It's hard to believe we are only in April. It has been quite the year already given the policy shifts and turns undertaken by the U.S. administration. While many of us are “tariff-ed out” at this point, we want to take a moment to reflect on the early impacts of the trade war and how your portfolio is positioned to navigate the turbulence.

In just a few short months, Trump has signed a series of executive orders imposing both broad-based and sector-specific tariffs. At the same time, there has been announcements of delays, carve-outs and exemptions. Several countries caught in the crossfire (Canada, Mexico, China, and the EU) have announced reciprocal tariffs of their own, many of which have also seen postponements.

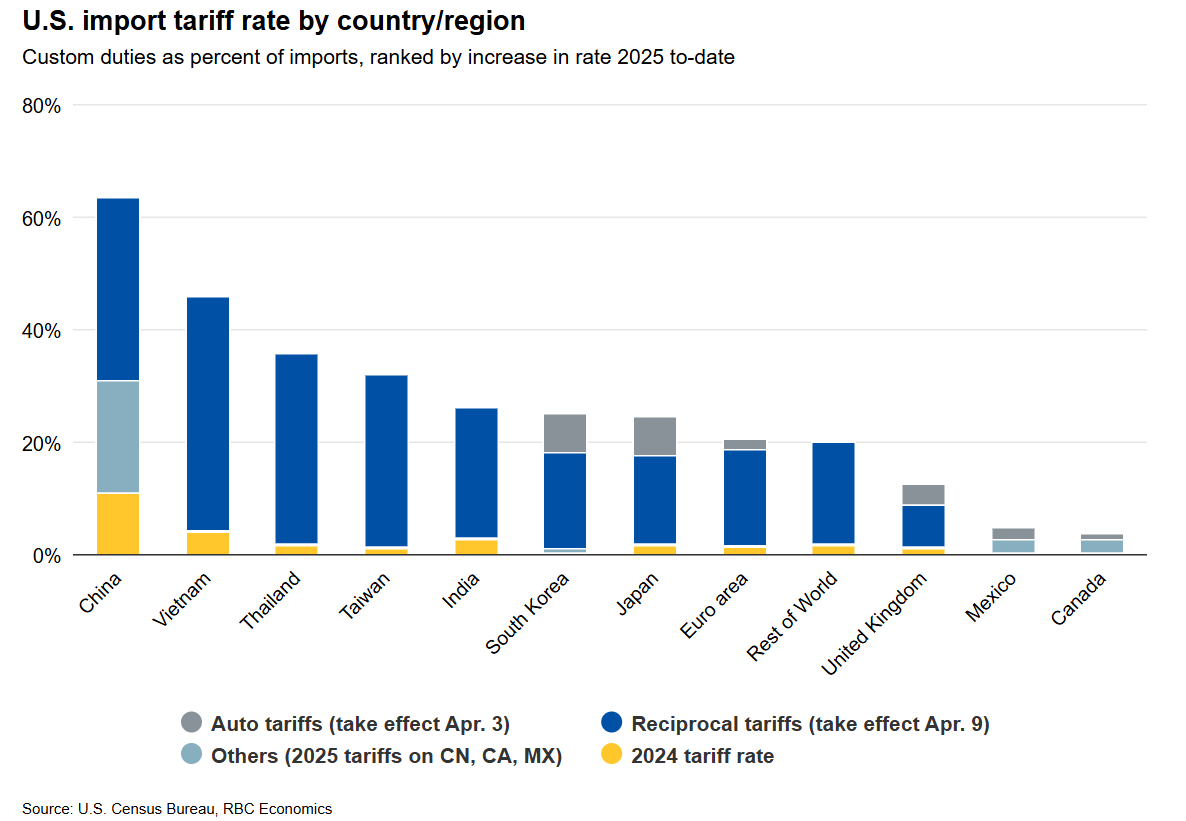

Most recently, on April 2nd, Trump announced a broad package of "Liberation Day" Tariffs. These included a 10% general tariff on all imported goods beginning April 5, with higher rates for certain countries - most notably: 46% on Vietnam, 34% on China, 32% on Taiwan, 26% on India and 20% on the EU. A 25% tariff on foreign-made automobiles is also scheduled to take effect at midnight on April 3rd. While Canada and Mexico have been temporarily exempted through USMCA, Canada will still be impacted by the Auto tariffs and Aluminum and Steel tariffs. Please see the chart below.

RBC Economics' Thought Leadership article U.S. reciprocal tariffs spare Canada/Mexico for now but trade risks remain shares our view that tariff announcements from this administration have often changed after the fact and there is a large possibility these latest measures may shift in the coming weeks. However, if fully implemented, these tariffs could push the US to its highest import duty level in over a century. Although the US economy is less trade sensitive than many of its trading partners, heightened trade uncertainty can create short term pressure in the equity market. That said, such volatility can also lead to pricing dislocations that we, as active managers are able to take advantage of.

Staying the Course: Our Investment Approach

The constant upheaval in policy has made an already uncertain environment even more unpredictable. It's no surprise that this environment is beginning to weigh on consumers, businesses and investors. While market volatility increases we would like to take this time to remind you of our investment philosophy and discipline.

We’re committed to a disciplined, long-term investment strategy that focuses on quality, diversification, and resilience. These principles remain at the heart of how we manage your wealth:

- Stay the Course. Emotional decisions often lead to costly mistakes. On days where the market is falling it is hard to not let emotions steer decision making. Panic selling in volatile times can derail long-term growth. Remember: missing even the best 10 days in the market can have adverse consequences on your long term returns. See: Staying the Course

- Invest in Quality Companies. We continue to invest in high-quality businesses that demonstrate resilience through uncertain environments. These are companies with strong balance sheets, consistent cash flow, durable competitive advantages, and experienced management teams that can adapt to changing economic conditions. Historically, quality stocks have outperformed lower-quality peers during periods of market stress, helping protect portfolios while positioning them for long-term growth.

- Build Portfolios Designed to Cushion the Downside. Our portfolios are built to help mitigate losses during periods of market stress. We structure portfolios to reduce downside participation and preserve capital through quality holdings and prudent risk management. Our US equity model has captured roughly half of the downside when compared to the drawdown of the US market year to date.

- Global Diversification. Exposure to global markets helps reduce reliance on any single region or policy outcome, adding resilience to your overall portfolio. International markets have outperformed both Canadian and US markets over the last quarter, adding a ballast to your equity portfolio. See Going global to diversity

- Maintain a Rebalancing Discipline. After a strong run in equities over the past year, we've proactively rebalanced portfolios to keep your investments aligned with your long term Asset Allocation. This means trimming from equities following a strong run and adding to Fixed income as well as realigning geographical weights. Maintaining a regular rebalance is crucial to achieving long term targets.

Additional Resources:

- Visit the RBC Economic's Trade Hub for timely updates

- Special Report: "Tariffs Bracing for Market Impact" examines the potential market implications of escalating tariff disputes, drawing lessons from the 2018-2019 U.S.-China trade conflict.

- Weekly Update: "Forward Guidance | RBC Economics". RBC’s latest Forward Guidance highlights how the U.S.'s newly announced reciprocal tariffs are casting a shadow over key North American job reports, with Canadian economic activity showing more resilience than sentiment suggests - even as trade uncertainty clouds the outlook.

- Article: "Fighting the trade wars: 3 strategies for investors" by Capital Group (international manager) explains how it’s more important than ever for investors to tune out the noise, maintain a well-diversified portfolio, and stay focused on the long term.

In uncertain times like these, it’s crucial to stick with a disciplined, long-term investment strategy. Reacting hastily to market fluctuations can be harmful to long term growth. Our diversified portfolios are designed to weather a variety of economic conditions, helping protect your financial future.

We will continue to keep a close watch on ongoing developments and share timely updates as new information becomes available. Our team is available to address any questions you may have, so please do not hesitate to contact us at 905.312.2901 or click here to schedule a meeting.

Hayes Vickers Private Wealth