As we step into the month of March, we're excited to bring you fresh insights and updates from the Hayes Vickers team.

Celebrating International Women's Day

Today marks International Women's Day. The day marks a global celebration of the social, economic, cultural and pollical achievements of women. We recognize the invaluable contributions of women in shaping the financial landscape and our communities. In honour of IWD, we're shining a spotlight on the remarkable women that inspire us every day. The Ancaster team is hosting a Women's and Children's Clothing Drive in support of Good Sheppard. The Good Shepherd provides critical support for our community's most vulnerable. Their services range from emergency food/clothing and community mental health programs to daily hot meals and emergency shelters. We believe that investing in women, we create a better world.

In the Community

Last weekend, Kieron and Nicky spent a wonderful evening supporting Hamilton Health Sciences Foundation at this years "Pump Up the Volume" gala. HHS provides care and research not only in our community but throughout South-Ontario. HHS is dedicated in securing vital funding to enhance patient care and well-being. Kieron and Nicky enjoyed their evening and look forward to supporting HHS for the years to come.

Market Update

Global equity markets have trended higher in recent weeks, maintaining their strong start to the year, with performance in all regions notably stronger. Investors have been focused on the employment picture and recent comments from the Bank of Canada and the U.S. Federal Reserve. Both institutions have reiterated the need for patience, awaiting further evidence that inflationary pressures are contained.

A key factor behind the equity market's strength lately has been earnings results. The “Magnificent Seven” technology-centric stocks, which make up nearly 30% of the U.S. S&P 500 index, have been crucial to driving the market’s overall earnings growth due to their sheer size and influence. In this perspectives article we highlight some key differences between the tech bubble 24 years ago and todays' AI-led rally.

During this earnings season, comments from management teams have been generally positive with respect to consumer demand, although several noted consumers’ growing sensitivity to prices. Many companies highlighted robust economic indicators, such as high job creation and low unemployment claims. In their view, this suggests consumers can continue to spend, albeit with budgets strained by inflation.

As we look to the rest of 2024, earnings growth is expected to pick up. Analyst estimates suggest an earnings growth rate of nearly 9% for the year. And unlike the past year, this growth is anticipated to be more broadly distributed across various companies, not just the “Magnificent Seven”. This more evenly distributed earnings growth would be a welcome development, but this outlook is predicated on several assumptions: consumer and business demand that remain resilient and potentially improve, a deceleration in inflation, and lower interest rates.

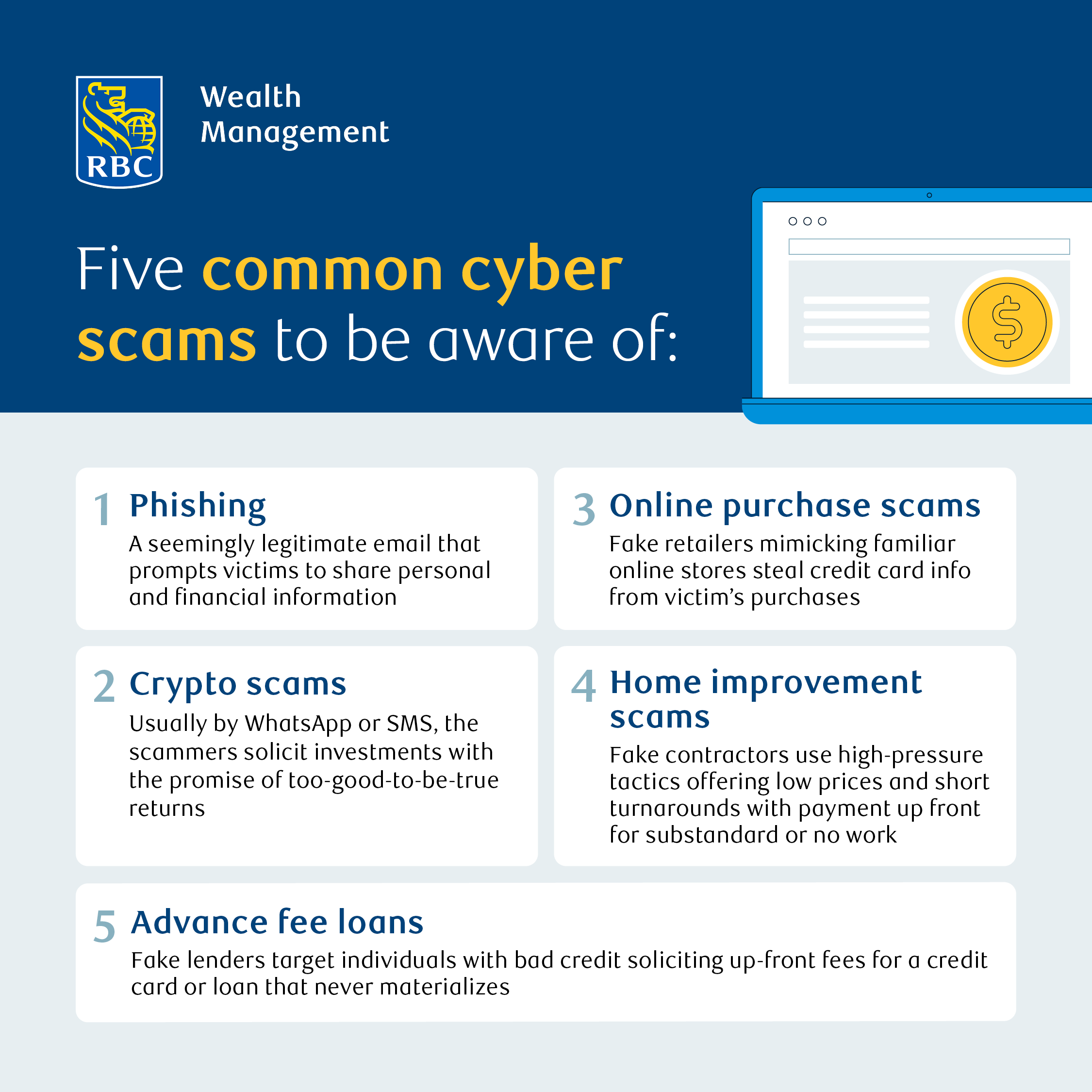

Cyber Security Month

In today's digital age, safeguarding your personal and financial information against cyber threats in paramount. This March, marks the 20th anniversary of Fraud Prevention month in Canada. In the past decade, technology has completely transformed the criminal landscape, making fraud easier to commit, more widespread, and more sophisticated than ever before. And while none of the most "lucrative" types of fraud are particularly new concepts, changes to the way Canadians spend their time and new methods of deliver have made us more susceptible to certain types of fraud. Below are the five most common types of cyber scams. If you have any questions about your security, please let us know.

Wishing everyone a safe and happy weekend,

Hayes Vickers Private Wealth