It’s not just the all-important monetary and fiscal stimulus programs that have been driving the U.S. equity market lately, or even the improvement in economic data.

The latest part of the rally has some meat on the bones.

As the S&P 500 has pushed back up near its all-time high reached last February, the market has been driven by better-than-feared profits and revenues, and an upward shift in earnings estimates not only for next quarter but also for the full year and 2021.

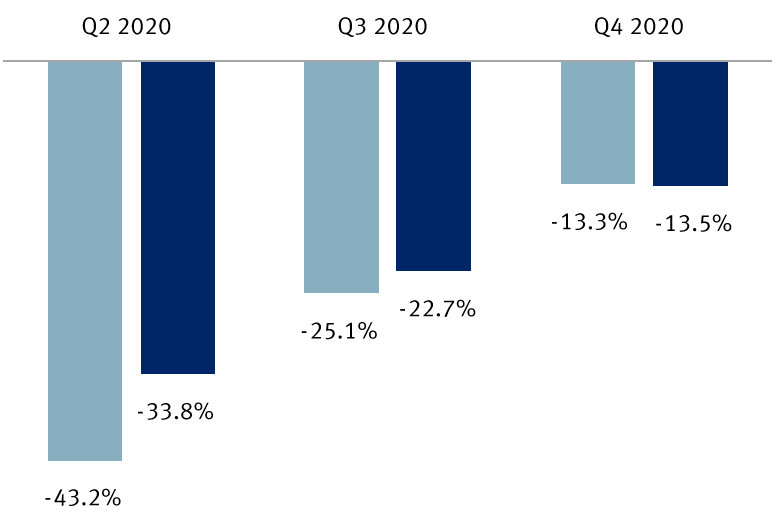

U.S. earnings estimates have moved in the right direction

S&P 500 consensus earnings growth by quarter: Previous vs. current forecast (% change year over year)

Estimate on June 30

Estimate on Aug. 12

Source - RBC Wealth Management, national research correspondent, Refinitiv I/B/E/S

Finding some footing

Heading into the Q2 reporting season, expectations were low. The consensus forecast was for a deep 43 percent decline in earnings compared to the same period a year ago—a Grand Canyon, of sorts.

While a big profits hole is still there, some positive developments have transpired:

- The percentage of earnings “beats” in Q2—those companies that have exceeded the consensus forecast—has wildly exceeded norms. With about 90 percent of companies having reported results, 81 percent have overshot profit estimates. This is much higher than the 65 percent long-term average. As a result, the Q2 slide in earnings is now pacing at about -34 percent instead of -43 percent.

- Q2 revenue beats have also been strong, at 63 percent.

- While management teams are still guarded with projections for future quarters, more issued formal estimates than were expected, and the guidance was largely positive. This helped push up the Q3 consensus forecast.

- 2020 earnings estimates for eight of 11 sectors have improved. The biggest positive percentage point change occurred for Consumer Discretionary, Health Care, and Financials—three important sectors.

- S&P 500 annual profit estimates for 2020 and 2021 pushed higher rather than lower.

2020 earnings estimates have improved for 8 of 11 sectors

S&P 500 and sector consensus earnings growth for 2020: Previous vs. current forecast (% change year over year)

| Estimate on June 30 | Estimate on Aug. 12 | Difference | |

|---|---|---|---|

| S&P 500 | -23.6 | -20.4 | 3.2 |

| Consumer Discretionary | -59.4 | -49.4 | 10.0 |

| Health Care | -1.6 | 3.3 | 4.9 |

| Financials | -36.5 | -32.2 | 4.3 |

| Materials | -20.3 | -17.2 | 3.1 |

| Energy | -108.6 | -105.5 | 3.1 |

| Information Technology | -0.6 | 2.5 | 3.1 |

| Communication Services | -16.8 | -14.2 | 2.6 |

| Consumer Staples | -3.7 | -2.2 | 1.5 |

| REITs | -9.7 | -11.0 | -1.3 |

| Utilities | 1.6 | 0.2 | -1.4 |

| Industrials | -52.8 | -55.4 | -2.6 |

Source - RBC Wealth Management, national research correspondent, Refinitiv I/B/E/S

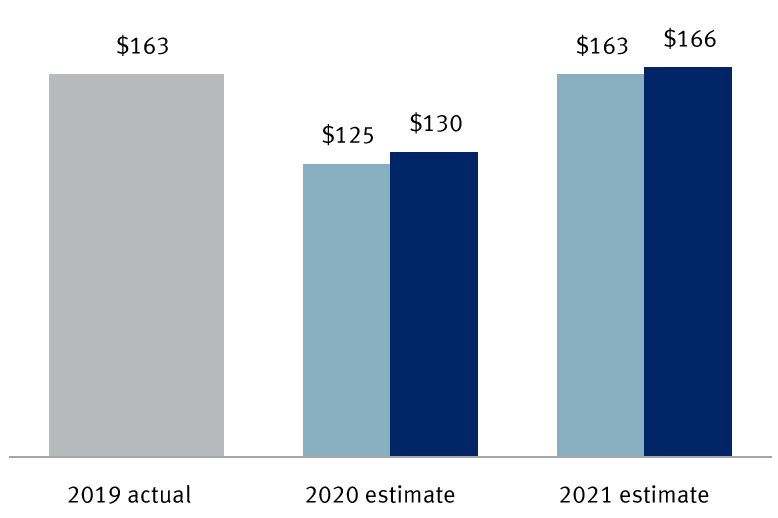

Annual EPS estimates have pushed higher, not lower

S&P 500 annual consensus earnings per share (EPS): Previous vs. current forecast

Estimate on June 30

Estimate on Aug. 12

Source - RBC Wealth Management, national research correspondent, Refinitiv I/B/E/S

Future perspective

We find the upward movement in 2021 S&P 500 profit estimates to $166 from $163 per share particularly interesting.

First, it catches our attention because 2020 is increasingly being viewed as a “lost year” for profits due to the COVID-19 shutdowns. The “less bad” Q2 results and revisions for Q3 indicate that the upwardly revised 2020 consensus forecast of $130 per share has some potential to move higher.

This is all well and good. But at this point on the calendar, even if the COVID-19 shutdowns and a recession had not occurred, heads would naturally turn toward the profit scenarios for next year. That’s just how “the market” thinks—it looks forward, not backward. 2020 results are almost yesterday’s news.

Second, the higher 2021 forecast strikes us because the sentiment among many market strategists heading into this reporting period was that this estimate was at risk of heading down, not up. This is because of elevated economic risks associated with the recovery in the wake of a pandemic. Just the opposite occurred—the 2021 estimate inched up.

The sticking point

Certainly, the $166 per share consensus forecast for 2021 would be at risk if the economic recovery stalls or additional COVID-19 shutdowns suffocate growth. We think it’s too soon to etch that estimate in stone because there are legitimate economic headwinds.

RBC Global Asset Management Inc. Chief Economist Eric Lascelles believes it will take until mid-2022 for the U.S. economy to get back to where it was before COVID-19, and until early 2024 to sop up the excess economic slack.

But we think the positive earnings and revenue trends in Q2, along with the upward revisions to Q3 and 2021, signal that a wider range of earnings possibilities should be considered, including more optimistic outcomes.

On the low end of the range, our strategists estimate earnings of $149 to $155 per share for 2021. We think there is upside potential to these estimates, stretching to the $165 consensus level and perhaps even a bit higher if earnings in the next couple quarters exceed expectations.

The market’s lofty valuation remains a sticking point. Even if 2021 earnings were to exceed the consensus forecast, the market’s valuation would still be stretched.

For example, if we use a wide earnings range for 2021 with $150 on the low end and $170 on the high end, the S&P 500 valuation would range from 19.8x to 22.5x, which is still well above the long-term 15.0x average.

Yes, there are multiple reasons to justify a high valuation, in our view: ultralow interest rates that seem entrenched, ultra-loose monetary policies, earnings and economic growth have troughed and seem set to improve, lack of investment alternatives, etc. Even so, such elevated valuations are hardly compelling.

The bottom line is: Corporate and market fundamentals are moving in the right direction, along with the economy. But the market’s valuation already reflects it.

Non-U.S. Analyst Disclosure: Jim Allworth, an employee of RBC Wealth Management USA’s foreign affiliate RBC Dominion Securities Inc. contributed to the preparation of this publication. This individual is not registered with or qualified as a research analyst with the U.S. Financial Industry Regulatory Authority (“FINRA”) and, since he is not an associated person of RBC Wealth Management, may not be subject to FINRA Rule 2241 governing communications with subject companies, the making of public appearances, and the trading of securities in accounts held by research analysts.

In Quebec, financial planning services are provided by RBC Wealth Management Financial Services Inc. which is licensed as a financial services firm in that province. In the rest of Canada, financial planning services are available through RBC Dominion Securities Inc.