Below is a list of companies in Canada and the United States that have increased their dividends in the month of April.

The companies we list are not the complete list of companies that have increased their dividends in Canada and the United States or the rest of the world however, they are companies we follow or own.

US Companies

| Company | Previous ($) | New ($) | Change (%) |

| Costco Wholesale Corporation | 0.90 | 1.02 | 13.3 |

| IBM | 1.65 | 1.66 | 0.6 |

| Johnson & Johnson | 1.13 | 1.19 | 5.3 |

| Kellogg | 0.59 | 0.60 | 1.7 |

| Procter & Gamble | 0.9133 | 94.07 | 3.3 |

| Sysco | 0.49 | 0.50 | 2.0 |

The dollar value listed per share represents a quarterly dividend payment.

Information was obtained from the companies directly.

History of Costco Wholesale Corporation

Costco Wholesale recently increased their quarterly dividend by 13.3% from $0.90 to $1.02. With this dividend increase, the company now pays an annual dividend of $4.08 per share to their shareholders. Costco started paying a dividend in 2004 and has been rewarding their shareholders with a growing dividend ever since. In addition to their regular payout, Costco is known for their history of paying a special dividend.

Special dividends are ad-hoc payments that can be made by any company even if it doesn’t pay a regular dividend however, it is common for companies to pay a special dividend in addition to paying regular dividends. Costco has previously been able to pay a special dividend ($7 per share in 2017 and $10 per share in 2020) due to their strong financial standings and consistent growth in revenue. Shareholders benefit from this additional payout because it can be reinvested and will allow their investments to further compound.

In 2020, we shared a blog post that highlighted the regular and special dividends paid by Costco. At the time, Costco was paying a quarterly dividend of $0.70 per share. Fast forward to today, three years later, Costco is now paying a quarterly dividend of $1.02; that is an increase of 45.71%. During this period, we experienced the pandemic which brought supply shortages and delays and a tumultuous economy with the potential of impacting the success of a company however, this wasn’t the case for Costco. The company was able to increase their revenue and continue to grow with their operating philosophy: “keep costs down and pass the savings on to our members.” This growth goes to show that Costco provides products and services that we use every day and there is a demand for what they offer. Individuals and families did not stop buying groceries or household products during this time.

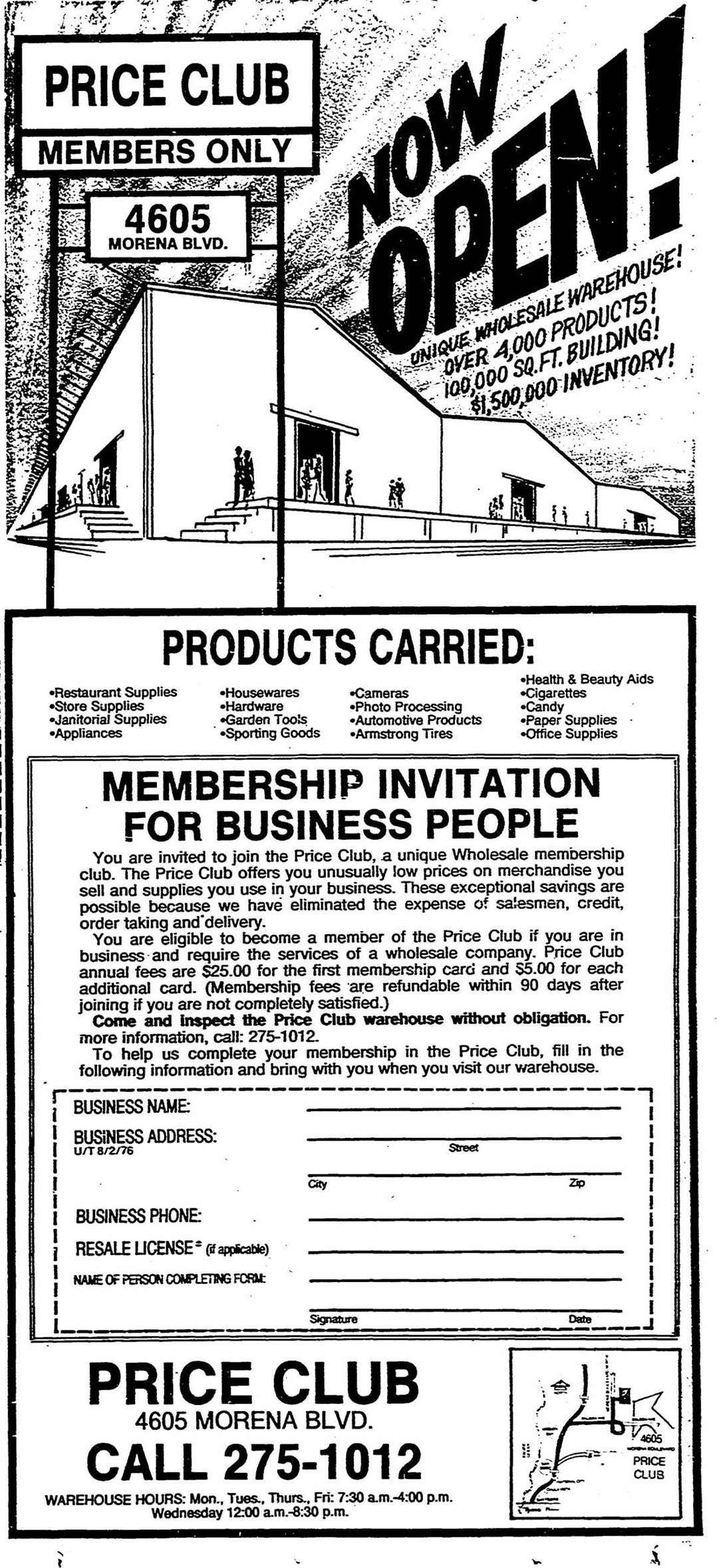

Costco is a membership warehouse club that offers brand-name products at the best possible prices. The company started out in 1976 in a converted airplane hangar in San Diego that operated under the name Price Club. Sol Price, originally from New York City, is accredited for introducing the retail concept of a membership warehouse club and ultimately creating Price Club. It originally served small businesses however, the company found it was more successful by also serving an audience of non-business members. Jim Sinegal was the executive vice-president of merchandising and marketing strategies of Price Club and he is responsible for turning the company into a success story through fine-tuning their strategies.

Jim Sinegal along with Jeff Brotman, co-founded Costco in 1983 and opened the first official Costco warehouse location in Seattle. It wasn’t until 1993 that Price Club and Costco combined and started operating under the name PriceCostco. At the time, there were 206 locations which were generating $16 billion in annual sales. An interesting fact is that Costco was the first company to ever grow from zero to $3 billion in sales in under 6 years.

The large membership base of Costco gives the company tremendous buying power and with their drive for efficiency, they are able to provide great prices for their members. To date, the company has hundreds of locations worldwide. In their latest fiscal year, Costco’s annual revenues was $222.7 billion. As of February 2023, Costco has 123 million cardholders and 68.1 million households. The stock has returned 35% over the past three years, 29% over the past five years, 22% over the past 10 years and 17% over the past 15 years. Those returns have meaningfully passed the S&P 500 over all those periods.

In addition to Costco’s wonderful dividends and strong financial standing, the company is also known for its signature $1.50 hot dog and pop combo from their food court. Costco sells over 100 million hot dogs a year, which is over four times the amount sold in all Major League Baseball stadiums combined.

We previously shared a brief history of Procter & Gamble. If you are interested, please take a look at our previous blog post:

“How will you replace your current income in retirement?” ™ – Jim Seyers