Good Afternoon Everyone, I hope you had a great Easter long weekend and are settling in to watch the Masters - one of my favorite weekends of the year.

I must admit, after an event-filled last 12 months (COVID-19, US election, COVID-19...) it feels like there is less to be pessimistic about these days. That said, I still seem to have many conversations where people are less than trusting of what's occurred in the markets and economy. I can assure you however, while the market has recovered completely from the COVID-19 fallout, there is likely more upside to come over the medium and long term. The US economy which has direct influence on our economy is reporting strong numbers in jobs, housing, and manufacturing. All things that have a large influence on the healthiness of the economy. Closer to home, commodities (oil, copper, lumber, iron ore, etc.) are very well bid which is something we haven't seen for the better part of 7 years. I think there is a reason to be optimistic right here in Central Alberta as well.

Topics of Discussion

- Fundstrat - A vaccine update - the US leads North America

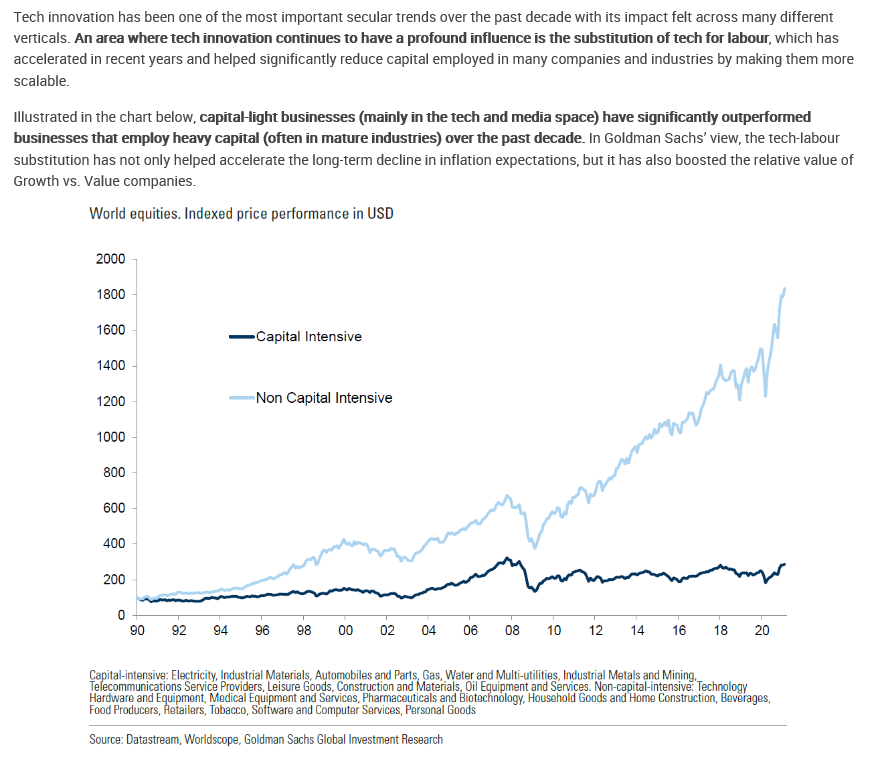

- Performance of technology companies - capital intensive companies vs non-capital intensive companies (technology)

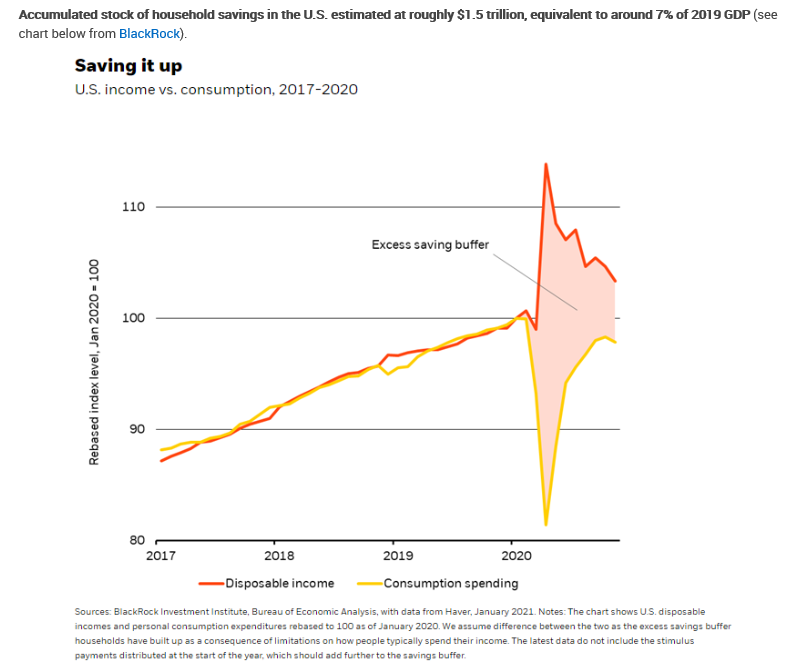

- Income vs consumption in the US - the savings rate is undeniable

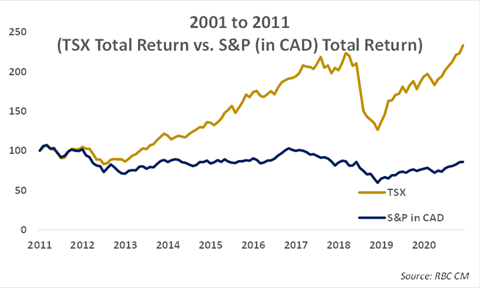

- The beginning of the turn? Canadian vs US market performance (2001-2011 & 2012-2020) What will 2021-2030 look like?

- Historical market performance in the second year (2021) of market recoveries

- US small business is recovering

Fundstrat - A vaccine update

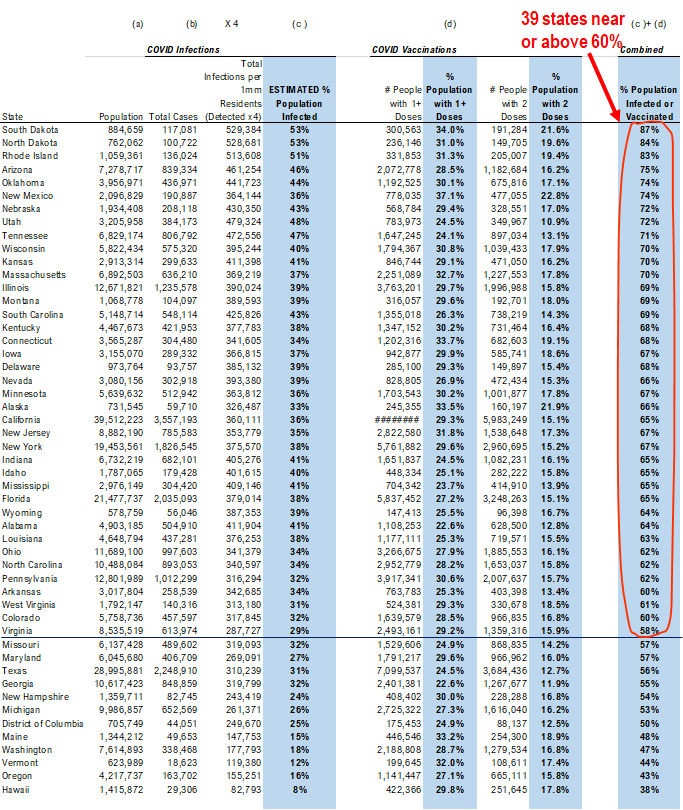

I don't think it comes as a surprise to anyone that the US leads in the manufacturing and administration of the COVID-19 vaccine in North America. Below is last week's update from Fundstrat on their interpretation of where US vaccinations are at. There are several states with >60% of their population either formerly infected (carry the antibodies) or have had their first dose of the vaccine. I am by no means an expert in the area, but this does point toward a continued opening in the US. Even over the weekend, several more states reduced their restrictions and the travel & service economies should continue to slowly thaw.

Point 2: Vaccine: 39 states (+1 from last Thursday) near ~60% infected + vaccinated...

Current Trends - Vaccinations:

Vaccinations ramping steadily

- avg 2.7 million this past week vs 2.5 million last week

- overall, 15.4% fully vaccinated, 28.0% 1-dose received

Vaccination frontier update - 39 states now near or above 60% combined penetration (vaccines + infections)

Below we sorted the states by the combined penetration (vaccinations + infections). As we commented in the past, the key figure is the combined value >60%, which is presumably near herd immunity. That is, the combined value of infections+ vaccinations as % population >60%

- Currently, 39 states (see below) are basically all at this level

- SD, ND, and RI are now above 80% combined penetration (vaccines + infections)

- So slowly, the US is getting to that threshold of presumable herd immunity

Source: CDC and Fundstrat

Source: CDC and Fundstrat

Performance of technology companies

Below is a chart that says a lot. Over the last year, the best performing companies in the stock market have generally been technology companies. While many of us may have thought this was a "stay at home trend", one can clearly see that the stock performance of technology companies has been pronounced for ~30 years. As many of you have heard me say, inflation is not a foregone conclusion after trillions of dollars of stimulus. I wouldn't disagree that inflation is "likely", but automation and technology are clearly deflationary forces.

Income vs consumptions in the US - the savings rate is undeniable

Again, another chart below that is a little mind boggling (yes, that is a formal financial term). Many people I talk to wonder what the state of the consumer looks like - "people must be heading toward bankruptcy in large numbers". I think it's actually quite the opposite. Sure there are unemployed people that are in precarious positions, but that has always been the case. And if you were a functioning member of the economy before this pandemic, you'll likely come out in good shape. As one fund manager I follow recently stated on a call, "the consumer has never come out of a recession in such good shape". As per below, there are plenty of savings out there and a large portion will be spent in the economy as people become more comfortable we're through this and are able to travel.

The beginning of the turn? Canadian vs US market performance (2001-2011 & 2012-2020). What will 2021-2030 look like?

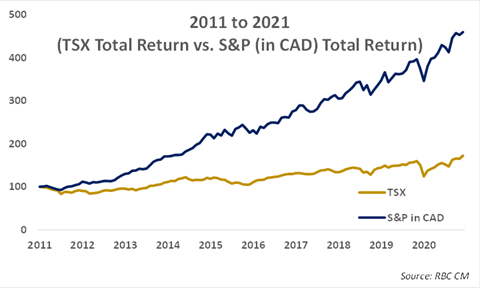

The last 10 years (2011-2021) has seen very strong relative performance of the US equity market over our own TSX - this can be seen by chart below on the right. The TSX is the mustard line while the S&P500 (one of the most followed US indexes) is the blue line. Clearly it doesn't take a PhD in economics to conclude "own more blue and own less mustard". Conversely, many of us will remember the hay days of the 2000's. Business was good for many of us and by no surprise, the left chart illustrates how the Canadian market outperformed the US market. Now there is no "dinner bell" for us to know when to come back to the table, but one could reasonably think that the next 10 years might look different again. Many of us are pessimistic on Canada and what's transpired over the last decade, but we may be early in a better economic outlook going forward. Of course, this is investable in your portfolio and something we follow closely. You can rest assured when we feel confident the tide is turning we will adjust the portfolios accordingly.

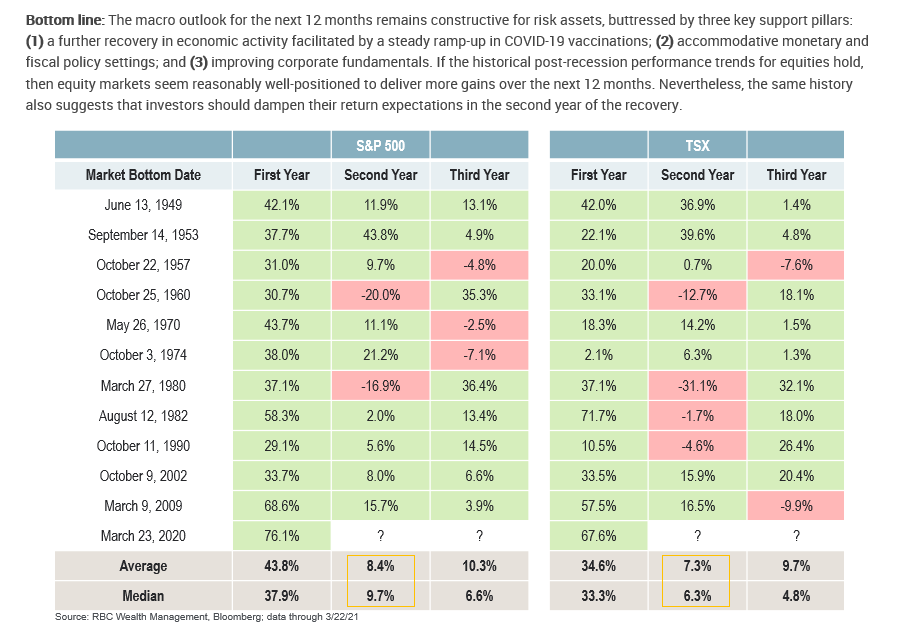

Historical market performance in the second year (2021) of market recoveries

The chart below highlights the market performance for equities during the first, second and third year after a market bottom. We now know (we didn't then), that March 23,2020 was the bottom. So we're now entering the second year after a bottom. While the second year is not as favorable as the first year historically, on average it is still very good.

US small business is recovering

US small business is recovering

Lastly, as mentioned above, many people are still pessimistic around the economy and outlook. Per below, small business sales in the US have not been higher in a year. While this makes sense to us as things open up (n\more in the US than Canada), it is nice to see it in one snapshot. It is especially constructive to see service sales coming up so strong as this represents a large swath of the North American economy. As sales come back, jobs will come back which will lead many people to spend some of that savings we saw in the third chart above.

While the trend in the market is never linear and we will have some downside volatility throughout the year, I believe we should feel confident that economies around the globe are getting better - some quicker than others. No doubt it will help us here in Canada that the US is right next door and is likely starting to fire on all cylinders.

As always, thank you for your trust and business. Our practice is growing so if you'd like to share this with someone you think would enjoy it, please feel free.

Take care and we'll chat soon,

John

Vice-President, CIM

Portfolio Manager & Wealth Advisor