Key Takeaways

- The headline saving numbers in the past few months are likely masking consequences for the future

- Mortgage deferrals that are coming up in the next few weeks will be an excellent test for the economy

- It's an opportune time to evaluate and update each of our investment strategies and objective

- Another technology company is once again the most valuable in Canada

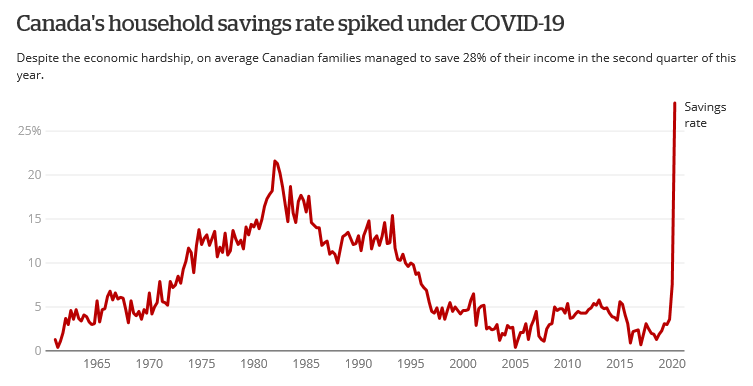

Since COVID-19 struck, one of the perhaps unintended personal finance consequences that at first glance might be viewed as a favourite is a seemingly unexpectedly better household debt picture. Statistics Canada reported this week that the debt to disposable income ratio fell to 158% in the three months between April and June, compared with a reading of 175.4% in the first three months of the year. That means that Canadian households owed $1.58 for every dollar they had to spend as of the end of June. That ratio peaked at 177% in 2017 and has held steady in the 170 range until the sudden drop this year.

While it's encouraging to think that Canadians are managing to pay down their debt loads during the pandemic, like many things in life, the devil is in the details. This debt numbers might be misleading about what's happening beneath the surface. Most of Canada's household debt comes in the form of mortgages, but Canadians also owed $779.4 billion on credit cards at the end of June. Personal insolvencies came to a screeching halt starting in March. Part of that was because courts shut down, making it hard for debtors to take legal action to get their money back. On the other side, the massive wave of support programs rolled out by governments across the country indeed, for now, have had the effect of keeping peoples' heads above water. While the record number of layoffs made a dent in incomes, many people who were in trouble before COVID-19 got some relief simply because they weren't spending as much.

By way of example, as daycares shut down and parents moved to work from home, for the most part, all of a sudden, people weren't paying thousands of dollars a month in daycare. Discretionary spending on things like restaurants, clothes, travel has also gone down. In many instances, some families were receiving benefits they wouldn't have had prior. Indeed, anecdotally, I often hear the refrain: "I'm spending way less" So the lockdown has to lead to more savings for some Canadians.

In addition to government stimulus, roughly one out of every six Canadian homeowners with a mortgage applied for programs that banks offered to defer all or part of payments for up to six months this spring. But those programs are slated to end in the coming weeks, and those bills have to be paid. I have had a few clients that went through this process: mortgage payments were easily put on hold, with a simple conversation with a banker, no paperwork required. All these mortgages are being turned back on (with accrued interest tacked on) shortly.

Here is a graph of the savings rate spike:

It's probably not unreasonable to expect headlines that speak to an increase of bankruptcies and insolvencies this fall and winter.

All told, Canadians owed $2.3 trillion at the end of June, which consists of $1.5 trillion worth of mortgages and $779.4 billion worth of consumer debt such as credit cards.

Of course, there are caveats to this, as the debt picture is uneven across different income groups. The lowest 20% of wage earners had a debt to income ratio of 281% at the end of 2019. Those in the top 20%, meanwhile, owed just $1.38 for every dollar of disposable income.

I'm still as an investment advisor, assessing the total hit to the economy of all of this and what the subsequent recovery looks like. For each of my clients, I am going through their current and anticipated future income requirements, and making sure your investment objectives and allocations are realistic and appropriate as we advance. I will continue to have these planning sessions with each of you this fall.

On a separate note, while technology companies will continue to be an essential component of investing in the future, I thought I would share this exciting fun fact: Shopify this week became the most valuable company in Canada, passing Royal Bank for the moment. Everything goes in cycles. Blackberry, remember when it was called Research in Motion, and the President of the U.S. at the time, Barack Obama, had to get a national security clearance to use his cherished Blackberry device. In 2005 RIM was the most valuable company in Canada, surpassing Royal Bank (again). It is incredible to look back and be reminded that Obama was the sitting President in the U.S. to use email!

Finally, I don't' think I've been successful in my sports predictions very much, but this week, the U.S. Open held at a venerable course in NY: Winged Foot. Rory McIlroy is going to emerge as the winner.