The recent rocky ride in the markets has been in the news a lot, so we feel that a little context might be beneficial for some as we head into the Holiday season. Please see below for our outlook for 2019, along with a timely commentary from our Market Strategist.

As always, I am happy to chat with anyone who is interested in more information on any of the below topics. Please feel free to share with anyone who might find the below to be of interest.

Happy Holidays everyone! We are extremely grateful to have such a great group of clients to serve. May the new year bring you peace, joy and happiness.

Sincerely,

Julien Moisan

Investment Advisor

Market Commentary

With equity markets hit by a fresh surge of volatility, vigilance is the watchword for the late-cycle period. We look at several inflamed pressure points and the appropriate posture to take toward equities as the market works through these challenges.

While there have been a number of issues fueling the correction since early October, concerns about U.S.-China tensions have been toward the top of the list lately. Equity markets, especially in the U.S., have also been preoccupied with the further flattening (and partial inversion) of the Treasury yield curve. Ongoing Brexit uncertainties have also been a factor.

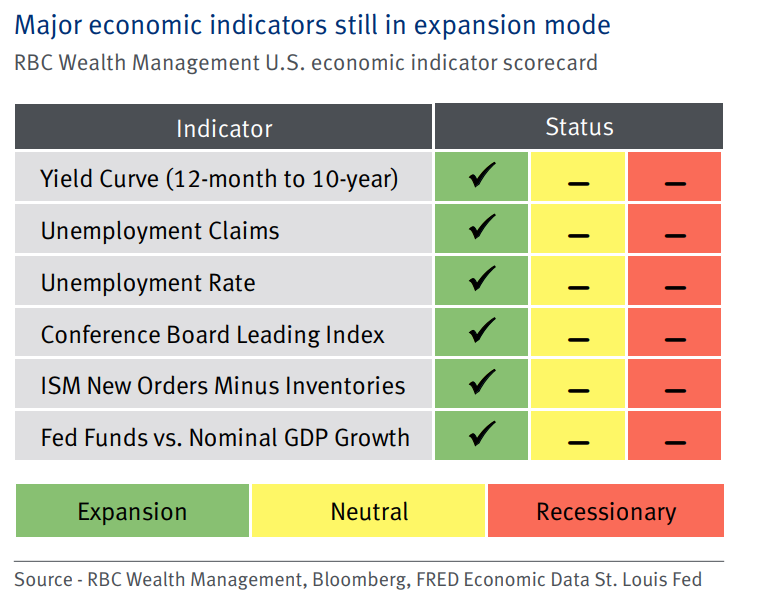

Underpinning each of these issues is the potential impact on the U.S. and global economies and related recession risks. Even though our key forward-looking indicators continue to flash green, it is late enough in the business cycle for these risks to warrant investors’ attention.

The correction has frayed investors’ nerves and could persist, however we don’t think it’s heralding the demise of the bull market. The U.S. economy remains in gear, and with valuations nearing a sweet spot we remain comfortable holding a Market Weight position in equities.

The correction has frayed investors’ nerves and could persist, however we don’t think it’s heralding the demise of the bull market. The U.S. economy remains in gear, and with valuations nearing a sweet spot we remain comfortable holding a Market Weight position in equities.

For more info on our late-cycle positioning and monitoring of these concerns, please see our Global Insight Outlook for 2019.

For our clients who are somewhat nervous at the recent volatility in the market, we remind you that our process involves carefully selecting well capitalized companies that have strong management and track record. This gives us a rather conservative portfolio to begin with, and our system affords us an easy ability to lower our Equity positioning to “underweight” if necessary. Our long-term view remains constructive for the time being, but we do keep a close eye on conditions. We will make appropriate changes to our portfolios if necessary.

Coping with the correction

On December 17th, our Global Portfolio Advisory Committee shared the following timely commentary titled Coping with the correction, in which they discuss current conditions and the different indicators we are watching closely.

Perspectives – Business Owner Special

In our recent Perspectives publication, we have a business owners’ special in which several interesting articles appear. See below for some examples of topics discussed.

In our recent Perspectives publication, we have a business owners’ special in which several interesting articles appear. See below for some examples of topics discussed.

- 8 Essential questions that should be asked when drafting a Shareholders’ Agreement.

When several parties are working together in a business, whether as a partnership, incorporated company or any other type of formal business venture, the parties can enter into a contractual agreement that would govern their relationship. In the case of a corporation, this contract would be referred to as a shareholders’ agreement.

While it is not mandatory to have a shareholders’ agreement, it can streamline the management of the business and provide guidance to shareholders at specific points during the lifetime of the business.

- Minimize tax and maximize your business sale.

There is a variety of reasons for deciding to sell your business — from retirement, to a new business opportunity, to an unsolicited offer. Whatever your reason for selling, it’s important to realize that the tax payable on the sale could be the largest one-time expense you will ever have to pay. Assuming you are planning an external sale and not transferring or selling the business to family members or management, there are a number of Canadian tax strategies you can consider.

The tax-planning article discusses the 4 stages in which strategies can help minimize the tax you pay, while maximizing the total value of the business for sale.

- What’s your business worth?

For business owners who may be looking to exit their business in the not-too-distant future, which, according to a recent study may be more than 40 percent of Canadian entrepreneurs, determining the value of the business is a very important step to take. And while this holds especially true for owners who may be planning their retirement and who intend to sell their business to provide a source of funds, having a clear idea of your company’s value is crucial in other situations as well.

The section on Business valuation is available in this month’s Perspectives magazine.