As they say, April showers bring May flowers! The days are growing longer, and the extra sunlight gives us all a little extra energy. Earlier this month we experienced a rare celestial event, the solar eclipse. On April 8th, the solar eclipse captivated observers around the globe, casting a temporary shadow over the sun. Our team went outside with their stylish glasses on to experience this rare event.

Proposed Federal Budget

On April 16, 2024, the Honourable Chrystia Freeland presented the 2024 Federal Budget in the House of Commons. One of the proposed measures announced in the Budget is an increase to the capital gains inclusion rate for individuals, corporations and trusts. With tax efficiencies playing an important part in building your wealth advantage, you may be wondering how these proposed changes will impact you.

The following proposed changes will take place on June 25 2024:

For individuals, any capital gains realized up to $250,000 will be taxed at an inclusion rate of 50%. Any capital gains realized above this threshold of $250,000 will be taxed at an inclusion rate of 66.67%.

For Corporations and Trusts, any capital gains realized will be taxed at an inclusion rate of 66.67%. There is no $250,000 threshold for corporations and trusts.

For a more in-depth look at how things will effect you on an individual and on a corporate level, we're pleased to share some resources with you:

-

Planning for the proposed increase to the capital gains inclusion rate, which outlines what’s known about the proposed changes at this time, as well as providing an example how this may effect you.

-

2024 Federal Budget Webinar - offers an overview of the proposed capital gains inclusion rate and planning considerations 2024 Federal Budget

-

Last week, we shared a few highlights of the 2024 Federal Budget summarized in this blog

Market Update

The past few weeks have seen an increase in volatility across all sectors of the markets due to a significant shift in U.S. interest rate expectations and heightened geopolitical tensions in the Middle East. From a market standpoint, the most influential developments have been on the inflation and interest rate fronts so we will expand on those below.

The U.S. inflation data for March showed that, for a third month in a row, the pace of inflation in the U.S. was no longer easing as it had for most of last year, and in some areas was reaccelerating. The stubbornness of inflation pressures presents a dilemma for the U.S. Federal Reserve, which had earlier expressed growing confidence that it would be able to cut rates at some point this year. Over the past few weeks, the tone has changed, with several Fed officials acknowledging a need for patience before taking any action on rates. Consequently, markets expectations have also changed dramatically from anticipating up to seven interest rate cuts in the U.S. just a few months ago, to now expecting as few as one to two. This recalibration has driven bond yields higher and stock markets lower as investors digest the prospect of prolonged higher rates potentially affecting growth and corporate earnings. The article Don’t fight (or fear) the Fed highlights why we believe the fed is often misunderstood, the high cost low rates can carry and that there is nothing to fear about an economy that can function on higher interest rates.

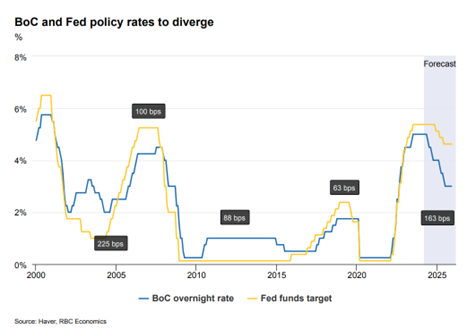

Meanwhile, in Canada, the Bank of Canada may not be able to keep rates higher for longer. There is a growing view that central banks in Canada and other regions may start cutting rates by the summer. The Canadian economy is underperforming global peers (in particular the US) which means the BoC may have to start cutting rates earlier and faster than the Fed. Please see the chart below for updated overnight forecasts from RBC Economics. This divergence would also lead to a widening of the differences between interest rate levels across the regions, which has traditionally been a driver of currencies.

We haven’t been surprised by the shift in interest rate expectations described above and it does not fundamentally alter our investment outlook. Higher bond yields have improved the return potential for bonds, providing us with a more useful tool while reinvesting maturities in client portfolios. We also believe equities will face a range of outcomes over the next few years that is a bit wider than normal but it is clear that the U.S. economy has demonstrated less sensitivity to interest rate increases which provides support for the equity markets. Having said that, we continue to monitor the macroeconomic backdrop and have been active in managing asset allocation positioning in portfolios.

Financial Health

As April draws to a close and tax season is behind us, now is a good time to review your financial plan. Building your financial plan is a journey that requires discipline, patience and a long-term perspective. By setting clear goals, diversifying your investments, we work with you to understand what is important to you. Please let us know if you have any questions or would like to review yours.

We hope that everyone has the opportunity to enjoy the sunshine this weekend!

Hayes Vickers Private Wealth