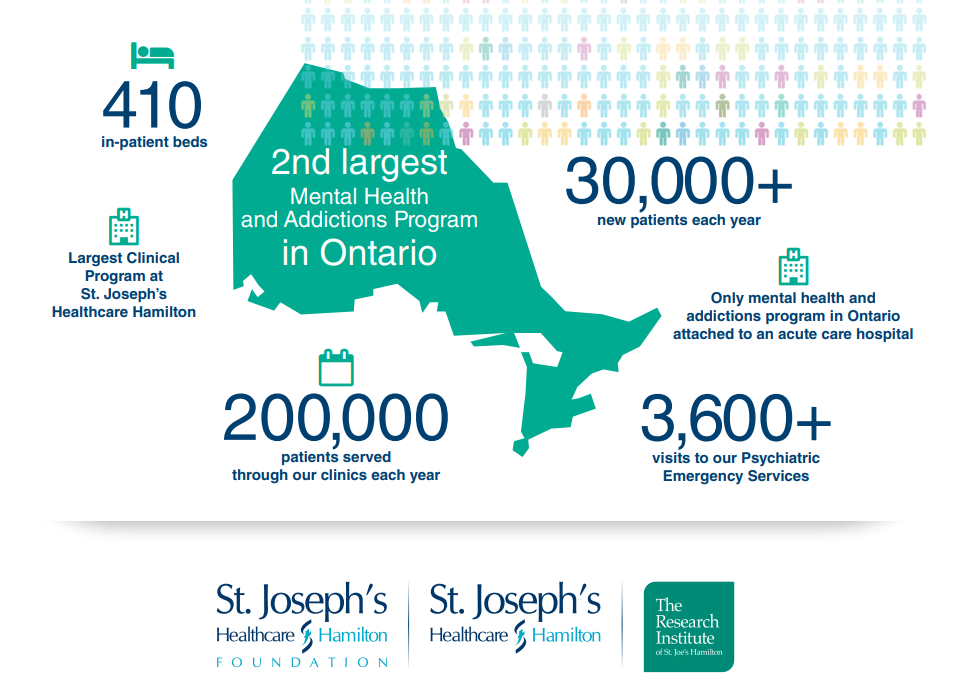

We also proudly support St. Joseph's Healthcare Hamilton, a leader in mental health care research, especially during their campaign honouring Mental Health Week this May. Below is a snapshot of the high quality and compassionate care provided by St. Joseph's Mental Health program.

For more information on St. Joseph's Mental Health Week initiatives and how you can get involved or support their work, please visit St. Joseph's Healthcare Foundation Mental Health page.

Team Spirit and Long-Term Thinking

Last month, two members of our team; Pia and Karly, participated in the Around the Bay race. Their commitment to training, teamwork, and pushing themselves outside their comfort zones was inspiring to all of us. This kind of dedication deeply reflects the themes of legacy and longevity. Whether personal, professional, or financial, meaningful outcomes are built through patience, discipline, and a long-term mindset. Longevity isn’t only about endurance, it is about moving with purpose, staying aligned with your goals, and leaning on a trusted team when the path becomes challenging. We’re proud of Pia and Karly for embodying these values. Their effort reflects the culture we’ve built at Hayes Vickers Private Wealth, consistency, and meaningful progress over time.

Looking Ahead with Intention

Legacy and longevity are built through intentional planning and thoughtful action. As we approach the Victoria Day long weekend, many take time to reset and prepare for the warmer weather. It is also a meaningful moment to reflect on the road ahead. We are here to help you navigate the path forward with clarity and confidence, offering guidance that connects your wellness and wealth to what matters most. If you would like to revisit your financial plan we would be happy to meet and help you align your next steps with your long-term vision.

Hayes Vickers Private Wealth